The investment case for the major & established cryptocurrencies and blockchain technology rests on several key arguments, and the legitimacy of those cases are quickly growing.

Here is our summary of the investment cases for Cryptocurrency and Blockchain technology addressing different aspects of technology, finance, and risk diversification.

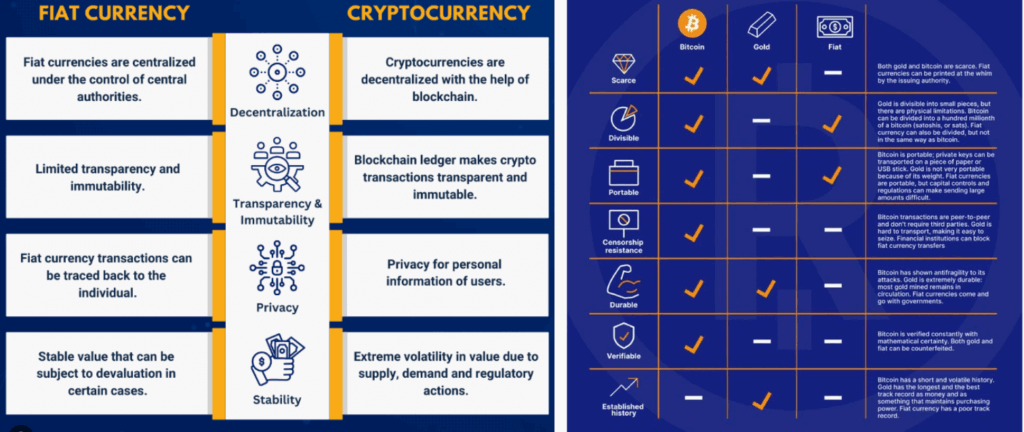

Diagram 1: Government issued currency vs Cryptocurrency Diagram 2: Store of value comparison

Crypto (e.g., Bitcoin, Solana, Ripple)

- Store of Value and Scarcity: Bitcoin is often referred to as “digital gold” due to its limited supply (capped at 21 million coins), which supports its use as a long-term store of value and a potential hedge against inflation.

- Inflation Hedge: Unlike fiat currencies, which can be printed by governments, crypto assets like Bitcoin have a fixed supply, making them attractive during periods of heightened inflation or currency devaluation.

- Diversification: Cryptocurrencies have historically shown low correlation with traditional asset classes like stocks and bonds, offering diversification benefits and potentially making portfolios more resilient in various market conditions.

