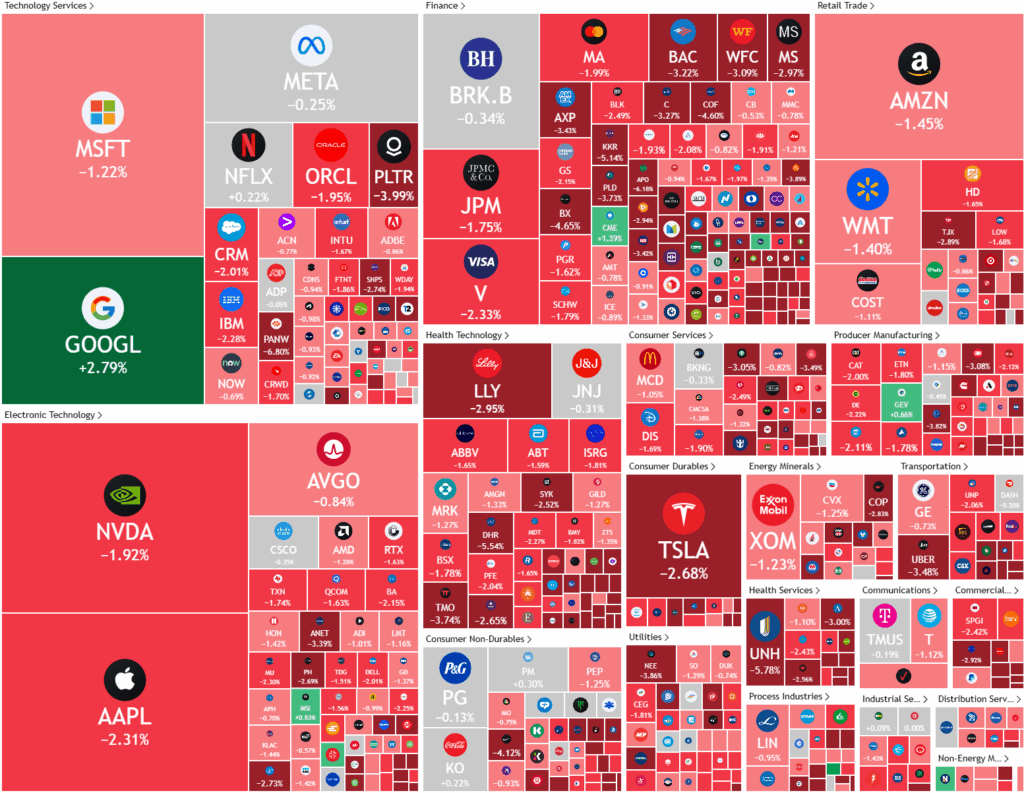

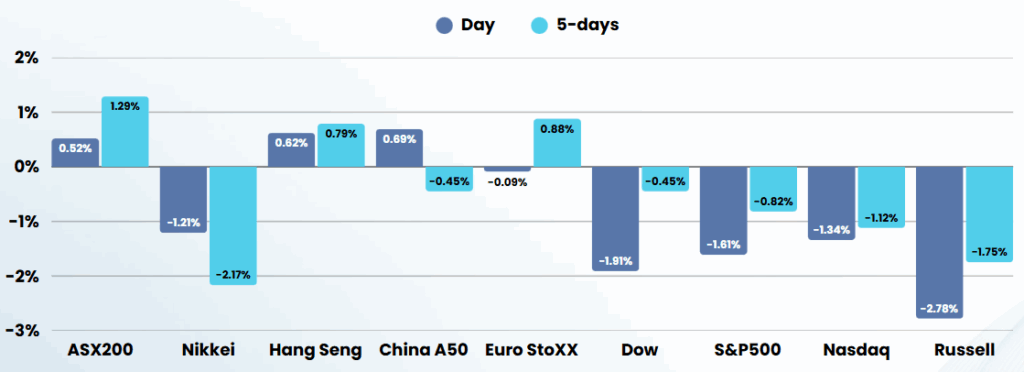

Overnight – Stocks lower as Global Long-term bond yields spike

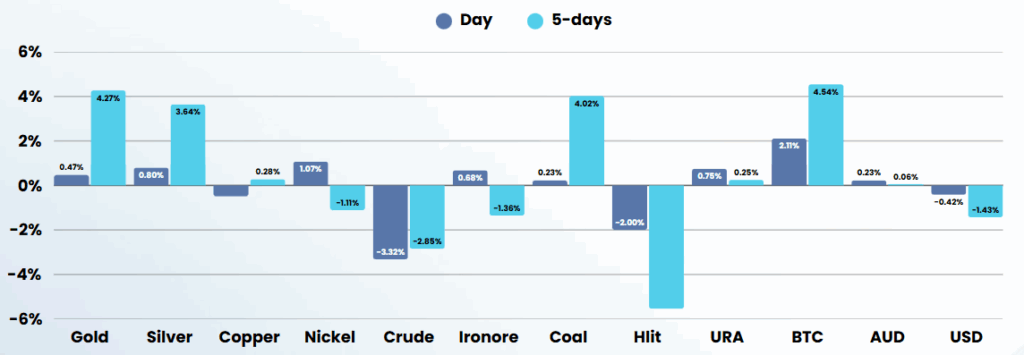

Surging Treasury yields put the squeeze on stocks as US30Y yields equalled their highs in 2023, which is the highest point in nearly 18 years, amid worries about the economy and the Republican tax bill lacking fiscal responsibility

Treasury yields rose sharply on concerns about economic growth, while a weak demand for the 20-year Treasury auction stoked fresh selling in U.S. sovereign bonds amid fresh signs that the recent knock to investor confidence in the US amid policy uncertainty remain front and centre. Investors have remained on edge over the U.S. economy after Moody’s downgraded the U.S. credit rating last week, while Congress prepared to vote on a sweeping tax cut bill backed by President Donald Trump.

On the trade front, investors were holding out for more trade deals between the U.S. and major economies. A host of reports showed high-level talks with Japan are set to resume this week, while negotiations with several other countries are ongoing. China added to the risk aversion by warning that the U.S.’ chip export controls threatened to undermine a trade truce reached in Geneva last week.

President Donald Trump’s tax cut and spending bill has apparently run into opposition from several dissenting lawmakers, and faces a critical stress test on Wednesday as Republicans in the U.S. House of Representatives try to overcome internal divisions. The bill, if approved, could add $3 trillion to $5 trillion to the country’s $36.2 trillion debt load, according to nonpartisan analysts, and comes after Moody’s downgraded its U.S. credit rating by a notch last week over growing national debt.

Several major retailer stocks have reported earnings ahead of the open, as the first-quarter earnings season winds down. Lowe’s stock fell after the home improvement chain reported net sales in the first quarter that were roughly in line with estimates, but flagged “near-term uncertainty”. Target stock fell after the big-box retailer slashed its annual sales forecast after posting a sharp decline in quarterly same-store sales, attributing the declines to weakened consumer confidence and a pullback in discretionary spending.

