What's Affecting Markets Today

Asia-Pacific Markets Rise as Investors Eye U.S.-China Trade Developments

Asia-Pacific equities advanced on Tuesday as investors awaited further clarity from ongoing U.S.-China trade discussions, scheduled to continue for a second day in London. U.S. Treasury Secretary Scott Bessent, Commerce Secretary Howard Lutnick, and Trade Representative Jamieson Greer met with China’s Vice Premier He Lifeng and his delegation on Monday.

While the tone of the talks has been cautiously optimistic, Christian Floro, market strategist at Principal Asset Management, cautioned that trade policy remains fluid, contributing to a continued backdrop of market uncertainty. He advised investors to brace for volatility and consider rotating into undervalued sectors and international equities.

Floro highlighted domestic-focused sectors—such as utilities, real estate, and financials—as relatively insulated from trade-related disruptions. He also sees selective upside in software and internet stocks.

Japan’s Nikkei 225 rose 0.92%, with the Topix up 0.43%. South Korea’s Kospi gained 0.42%, and the Kosdaq climbed 0.77%. China’s CSI 300 edged 0.16% higher, while Hong Kong’s Hang Seng added 0.33%. Australia’s ASX 200 rose 0.73%, and India’s Nifty 50 was flat at open.

ASX Stocks

ASX 200 8,589.3 (+0.86%)

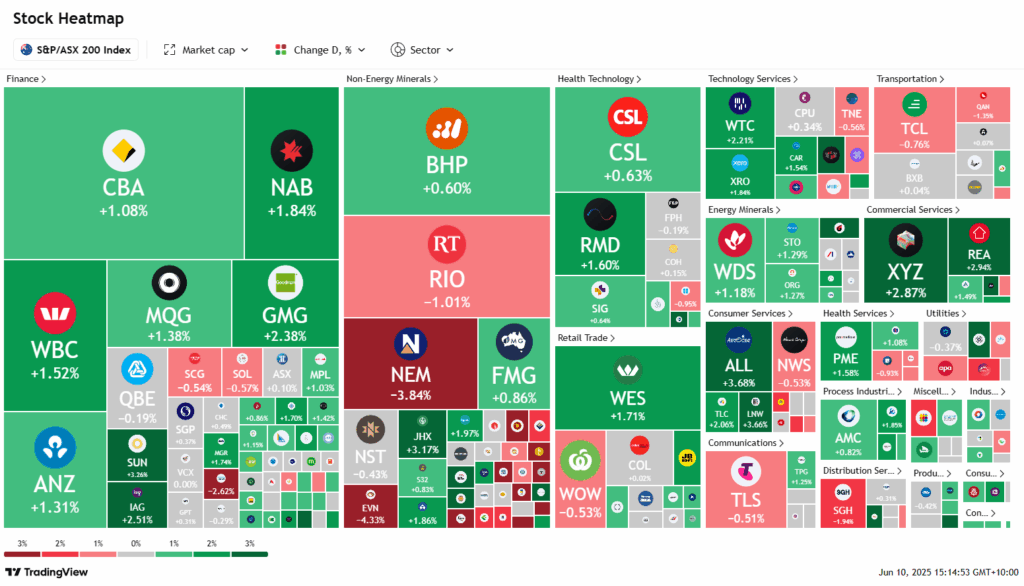

ASX Edges Toward Record High as Energy and Banks Lead Gains

The ASX 200 surged 0.9% to 8590 by midday, surpassing its February record of 8555.8, driven by strength in energy and banking stocks amid optimism surrounding US-China trade talks in London. Nine of 11 sectors posted gains. The Australian dollar touched a six-month high at US65.25¢.

Investor sentiment improved following extended overnight negotiations between US and Chinese delegates. President Trump described talks as “positive but not easy”, while Commerce Secretary Lutnick and Treasury Secretary Bessent called discussions “fruitful” and “good”, respectively.

Woodside Energy and Santos climbed over 1% as oil prices rose. Commonwealth Bank led a rally in financials, up 1.2%. In contrast, gold miners Evolution, Genesis, and Newmont dropped over 2% as bullion softened to $US3,320/oz.

Monash IVF tumbled 23.9% after another embryo incident, down 55% in 12 months. Austal jumped 6.8% following US clearance of a full acquisition by Hanwha Group. Johns Lyng entered a trading halt amid takeover speculation by Pacific Equity Partners.

Meanwhile, defence ETFs surged, with Global X up 46.4% YTD, buoyed by rising global military spending.

Leaders

ZIM – Zimplats Holdings Ltd (+14.61%)

BGP – Briscoe Group Australasia Ltd (+8.50%)

DRO – Droneshield Ltd (+6.47%)

ASB – Austal Ltd (+6.41%)

ZIP – ZIP Co Ltd (+6.39%)

Laggards

PPM – Pepper Money Ltd (-7.49%)

IPX – Iperionx Ltd (-6.58%)

WAF – West African Resources Ltd (-6.46%)

VAU – Vault Minerals Ltd (-5.68%)

ADT – Adriatic Metals Plc (-5.19%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!