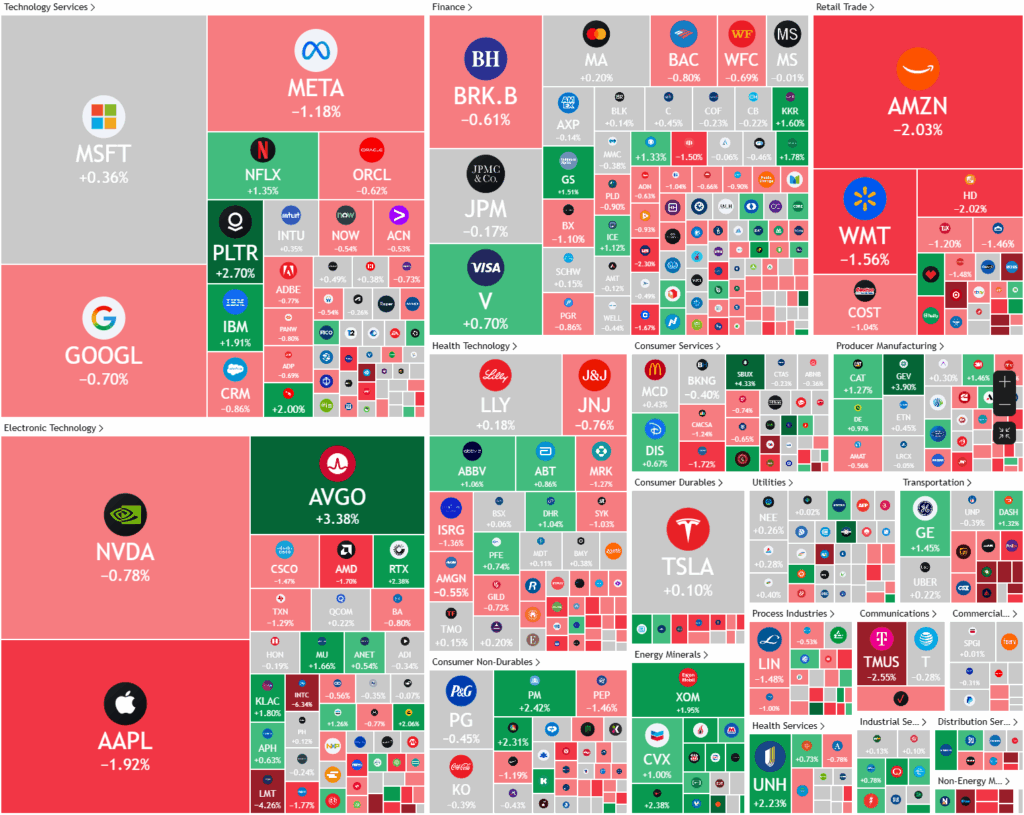

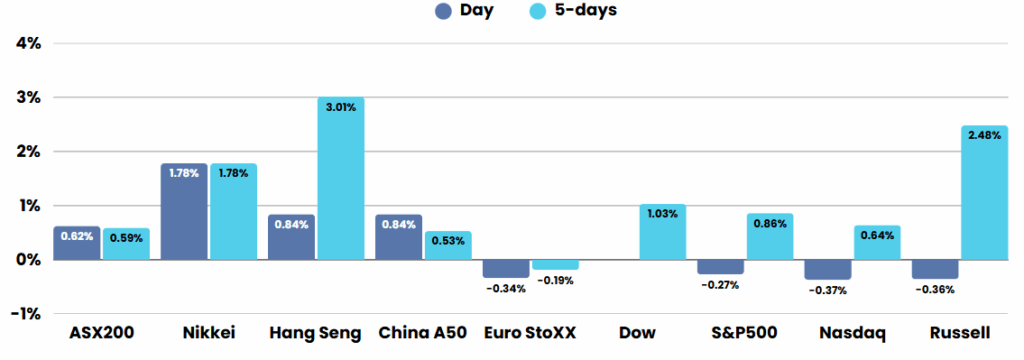

Overnight – Stocks drift lower as trade “deal” drags on

Stocks snapped a three-day winning streak despite slowing inflation stoked bets on Federal Reserve rate cuts just as US President Donald Trump “confirmed” that his administration had struck a trade deal with China, albeit without any confirmation from China

US President Donald Trump announced that a trade agreement between the United States and China is effectively finalized, pending final approval from both him and Chinese President Xi Jinping. The deal, which emerged after intense negotiations in London, will grant the U.S. access to Chinese rare earth minerals and magnets—a key priority for American officials—while allowing Chinese students to continue attending U.S. colleges and universities. The agreement maintains a 55% tariff on Chinese goods entering the U.S. and a 10% tariff on American goods exported to China. Despite the positive tone, uncertainty remains due to the lack of detailed framework specifics, leaving investors cautious as previous agreements have not always lasted.

