Overnight – Wall Street Shrugs as US Debt Warnings Mount

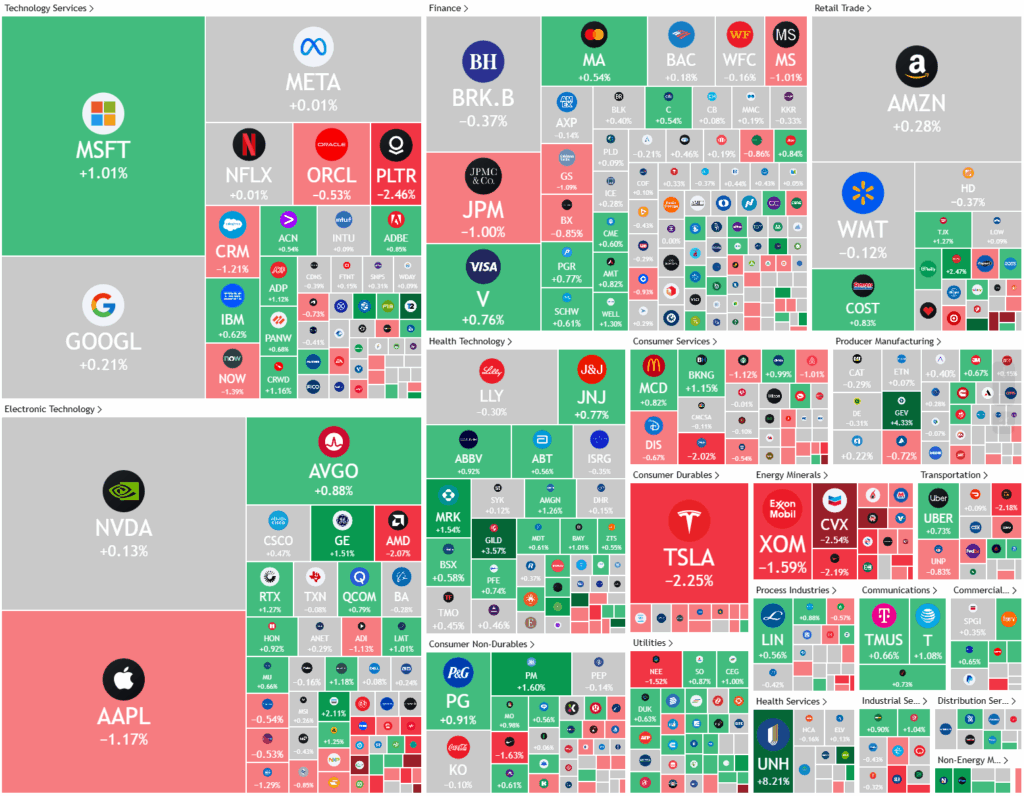

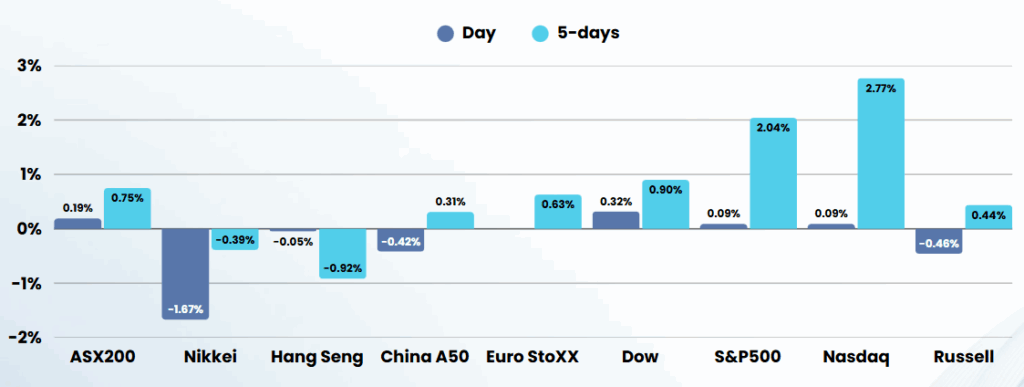

Stocks eked out a small gain overnight as retail investors shrugged off warnings from Ratings agency, Moodys, about the spiraling US Government debt

Moody’s has downgraded the U.S. sovereign credit rating from its highest “Aaa” to “Aa1,” marking the first time in over a century that the U.S. no longer holds a perfect rating from any major agency. The downgrade comes amid mounting concerns over the federal government’s $36 trillion debt and persistent annual deficits, which Moody’s says have reached levels much higher than those of similarly rated countries. This move follows earlier downgrades by S&P in 2011 and Fitch in 2023, and signals that neither successive administrations nor Congress have implemented effective measures to reverse the growing debt and interest burden.

