What's Affecting Markets Today

Asia-Pacific markets were mostly higher on Friday as investors digested a wave of regional economic data and developments in U.S.-China relations. Japan’s Nikkei 225 rose 1.04%, with the broader Topix up 0.89%, following data showing core inflation accelerated to 3.5% in April, driven partly by rising rice prices. The figures come as the Bank of Japan considers a pause in rate hikes amid growing uncertainty over U.S. tariffs.

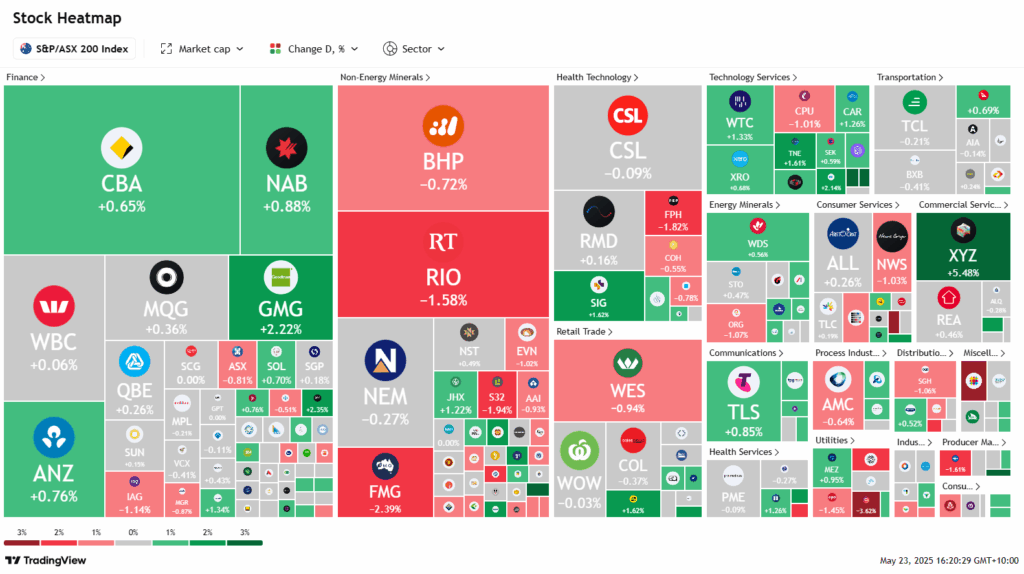

South Korea’s Kospi gained 0.36%, though the tech-heavy Kosdaq slipped 0.34%, as investors reviewed April PPI data. Australia’s S&P/ASX 200 climbed 0.33%. Meanwhile, Hong Kong’s Hang Seng Index and China’s CSI 300 opened flat.

New Zealand retail sales and Singapore’s April core inflation, which rose 0.7% year-on-year versus a 0.5% forecast, also drew attention.

U.S. futures were little changed, with Dow and S&P 500 futures edging up 0.03% and Nasdaq 100 futures marginally lower. Overnight, U.S. equities closed mixed. The Dow slipped 1.35 points, the S&P 500 fell 0.04%, and the Nasdaq added 0.28%, as markets weighed higher Treasury yields and concerns over U.S. deficit growth following a new fiscal bill.

ASX Stocks

ASX 200 8,360.9 (+0.15%)

Australian shares are poised to close the week higher, supported by easing US Treasury yields and renewed expectations of interest rate cuts from the Reserve Bank. The S&P/ASX 200 was up 0.2% to 8366.4 by 2pm, on track for a second consecutive weekly gain, while the All Ordinaries rose 0.3%.

Investor sentiment improved after US 10-year Treasury yields fell 7 basis points to 4.53%, calming earlier concerns over US debt stability. Locally, attention has turned to the upcoming April CPI report, expected to show inflation easing to 2.3%, reinforcing the RBA’s dovish stance.

Rate-sensitive sectors led the ASX rally, with Goodman Group up 2.5%, CBA rising 1%, and ANZ adding 1.3%. Tech stocks gained in line with Nasdaq strength—NextDC rose 1.8% and Xero 0.8%.

Uranium miners surged after reports that Trump will streamline US nuclear approvals. Boss Energy jumped 11.8%, Paladin 6.8%, and Deep Yellow 7.8%. Offsetting gains, iron ore weakness weighed on miners, with Fortescue and Rio Tinto down 1.7% and 1.2%, respectively. Nufarm slid 6.3% after a cautious broker note, while Duratec dropped 4.8% on downgraded revenue guidance.

Leaders

BOE Boss Energy Ltd (+12.82%)

DYL Deep Yellow Ltd (+9.13%)

NXG Nexgen Energy (Canada) Ltd (+8.94%)

PDN Paladin Energy Ltd (+7.02%)

PRN Perenti Ltd (+6.36%)

Laggards

BOT Botanix Pharmaceuticals Ltd (-5.33%)

NUF Nufarm Ltd (-5.32%)

CYL Catalyst Metals Ltd (-4.52%)

VGL Vista Group International Ltd (-4.46%)

CU6 Clarity Pharmaceuticals Ltd (-3.49%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!