The figures come against a backdrop of increased tariff tensions that have contributed to gloomy returns and forecasts from a host of consumer-facing companies. This includes big-box retail titan Walmart, which warned last week of impending price hikes.

Company Specific

- Alphabet jumped more than 2% on Wednesday, a day after the company unveiled a slew of new AI-related products and initiatives to ensure that it remains competitive in the AI race.

ASX SPI 8326 (-0.97%)

The Aussie market is likely to follow the US to the downside as global long-term or “long end” yields in Japan, US and UK 30 year bonds are hitting multi year (decade) highs, increasing the cost of money which is not good for economic growth or growth stocks.

To give some perspective, global indices sit just 3%-5% from record highs. Since those highs were made in December last year, the US has started a tariff war, we are 70bps higher in long-end bond yields at multi decade highs (despite rate cuts), leading economic indicators are showing a softening economy and higher inflation. Now I’ll say it again, global indices sit just 3%-5% from record highs

Company Specific

- Dexus has staved off attempts by its co-investors in Melbourne Airport to force the asset manager to sell its shares after securing an injunction until its alleged breach of confidentiality can be debated in court in August.

- Helloworld bought another 5 per cent of Webjet on Wednesday evening, lifting its stake past 15 per cent

- Karoon Energy holds its annual general meeting. New Zealand Finance Minister Nicola Willis delivers the country’s budget.

Be Alert, But Not Alarmed: Cracks Showing in Credit Markets

With so much happening in AI, precious metals, geopolitics & US politics, it’s easy to get caught up in the day-to-day noise. But one thing that is very important to monitor is the subtle yet significant shift is emerging in credit markets that’s worth keeping on your radar.

The Scramble for Critical Minerals: A Boom for ASX Investors?

In the high-stakes world of global commodities, a new scramble is underway—one that could redefine supply chains and spark massive investment opportunities