Stocks rose sharply overnight after U.S. consumer confidence rebounded following a five-month slump, cooling fears about the economy just days after President President Donald Trump postponed plans to impose steep trade tariffs on the European Union.

U.S. consumer confidence rebounded sharply in May, ending a five-month slide, as optimism surged following the announcement of a U.S.-China trade deal and a temporary pause in tariff hikes. The Conference Board’s Consumer Confidence Index jumped 12.3 points to 98.0, far exceeding expectations and marking the largest monthly gain in four years. The rebound was driven by improvements in both consumers’ short-term outlook—with the Expectations Index rising 17.4 points to 72.8—and their assessment of current conditions, as the Present Situation Index climbed to 135.9. This renewed optimism was broad-based, spanning all age, income, and political groups, though concerns about inflation and the impact of tariffs on prices persisted.

In the markets, major tech stocks led gains ahead of Nvidia’s highly anticipated earnings report, with the chipmaker’s shares climbing over 3% as investors looked for signals on global AI demand. Tesla also rallied more than 6% after CEO Elon Musk pledged to focus more on the company, helping restore some investor confidence. Meanwhile, CoreWeave soared over 20% despite a recent downgrade, and Salesforce shares advanced on news of its $8 billion acquisition of Informatica, strengthening its position in AI and data infrastructure. The broader earnings season is winding down, with nearly 78% of S&P 500 companies surpassing analyst expectation.

On the policy front, President Trump’s decision to delay a planned 50% tariff on EU goods until July 9, following talks with EU President Ursula von der Leyen, provided some relief to markets rattled by trade tensions. However, uncertainty remains high as investors await further developments in U.S.-EU trade negotiations and monitor the Federal Reserve’s response to ongoing tariff and inflation dynamics. Durable goods orders fell 6.3% in April, reflecting some underlying economic caution. Fed officials, including Neel Kashkari and John Williams, have advocated for holding interest rates steady amid tariff uncertainty, underscoring the fragile balance between supporting growth and containing inflation

ASX SPI 8488 +51 (+0.60%)

ASX Set to Rise Following Wall Street Rally on Trade Optimism, Consumer Confidence

Australian shares are poised to open higher, with ASX 200 futures up 50 points or 0.6%, tracking Wall Street gains after a sharp rebound in US consumer confidence and progress in EU-US trade talks. The index is now within 1.1% of its record high.

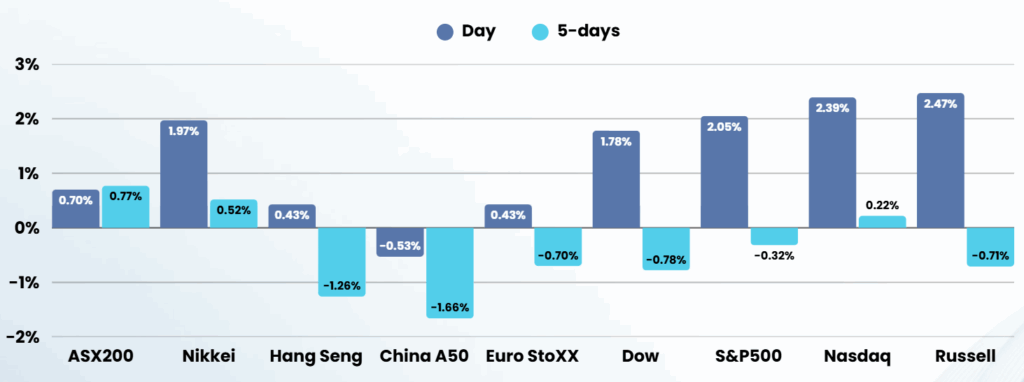

US President Trump’s decision to delay EU tariffs to July 9 boosted risk appetite, alongside a stronger-than-expected rise in the US Consumer Confidence Index to 98.0 in May. The S&P 500 climbed 2.1%, the Nasdaq 2.5%, led by Nvidia and Tesla, while all S&P sectors closed in the green. A global bond rally also lifted sentiment.

Key stocks: Fisher & Paykel reported a 43% rise in FY25 profit to NZ$377.2m; Infratil posted a loss on lower asset valuations; Mineral Resources downgraded iron ore guidance again.

Today, investors will watch for Australia’s April CPI, expected to ease to 2.3%. RBNZ is tipped to cut rates by 25bps at midday.

Be Alert, But Not Alarmed: Cracks Showing in Credit Markets

With so much happening in AI, precious metals, geopolitics & US politics, it’s easy to get caught up in the day-to-day noise. But one thing that is very important to monitor is the subtle yet significant shift is emerging in credit markets that’s worth keeping on your radar.

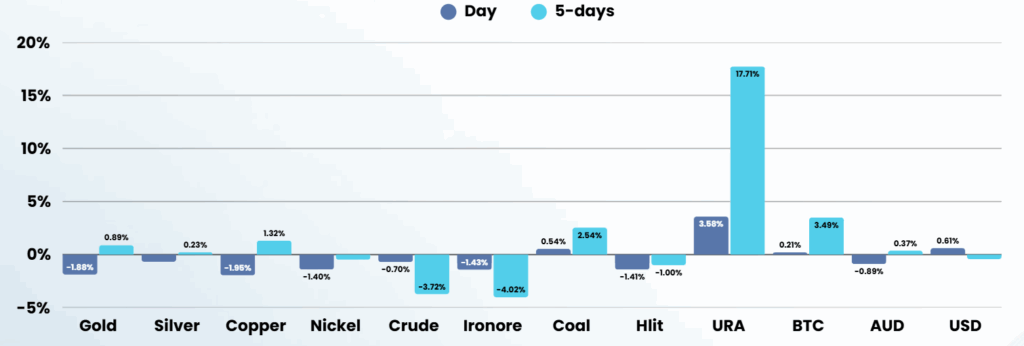

The Scramble for Critical Minerals: A Boom for ASX Investors?

In the high-stakes world of global commodities, a new scramble is underway—one that could redefine supply chains and spark massive investment opportunities