What's Affecting Markets Today

Asia-Pacific markets declined on Thursday, echoing losses on Wall Street as concerns mounted over the fiscal implications of a proposed U.S. budget bill. Investors fear the plan could significantly expand the U.S. deficit, driving bond yields higher and dampening risk appetite.

Japan’s Nikkei 225 fell 1.06% at the open, while the Topix dropped 0.85%. South Korea’s Kospi slipped 0.59%, with the Kosdaq down 0.69%. Australia’s S&P/ASX 200 shed 0.36%. In Greater China, Hong Kong’s Hang Seng Index eased 0.24% and the CSI 300 fell 0.14%.

Investor focus is also turning to New Zealand’s upcoming 2025 federal budget announcement.

In the U.S., markets closed sharply lower overnight. The Dow Jones Industrial Average tumbled 816.80 points, or 1.91%, to 41,860.44. The S&P 500 declined 1.61% to 5,844.61, while the Nasdaq Composite lost 1.41% to 18,872.64.

Yields surged, with the 30-year Treasury bond hitting 5.09%—the highest since October 2023—while the 10-year yield reached 4.59%. Futures across major U.S. indices were little changed in overnight trade, reflecting ongoing caution.

ASX Stocks

ASX 200 - (-0.60%)

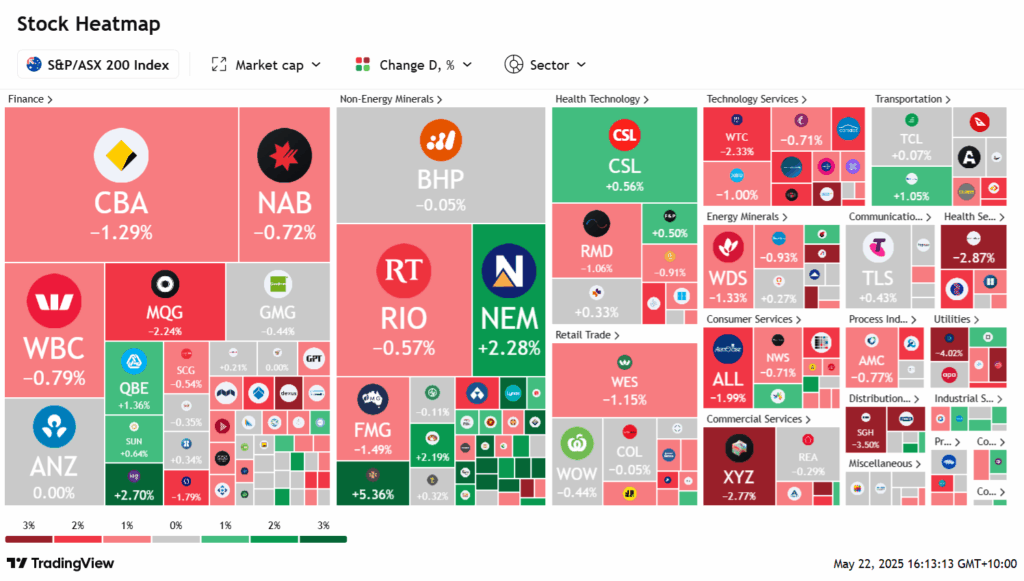

The Australian sharemarket declined on Thursday, weighed down by profit-taking in major banks and miners, following Wall Street’s sharpest fall in a month. The S&P/ASX 200 dropped 0.5% to 8342.3 by 2pm, while the All Ordinaries fell 0.6%. Nine of 11 sectors traded lower, led by energy.

Wall Street’s S&P 500 fell 1.6% after weak demand for a $US16 billion 20-year bond auction sent Treasury yields higher. This followed Moody’s downgrade of US Treasuries amid rising fiscal concerns linked to President Trump’s proposed tax and spending plans. Gold rallied for a fourth straight day, surpassing $US3300/oz.

CBA fell 1.3% and Macquarie declined 2.3% as banks reversed gains from the RBA-driven rally. Iron ore names also weakened, with Fortescue down 1.6% and Rio Tinto off 0.6%.

Gold stocks outperformed, led by Northern Star (+5.1%) and Newmont (+2.7%). MA Financial rose 5.2% after acquiring IP Generation. Zip Co sank 7% following Klarna’s credit warning. SKS Technologies surged 22.2% on a $100m data centre deal, while Novonix gained 1.2% on positive US trade news.

Leaders

CAT Catapult Group (+8.18%)

WA1 WA1 Resources Ltd (+6.78%)

LYC Lynas Rare Earths Ltd (+6.38%)

NST Northern Star (+5.62%)

GMD Genesis Minerals Ltd (+5.54%)

Laggards

CMW Cromwell Property Group (-7.90%)

NUF Nufarm Ltd (-6.94%)

ZIP ZIP Co Ltd (-6.25%)

PNV Polynovo Ltd (-4.95%)

PDN Paladin Energy Ltd (-4.39%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!