Overnight – Stocks higher as US/China trade talks enter day 3 of a 1 day meeting

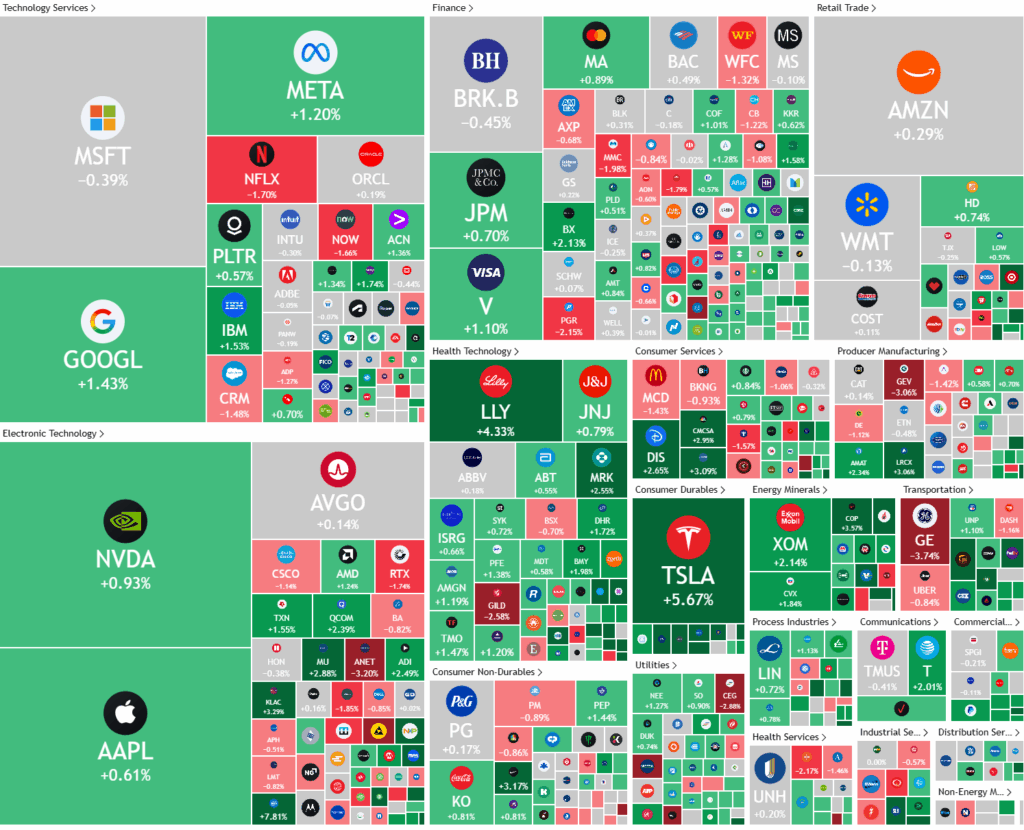

Stocks edged higher overnight on rising hopes for a U.S.-China trade deal after U.S. Commerce Secretary Howard Lutnick said the second-day of trade talks between the two nations were “going well.”.

Despite this optimism, we are heading into day 3 of a 1-day meeting, with the only details coming from the meeting being arbitrary comments like “going well” “positive steps” “there is progress” which doesn’t fill us with as much hope as the market.

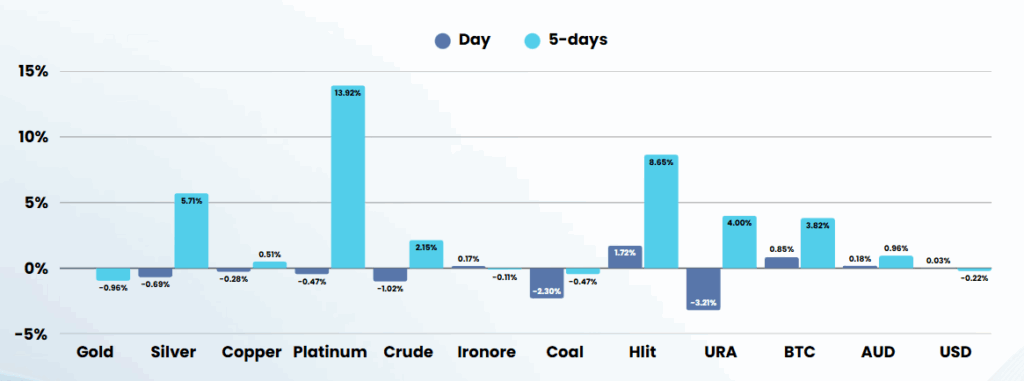

Trade negotiations between the United States and China, the world’s largest economies, have entered an intense phase in London, with both sides aiming to resolve disputes over export controls, particularly those involving rare earth minerals and advanced semiconductors. The talks, led by U.S. Commerce Secretary Howard Lutnick and Chinese Vice Premier He Lifeng, follow a preliminary agreement in Geneva to temporarily reduce tariffs, but tensions remain high after China imposed new restrictions on rare earth exports—materials critical for high-tech industries and defense. These restrictions, which have caused immediate supply chain disruptions and price surges for key minerals, underscore China’s dominant position in the global rare earth market, where it controls nearly 90% of production and processing.