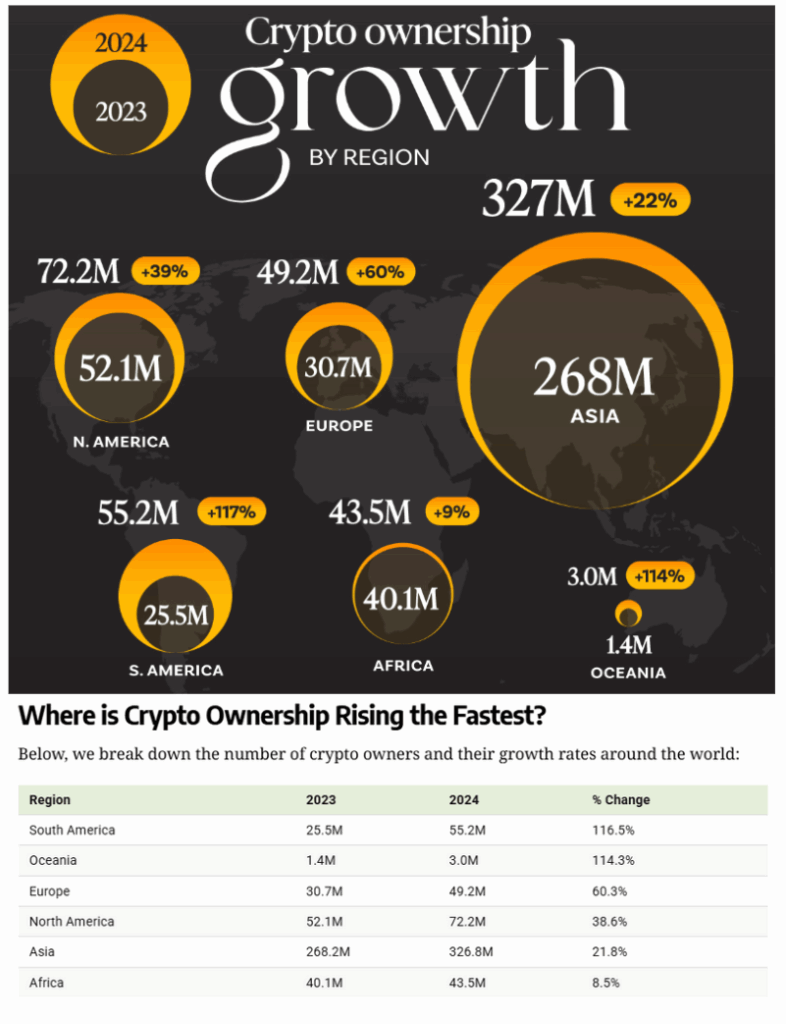

- Institutional Adoption: Increasing support from financial institutions—such as the launch of crypto ETFs—and clearer regulatory frameworks have legitimized crypto as an investable asset class, attracting significant capital and reducing barriers to entry for mainstream investors.

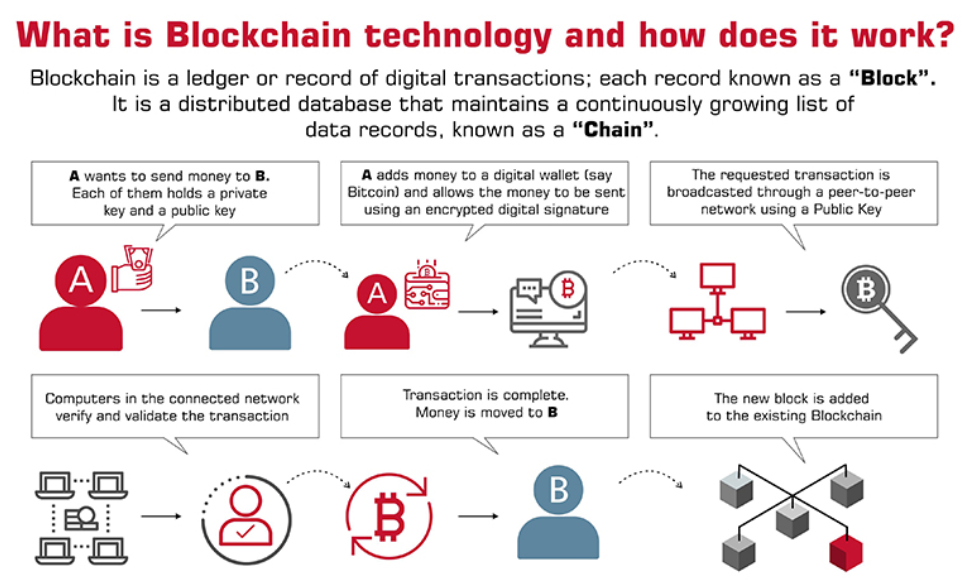

- Decentralization and Transparency: Crypto operates on decentralized blockchain networks, making it resistant to manipulation by central authorities and providing transparent transaction records.

