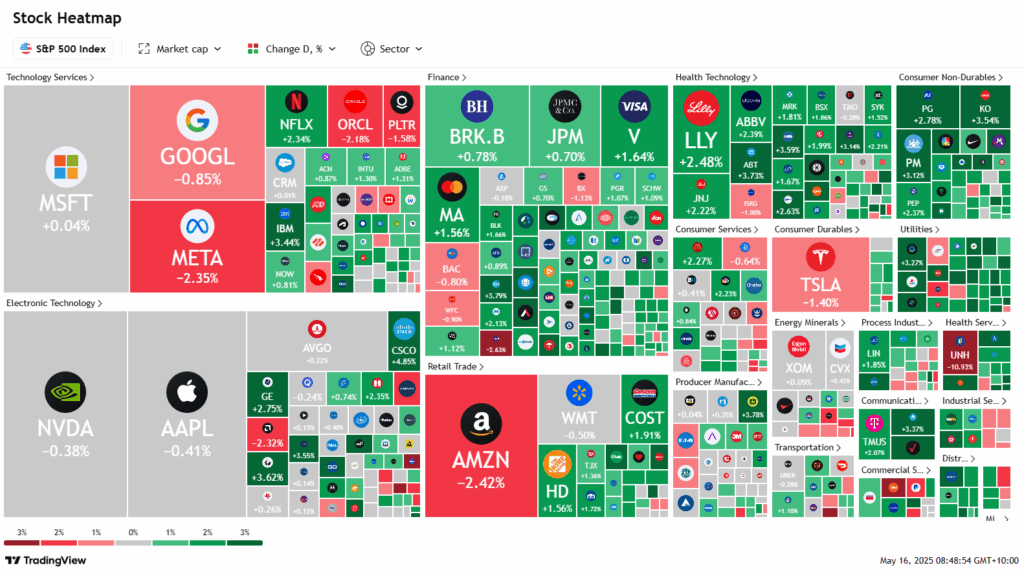

The S&P 500 rose for a fourth consecutive session, gaining 0.41% to close at 5,916.93, as easing U.S.-China trade tensions and falling Treasury yields lifted market sentiment. The Dow Jones Industrial Average advanced 271.69 points (+0.65%) to 42,322.75, while the Nasdaq Composite edged down 0.18% to 19,112.32 despite strong tech performance earlier in the week.

Markets reacted positively to reports that U.S. Treasury Secretary Scott Bessent and Chinese officials agreed to temporarily reduce tariffs, alleviating short-term economic and inflation concerns. Tech giants continued their rally, with Nvidia and Tesla up 15% this week, while Meta gained 9%, and Amazon and Alphabet rose over 6% and 7%, respectively.

Foot Locker shares surged 86% on news of a $2.4 billion takeover by Dick’s Sporting Goods. Conversely, UnitedHealth fell 11% amid reports of a DOJ probe, though the company said it had not been formally notified.

Economic data showed wholesale prices unexpectedly declined 0.5% in April, while retail sales rose 0.1%. Bond yields fell, with the 10-year at 4.44% and the 2-year at 3.96%.