What's Affecting Markets Today

Asia-Pacific markets traded mixed on Wednesday, following a strong Wall Street session driven by optimism around U.S. trade policy. Investor sentiment improved after President Donald Trump extended the deadline for a 50% tariff on EU imports to July 9.

Japan’s Nikkei 225 rose 0.31%, and the Topix gained 0.42%. South Korea’s Kospi outperformed, climbing 1.78%, while the Kosdaq added 0.66%. Australia’s S&P/ASX 200 edged down 0.13%, weighed by financials. Inflation in Australia held steady at 2.4% in April, slightly above the 2.3% forecast.

Hong Kong’s Hang Seng fell 0.55%, and China’s CSI 300 was flat. India’s Nifty 50 dipped 0.17%. In New Zealand, the central bank cut the official cash rate to 3.25% as expected, prompting a modest rise in the New Zealand dollar to 0.5947 USD.

Investors are awaiting Nvidia’s earnings and the U.S. Federal Reserve’s May meeting minutes. Overnight, U.S. markets rebounded strongly: the Dow surged 1.78% to 42,343.65, the S&P 500 gained 2.05%, and the Nasdaq jumped 2.47% to 19,199.16, led by tech stocks including Tesla.

ASX Stocks

ASX 200 8,395.4 (-0.15%)

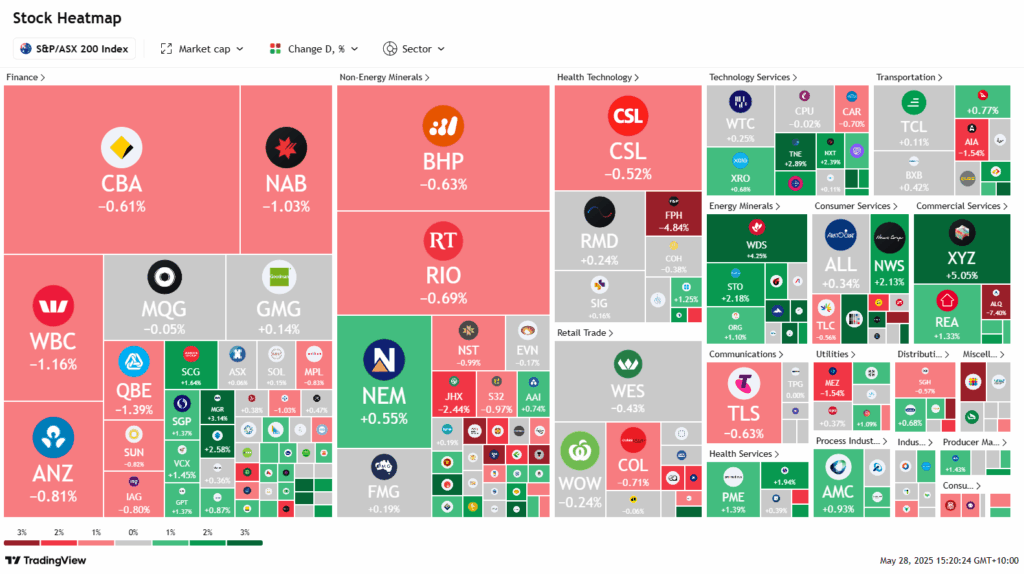

The ASX edged lower on Wednesday as profit-taking in major banks erased earlier gains sparked by a strong Wall Street lead. The S&P/ASX 200 dipped 0.1% to 8399.4 by 2pm, after hitting its highest intraday level since February 19. Financials led sector declines, with Commonwealth Bank down 0.6% and Macquarie easing 0.3% after an initial 1% rally.

The earlier rally followed a sharp rebound in US markets, driven by a jump in consumer confidence and a delay in US-EU tariffs. The Nasdaq and S&P 500 gained over 2%, aided by Nvidia’s 3.2% rise ahead of earnings.

Locally, tech stocks outperformed, with Block climbing 4.8%, NextDC 2.5%, and TechnologyOne 2%. Energy stocks rose on government approval for Woodside’s gas project; Woodside advanced 3.9%, Santos 2.2%. Coal miners also gained, led by Whitehaven (+3.5%) and Yancoal (+2.5%).

Among laggards, Fisher & Paykel fell 4.3% despite strong earnings. Infratil dropped 4.8% on valuation markdowns. Mineral Resources plunged 5.9% after slashing iron ore guidance. Web Travel Group surged 12.2% on a positive trading update, while Eagers Automotive slid 2.5%.

Leaders

WEB Web Travel Group Ltd (+11.11%)

GDG Generation Dev Group Ltd (+6.39%)

XYZ Block, Inc (+4.78%)

WDS Woodside Energy (+3.99%)

MAF MA Financial Group Ltd (+3.79%)

Laggards

PDI Predictive Discovery Ltd (-17.24%)

ALQ ALS Ltd (-7.60%)

IFT Infratil Ltd (-5.60%)

MIN Mineral Resources Ltd (-5.14%)

FPH Fisher & Paykel (-4.51%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!