Overnight – Global markets on edge leading into US-China Talks in Switzerland

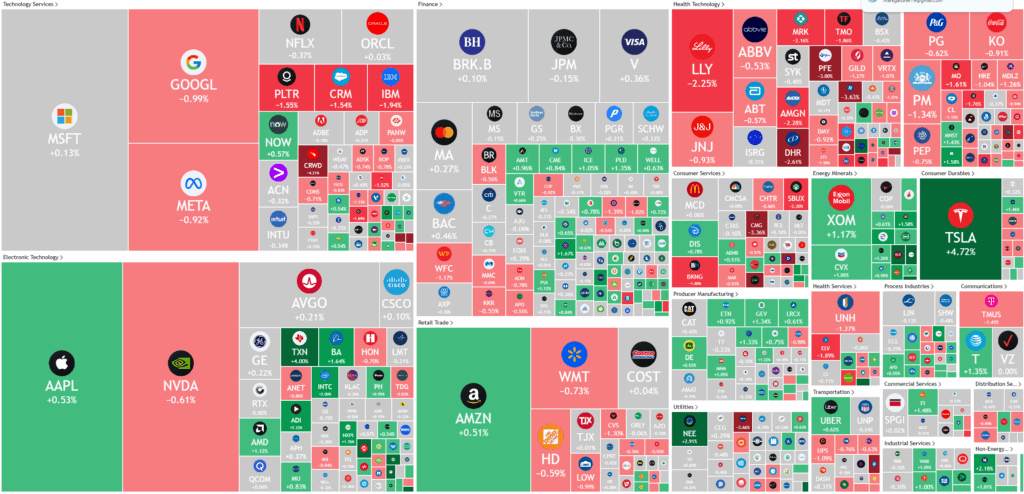

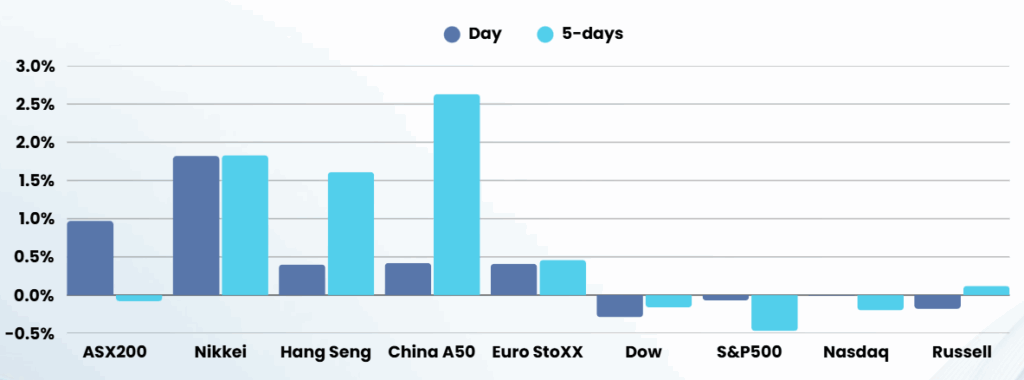

Stocks drifted lower Friday night as global markets remained on edge as high-level U.S. and Chinese officials meet in Geneva for the first substantive talks.

President Trump has signalled a possible reduction of tariffs on Chinese goods from the current 145% to 80%, ahead of high-level U.S.-China trade talks in Geneva. In a social media post, Trump stated that an “80% tariff on China seems right,” but left the final decision to Treasury Secretary Scott Bessent, who is leading the U.S. delegation. While this would mark a significant reduction, analysts caution that an 80% tariff remains a substantial barrier to trade and would not fundamentally resolve the disruptions caused by the ongoing trade war, which has already led to steep declines in bilateral trade and increased costs for consumers and businesses in both countries. The talks are seen as a tentative first step toward de-escalation, with both sides under pressure to ease tensions, but expectations for a breakthrough remain low.

Despite the proposed tariff cut, the broader economic impact is expected to persist. Economists note that even an 80% tariff would continue to suppress imports, keep prices elevated, and maintain uncertainty for global supply chains. U.S. companies are seeking alternatives to Chinese suppliers, while Chinese manufacturers are redirecting exports and pushing for domestic stimulus. Both governments have signalled willingness to negotiate, but deep mistrust and political sensitivities linger, suggesting that any resolution will likely require prolonged negotiations. The initial Geneva talks are viewed as confidence-building measures rather than a forum for immediate agreement, with further discussions anticipated as both sides explore the possibility of a more lasting détente

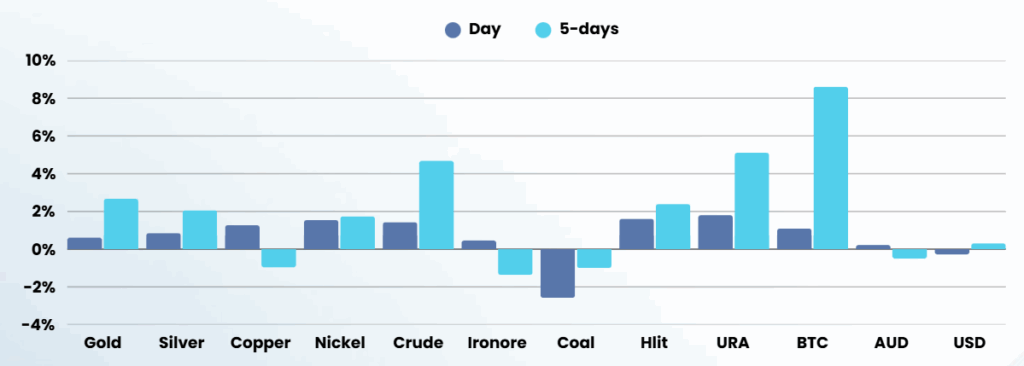

The U.S. dollar slipped on the day, with the dollar index falling 0.28% to 100.37, yet it remained poised for a weekly gain against major currencies, buoyed by optimism over upcoming U.S.-China trade talks. US Treasury yields were little changed amid thin trading and uncertain sentiment ahead of the trade talks; the 10-year yield edged up 1.3 basis points to 4.386%, while the 2-year yield slipped 0.8 basis points to 3.887%. Oil prices climbed, with U.S. crude rising 1.85% to $61.02 a barrel and Brent up 1.7% to $63.91, both posting their first weekly gains since mid-April as trade optimism lifted demand expectations. Gold prices also advanced as the dollar softened and investors awaited further developments from U.S.-China negotiations.

Company Earnings

- Affirm Holdings – stock fell 14% after the buy-now-pay-later firm’s outlook for the fourth quarter and full fiscal year 2025 failed to impress, even as it reported better-than-expected third-quarter earnings.

- Expedia –stock slumped more than 7% after the online travel-booking platform missed Wall Street estimates for quarterly revenue due to weaker than expected demand in the U.S..

- Pinterest – stock climbed nearly 5% after the image-sharing company provided a strong quarterly revenue forecast which allayed investor jitters about the uncertainty of advertising spending on its platform amid global economic volatility.

- LYFT Inc – jumped more than 28% after boosting its stock buyback program to $750M as the ride-sharing company swung to a profit in Q1.

ASX SPI 8265 (+0.19%)

The ASX should grind higher today on optimism from the weekends talks between the US and China. For a detailed update, check out our article The First Step: US-China Trade Talks in Geneva