What's Affecting Markets Today

Asia-Pacific Markets Mixed as Wall Street Rally Pauses

Asia-Pacific equities traded mostly higher on Wednesday despite a weak lead from Wall Street, which snapped a six-day winning streak. Japan’s Nikkei 225 slipped 0.23% following data showing exports contracted for a second consecutive month, pressured by U.S. President Donald Trump’s broad-based tariffs.

In contrast, South Korea’s Kospi rose 0.58%, while the tech-heavy Kosdaq gained 0.95%. Australia’s S&P/ASX 200 added 0.43%, and Hong Kong’s Hang Seng Index opened 0.45% higher. China’s CSI 300 remained flat.

Markets are watching the Bank of Indonesia’s policy decision due later today. HSBC expects the central bank to resume rate cuts in May, citing soft Q1 GDP data and currency pressure. The bank last cut rates in January but has held steady at 5.75% since.

U.S. equity futures were marginally lower in early Asia trading. S&P 500 and Nasdaq 100 futures fell 0.2%, while Dow futures slipped 93 points.

Overnight, the S&P 500 fell 0.39% to 5,940.46, while the Nasdaq lost 0.38%. The Dow declined 0.27%. Technology stocks led losses, with Nvidia down 0.9%.

ASX Stocks

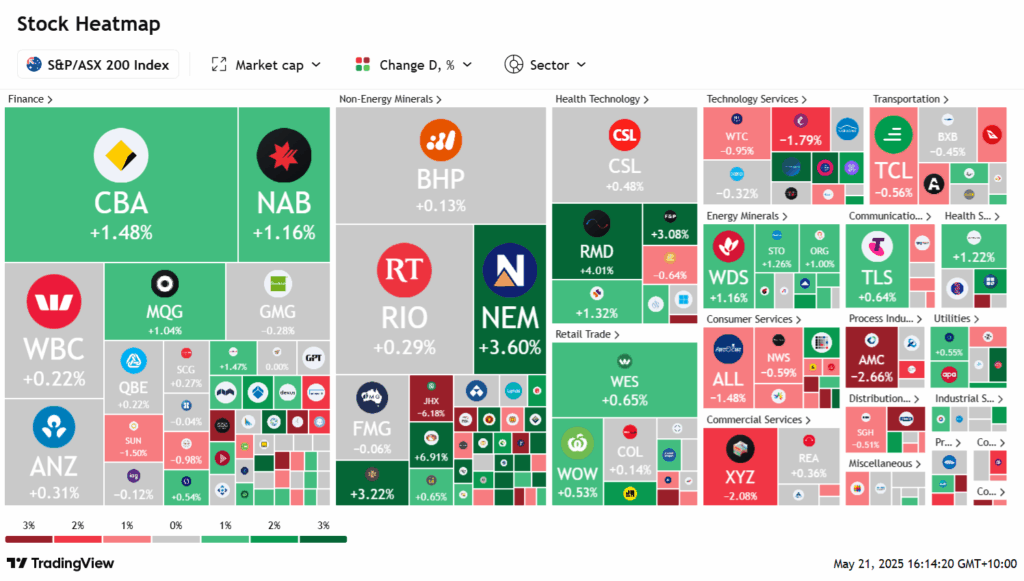

ASX 200 - 8,343.3 (+0.60%)

ASX Rallies on RBA Rate Cut and Dovish Outlook

The Australian sharemarket climbed on Wednesday, buoyed by the Reserve Bank of Australia’s decision to cut interest rates by 25 basis points to 3.85%, with the S&P/ASX 200 rising 0.7% to 8398.1—less than 2% from its record high. Ten of the 11 sectors advanced, led by banks and utilities, as bond yields fell and rate cut expectations firmed.

Commonwealth Bank surged 1.5% to an intraday record, while NAB gained 2.1% and Westpac rose 0.5%. CBA economists now forecast further cuts in August and September, citing Governor Bullock’s dovish tone. Utilities also gained, with APA Group up 1.9% and Origin Energy up 1%.

Healthcare stocks rallied, led by ResMed (+4.6%) and Fisher & Paykel (+2.6%). Energy names advanced on geopolitical tensions, with Woodside and Santos both gaining over 1%.

Notable movers included Adriatic Metals (+25.3%) on takeover interest from Dundee, and Catapult (+12.2%) after a strong revenue update. In contrast, Nufarm (-29.6%) and Mayne Pharma (-30.6%) sank on disappointing updates and deal uncertainty.

Leaders

ADT – Adriatic Metals Plc (+25.93%)

CAT – Catapult Group International Ltd (+13.14%)

PDI – Predictive Discovery Ltd (+9.09%)

EMR – Emerald Resources NL (+9.05%)

PRU – Perseus Mining Ltd (+9.00%)

Laggards

IEL – IDP Education Ltd (-6.88%)

HMC – HMC Capital Ltd (-6.40%)

LTR – Liontown Resources Ltd (-5.99%)

DDR – Dicker Data Ltd (-5.47%)

JHX – James Hardie Industries Plc (-4.99%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!