What's Affecting Markets Today

Asia-Pacific markets traded mixed on Wednesday, despite a rebound on Wall Street driven by easing U.S.-China trade tensions. Japan’s Nikkei 225 fell 0.68% following four consecutive gains, while South Korea’s Kospi added 0.53%. Australia’s S&P/ASX 200 was flat. In China, the Hang Seng Index rose 0.96%, but the mainland CSI 300 ended little changed.

Wall Street surged after the U.S. and China reached a temporary truce on tariffs, with the Dow Jones Industrial Average jumping over 1,000 points on Monday. However, analysts remain cautious. Julius Baer noted that while market sentiment has improved, expectations of a swift resolution to the trade conflict are premature. “Any new deals are likely to involve complex conditions and lengthy implementation timelines,” the bank said, adding that a full rollback of tariffs is unlikely.

Attention is now turning to Asian semiconductor stocks after Nvidia shares rallied. CEO Jensen Huang said the company will deliver over 18,000 next-generation AI chips to Saudi-backed startup Humain, boosting investor sentiment in the region’s tech sector.

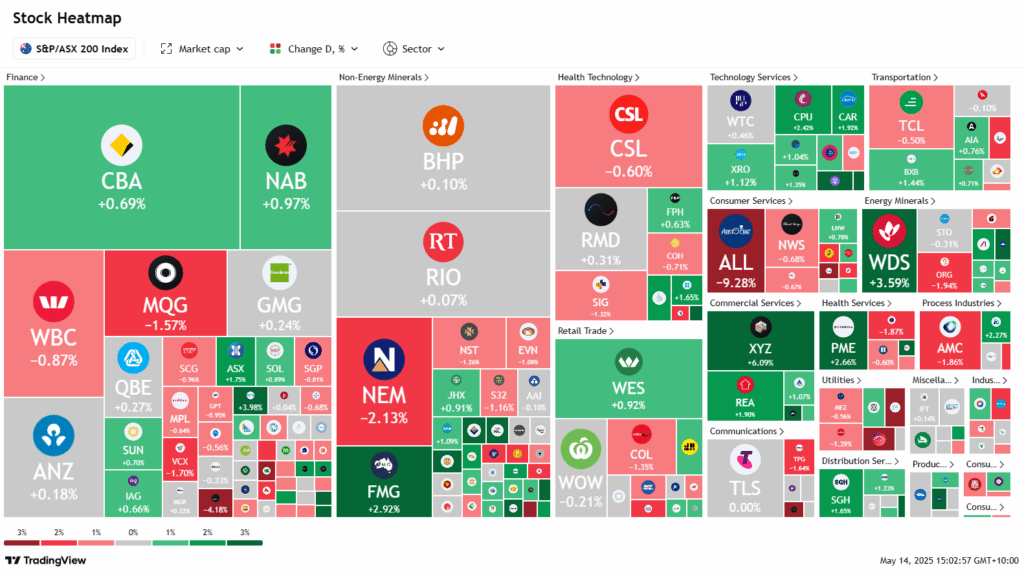

ASX Stocks

ASX 200 - 8,275.61 (+0.10%)

The ASX 200 edged 0.1% lower to 8260 by 2pm, with losses in Macquarie Group and Aristocrat Leisure offsetting strength in energy stocks. The All Ordinaries also slipped 0.1%, as the local market showed muted movement despite a strong overnight rally on Wall Street, led by Nvidia’s 5.6% jump after US President Trump eased AI chip export restrictions.

Macquarie dropped 2.1% following news ASIC is suing its securities arm over alleged short sale misreporting. Aristocrat plunged 12.7% after posting weaker-than-expected half-year revenue. In contrast, energy stocks gained on a 2.5% rise in Brent crude to US$66.55. Woodside rose 3.6% amid reports of a potential Aramco stake in its Louisiana LNG project, while Ampol climbed 1.4%.

CBA gained 0.7% after a solid quarterly update, with ANZ and NAB also advancing. Tech remained firm; Life360 soared 10.2% after upgraded guidance from Morgan Stanley. Insignia fell 15.3% after Bain Capital pulled its takeover bid, citing macro risks. Mayne Pharma shares were halted after dropping 12.2% on regulatory concerns.

Leaders

360 LIFE360 Inc (+10.08%)

LTR Liontown Resources Ltd (+8.11%)

XYZ Block, Inc (+6.27%)

SX2 Southern Cross Gold (+6.25%)

CYL Catalyst Metals Ltd (+5.96%)

Laggards

IFL Insignia Financial Ltd (-15.13%)

PNV Polynovo Ltd (-9.88%)

ALL Aristocrat Leisure Ltd (-9.86%)

ADT Adriatic Metals Plc (-5.58%)

LIC Lifestyle Communities Ltd (-5.37%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!