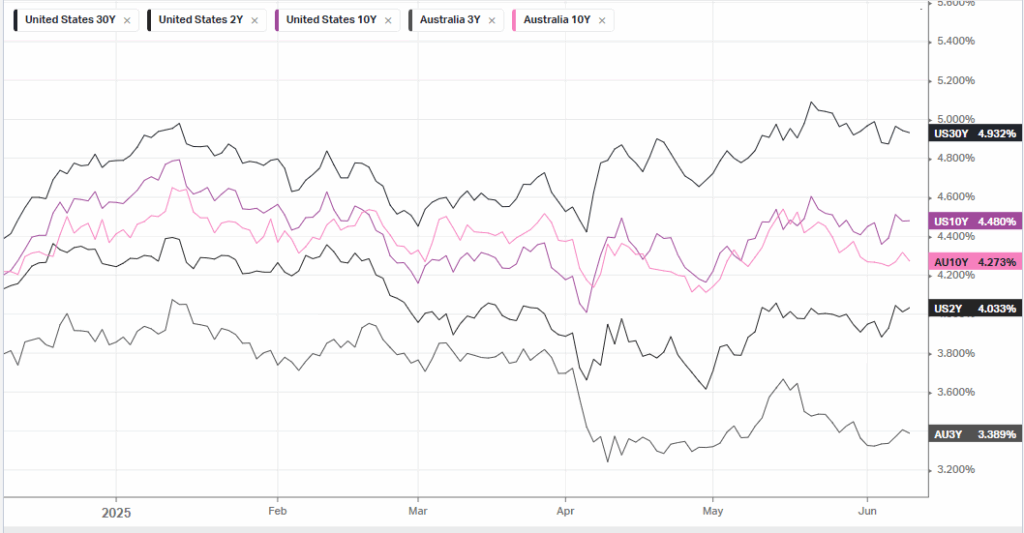

Financial analysts are watching the negotiations closely, as any breakthrough could influence global markets, especially in China. However, experts at Capital Economics caution that even if a deal is reached, it is unlikely to trigger a major rally in Chinese equities or a significant appreciation of the renminbi, given the deeper impact of domestic policies and the expectation that the U.S. will not fully relax its export controls. The broader economic environment remains uncertain, with U.S. tariffs contributing to higher import prices and inflation, prompting speculation about potential Federal Reserve rate cuts later in the year. Citi analysts predict the Fed will hold rates steady in the near term but begin a series of reductions in September, depending on upcoming inflation data and the outcome of trade talks.

In the past 24 hours, global geopolitical issues continues to flare up with Russia launching its largest combined drone and missile attacks of the war in the past 24 hours, targeting multiple Ukrainian cities, including Kyiv and Odesa. Meanwhile in Los Angeles, protests over immigration raids turned more violent and confrontational. President Trump’s deployment of thousands of National Guard troops and Marines, opposed by California officials, has heightened tensions and led to legal challenges. While the unrest remains mostly confined to downtown LA, the intensity of clashes and the federal intervention mark a clear escalation

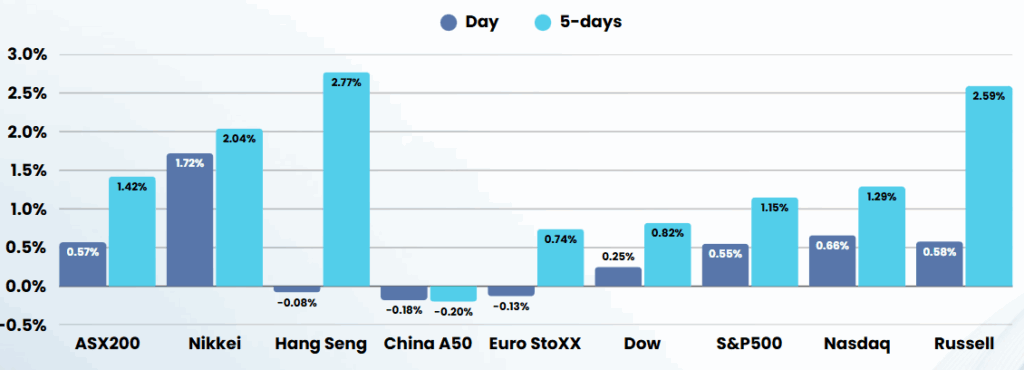

ASX SPI 8620 (+0.27%)

The ASX200 is headed for fresh records today and break out of “bear market” territory in the fastest recovery in stock market history. The 20% rally is a far cry from where we thought we would be just 61 days ago when the index traded 7170, so expect the bull market calls to be front and centre in the press. We are happy to buy single stocks with investment catalysts, but remain cautious on a macroeconomic and geopolitical level with so many unresolved issues.

While the 20% rally technically now classifies as a break of a bear market, one of the key fundamentals of a bear market rally is the question “has anything changed?” we still have tariffs, Russia just has its busiest day of the Ukraine conflict, the US Debt is worsening and global economic numbers are softer…. So we are not feeling any form of FOMO

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.