What's Affecting Markets Today

Asia-Pacific markets traded mixed on Thursday as weak U.S. private sector hiring data raised concerns about the impact of trade policy uncertainty on the global economy. U.S. payrolls rose just 37,000 in May, well below expectations of 110,000 and marking the slowest pace in over two years, according to ADP.

South Korea’s Kospi advanced 1.33%, hitting a 10-month high, while the Kosdaq gained 0.79%. Nomura analysts forecast the Kospi to reach 2,900 by year-end, driven by expected capital market reforms and fiscal stimulus under President Lee Jae-myung, including a potential second supplementary budget in July.

Japan’s Nikkei 225 fell 0.42%, with the broader Topix index down 1.02%, weighed by profit-taking and caution ahead of key U.S. data. Australia’s S&P/ASX 200 slipped 0.14%.

Hong Kong’s Hang Seng rose 0.46%, supported by tech gains, while mainland China’s CSI 300 was flat as investors remained cautious on policy direction.

India’s Sensex and Nifty 50 opened flat, with markets awaiting the Reserve Bank of India’s decision on Friday, where a 25 basis point rate cut to 5.75% is widely anticipated.

ASX Stocks

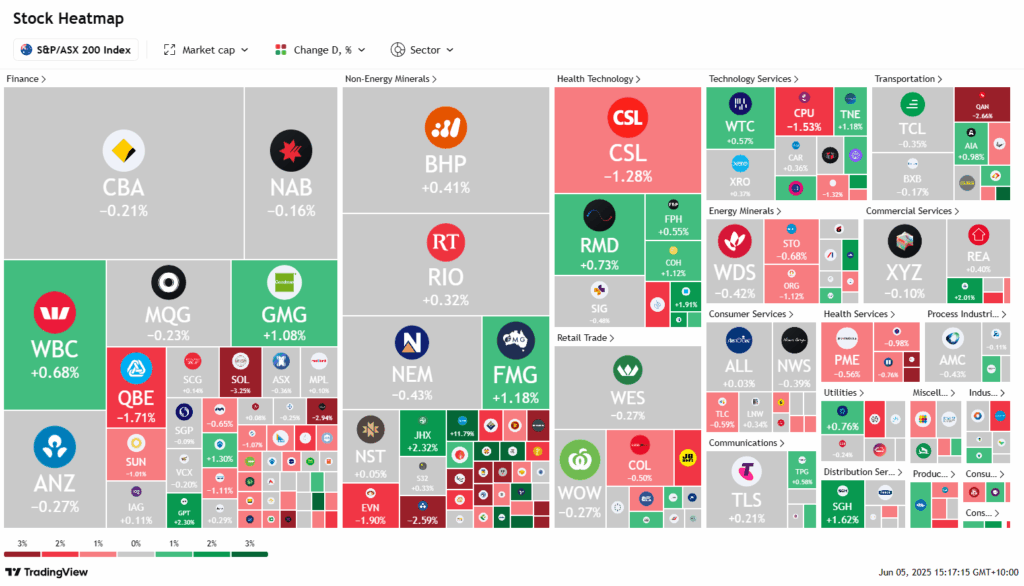

ASX 200 8,535.9 (-0.07%)

The Australian sharemarket edged slightly lower on Thursday, with the S&P/ASX 200 dipping 10.8 points, or 0.1%, to 8531 by 2pm. The index had opened higher but gave up gains as investors awaited a catalyst to push it to a new record, after coming within 15 points of an all-time high on Wednesday.

Seven of the 11 sectors traded lower, led by weakness in the major banks. Commonwealth Bank slipped 0.5%, while NAB and ANZ also posted losses. In contrast, lithium and rare earths stocks rallied, buoyed by news that Albemarle received $US150 million from the US government for a new processing facility. Mineral Resources surged 11.8%, Lynas rose 11.5%, and Liontown climbed 4.9%.

Technology shares advanced following a positive session for the Nasdaq, supported by growing expectations of two US Fed rate cuts. WiseTech Global gained 0.7% and TechnologyOne added 1.5%.

In company news, IperionX soared 26.3% on a US defence contract. Tyro dropped 9.8% on its CEO’s resignation, while Pacific Current fell 5.4% and Catapult declined 2.1% following acquisition news.

Leaders

IPX – IperionX Ltd (+28.03%)

MIN – Mineral Resources Ltd (+13.37%)

LYC – Lynas Rare Earths Ltd (+11.60%)

PLS – Pilbara Minerals Ltd (+8.75%)

VUL – Vulcan Energy Resources Ltd (+5.93%)

Laggards

RDX – Redox Ltd (-6.49%)

IEL – IDP Education Ltd (-5.29%)

REG – Regis Healthcare Ltd (-4.64%)

NGI – Navigator Global (-4.19%)

SOL – Soul Patts (-3.65%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!