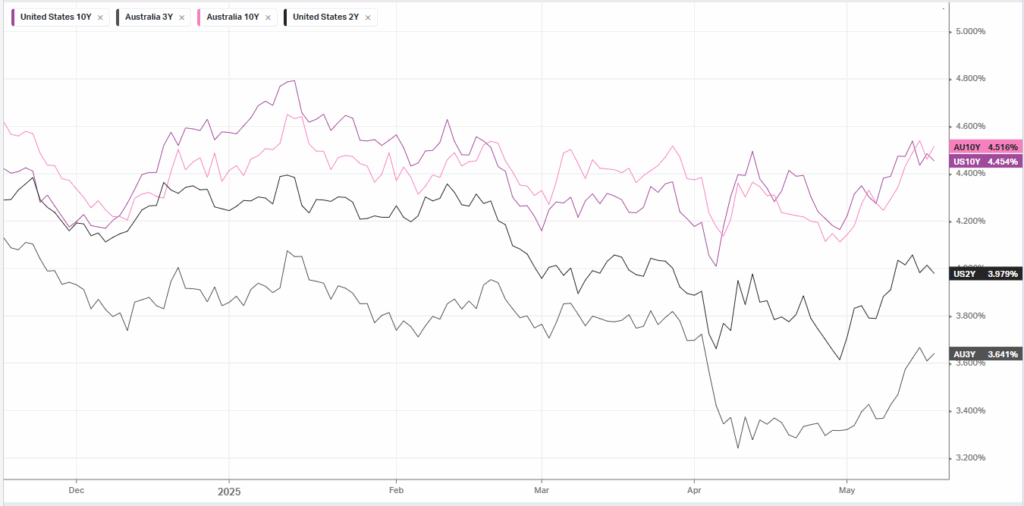

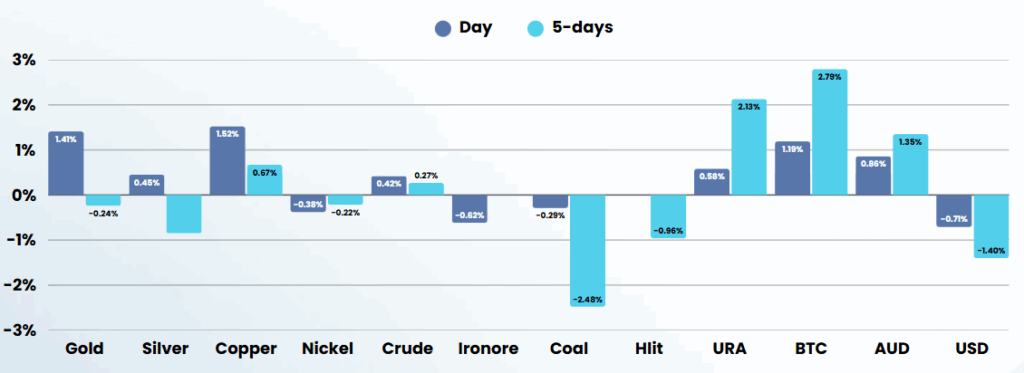

The immediate market reaction saw Treasury yields climb and U.S. stock futures dip, as investors worried about the prospect of higher government borrowing costs and the potential ripple effects on consumer interest rates for mortgages and credit cards. The downgrade coincided with the advancement of President Donald Trump’s sweeping tax cut bill, which, if passed, is projected to add $3 trillion to $5 trillion to the national debt over the next decade. While the administration has criticized the downgrade and highlighted efforts to cut spending, such as through the Department of Government Efficiency, Moody’s remains skeptical that current policies will meaningfully reduce deficits in the long term.

Beyond the credit rating news, the economic landscape remains volatile. Major companies like Walmart are warning of price hikes due to tariffs, and the Federal Reserve has flagged policy uncertainty and trade tensions as headwinds for growth. Meanwhile, market attention is also focused on tech leaders like Nvidia, which continues to unveil new AI products, and on companies like Reddit, which recently saw its stock slip after a downgrade linked to competitive threats from AI-driven search engines. The Moody’s downgrade underscores the broader challenge facing U.S. policymakers: balancing economic stimulus and tax cuts with the need for sustainable fiscal management

ASX SPI 8384 (+0.87%)

The local market will see a bounce from the open as US futures have turned around about 1% since the close yesterday. The main focus for markets is the Reserve Bank’s interest rate decision this afternoon. Most economists expect the central bank to cut for the second time this year. The current expectation is a quarter of one percentage point cut, which would take the cash rate below 4 per cent for the first time since 2023

Company Specific

- Rio Tinto will invest up to $US900 million ($1.4 billion) in a Chilean lithium project, taking 49.9 per cent ownership in the process.

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.