Overnight – Wall St Rallies on US/China meeting, while military is sent into L.A.

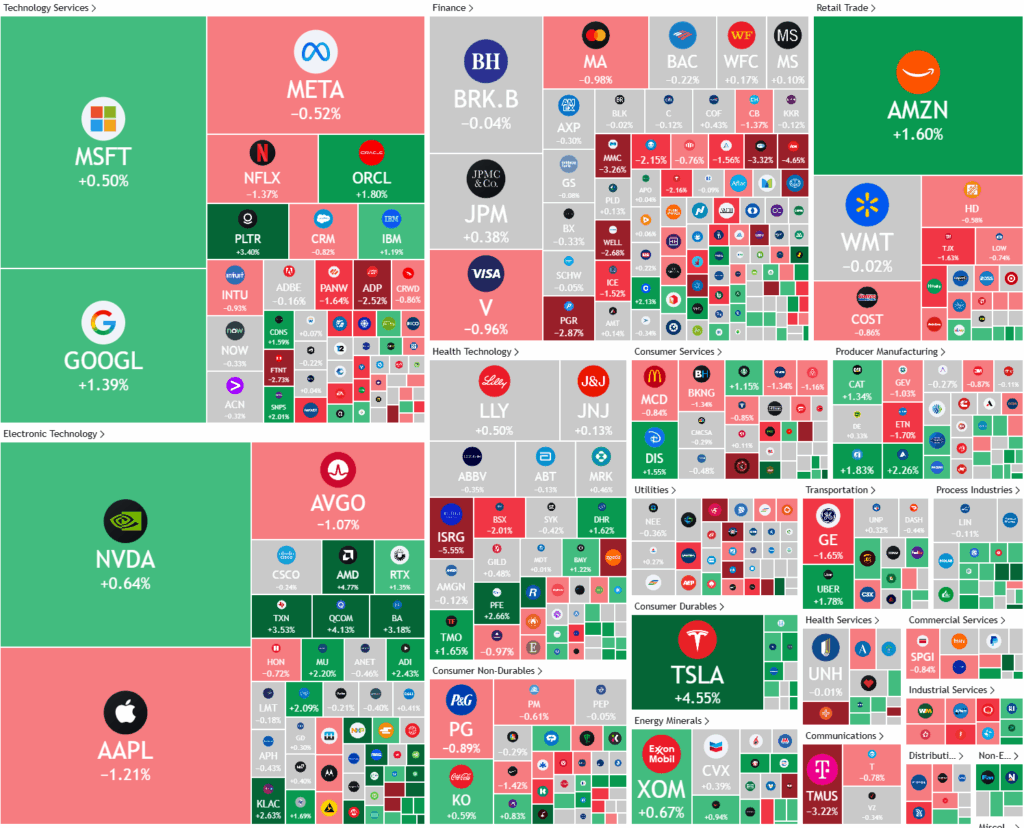

Stocks squeezed out a small gain as the US/China trade talks started a positive footing, while markets and financial media completely ignored that active marines joined the national guard in Los Angeles to combat riots.

President Trump ordered active marines to join the National Guard, without the consent of the Californian Governor, a move that is only been used once in US history, the 1965 civil rights demonstrations in Selma, Alabama. Financial markets and financial markets press are broadly brushing this off as a footnote, with eyes only for the US/China trade deal talks in London.

High-level trade talks between the United States and China resumed in London on Monday, with U.S. Commerce Secretary Howard Lutnick and Treasury Secretary Scott Bessent describing the discussions as productive. The meetings aim to reinforce a fragile 90-day truce established after negotiations in Geneva last month, which temporarily reduced tariffs and paused further escalations. Despite this pause, tensions remain high over issues such as rare earth mineral exports, advanced technology restrictions, and the broader strategic rivalry between the world’s two largest economies.

Recent trade data underscore the ongoing strain: China’s exports to the U.S. plunged by 34.5% year-on-year in May, the steepest drop since February 2020, even as overall Chinese exports grew by 4.8%—a slowdown from previous months and below market expectations. Imports from the U.S. also declined sharply, contributing to a significant reduction in China’s trade surplus with the U.S. This downturn comes amid persistent uncertainty over tariff policy, with both sides having front-loaded shipments earlier in the year to avoid anticipated tariff hikes. However, China’s exports to other regions, such as Southeast Asia and the European Union, have remained robust, helping to offset losses from the U.S. market.

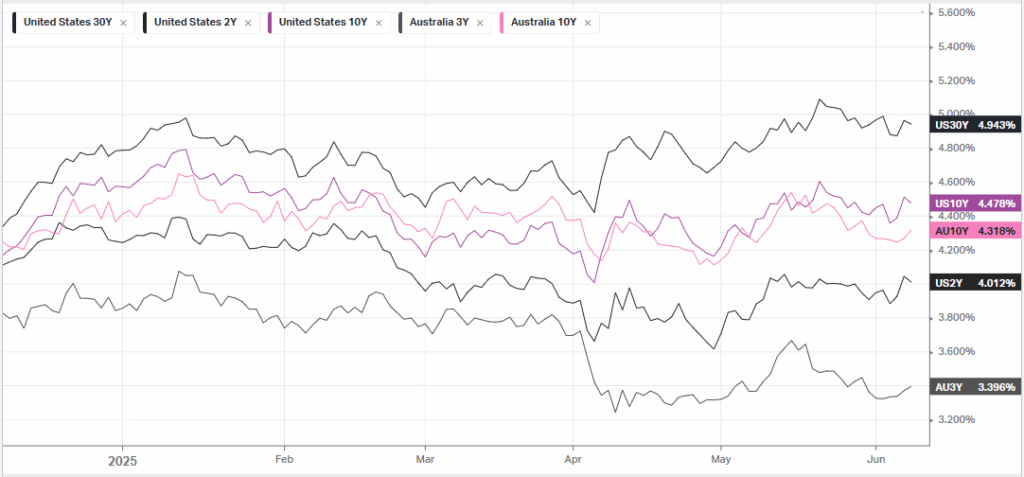

Looking ahead, investors and policymakers are closely watching upcoming U.S. inflation data for further signals on the economic impact of ongoing trade tensions and tariffs. Meanwhile, the broader market is reacting to other corporate developments, such as Apple’s stock dip following an underwhelming developers conference and significant moves by companies like Warner Bros Discovery, Merck, and Baker Hughes. As trade negotiations continue, the global economy remains sensitive to the outcome, with supply chains, inflation, and sector-specific industries all affected by the evolving U.S.-China relationship

ASX SPI 8556 (-0.01%)

We are likely to drift lower again as US/China talks have been described as “not easy”, however commodity based sectors of the market should be buoyant after a week long rally continued in Silver, Copper, Platinum.

The list of issues continue to grow with the equity market sitting at near record highs, which can’t last forever. Caution is warranted given there are riots in California, Tariffs remain in place, the US debt will keep spiralling with the “big beautiful Bill” gives tax cuts in excess of any progress savings/tariffs have made and the leader of the free world keeps abusing executive power and bypassing congress

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.