Blockchain Technology

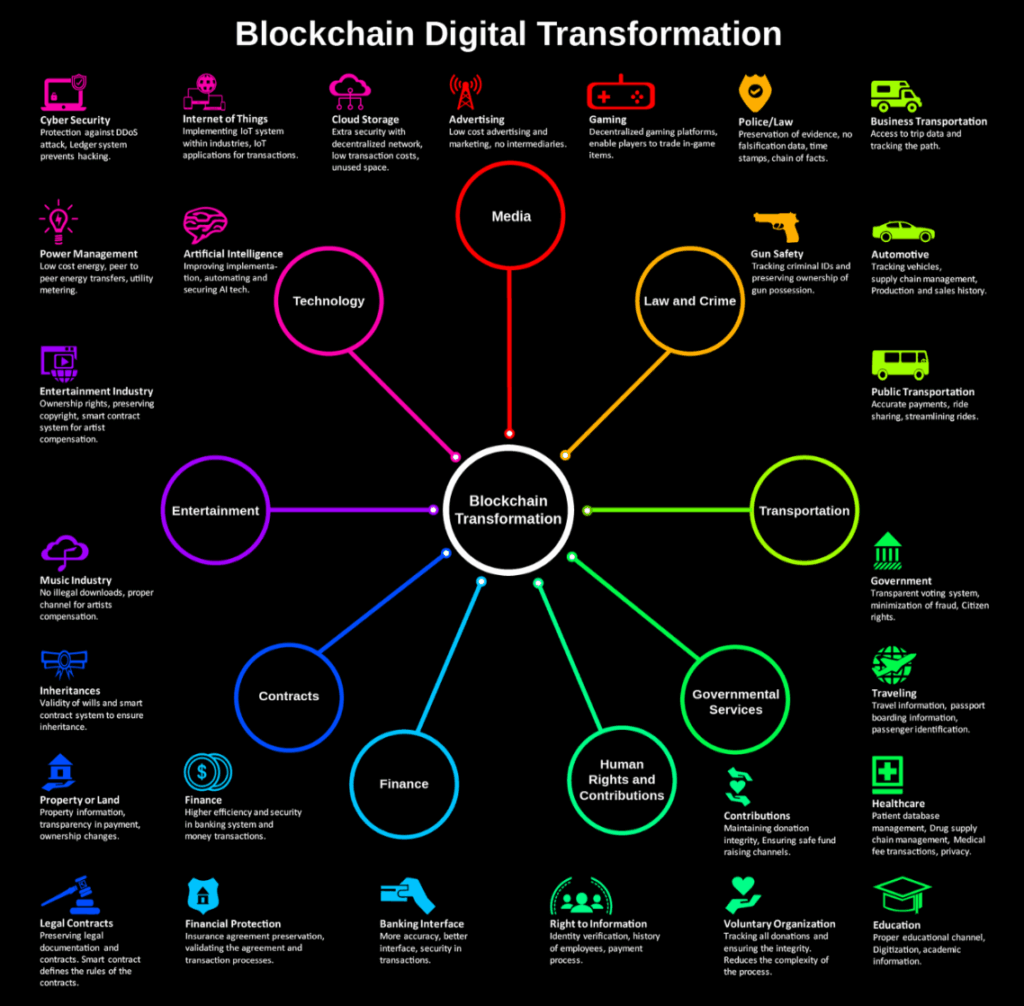

- Efficiency and Cost Reduction: Blockchain enables faster, cheaper, and more secure transactions by eliminating the need for intermediaries and reducing processing times—especially beneficial in cross-border payments and trade finance.

- Transparency and Security: All transactions are recorded on a distributed ledger, making them tamper-resistant and accessible in real time to all authorized participants, which enhances trust and reduces fraud.

- Automation and Smart Contracts: Smart contracts automate contract execution and reduce reliance on human intervention, streamlining business processes such as supply chain management, asset issuance, and compliance.

- Innovation in Capital Markets: Blockchain facilitates the issuance of digital assets and securities, lowers barriers to capital raising, and increases market liquidity by enabling programmable financial instruments and more efficient settlement systems.

- New Business Models: The technology enables decentralized finance (DeFi), crowdfunding, and novel forms of asset ownership and governance, creating new opportunities for investors and issuers alike.

The investment case for crypto and blockchain is built on their potential as alternative stores of value, inflation hedges, portfolio diversifiers, and transformative technologies that improve efficiency, transparency, and innovation across financial markets and beyond. While it is still early days in this fledgling asset class, the future industrial use and continual abuse of the Fiat currency system by central banks printing money is quickly making Crypto an appealing asset class

Got a question about this article? Ask the Team at MPC

ASK A QUESTION

GENERAL ADVICE WARNING:

Recommendations and reports managed and presented by MPC Markets Pty Ltd (ABN 33 668 234 562), as a Corporate Authorised Representative of LeMessurier Securities Pty Ltd (ABN 43 111 931 849) (LemSec), holder of Australian Financial Services Licence No. 296877, offers insights and analyses formulated in good faith and

Opinions and recommendations made by MPC Markets are GENERAL ADVICE ONLY and DO NOT TAKE INTO ACCOUNT YOUR PERSONAL CIRCUMSTANCES, always consult a financial professional before making any decisions.