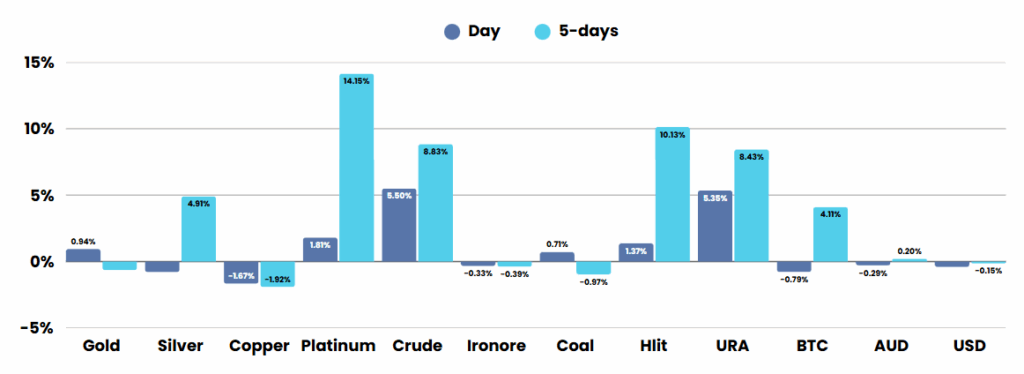

On the geopolitical front, the U.S. is preparing to partially evacuate its embassy in Iraq and permit military dependents to leave certain Middle Eastern locations, citing unspecified security concerns. This move coincides with heightened tensions between the U.S. and Iran, as Washington has warned of potential military action if talks to curb Iran’s nuclear program fail. These developments contribute to a climate of uncertainty in global markets, particularly affecting commodities and energy sectors, which are sensitive to both trade and geopolitical risks12.

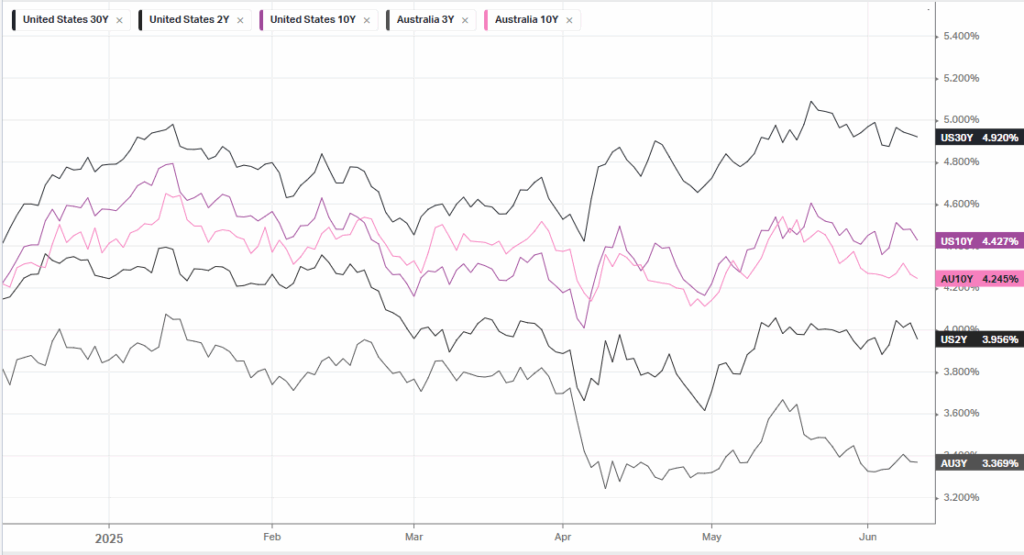

Meanwhile, economic data indicates that U.S. inflation slowed in May, with the annual consumer price index rising 2.4%, slightly below expectations. On a monthly basis, inflation eased to 0.1%. Core inflation, which excludes volatile food and energy prices, remained steady at 2.8% year-over-year but also showed a slight monthly decline. The subdued inflation figures have led to increased expectations for a Federal Reserve rate cut in September. However, some analysts warn that inflation could rebound later in the year, especially if new tariffs exert upward pressure on prices. In the corporate sphere, Oracle is set to report earnings, with market attention focused on its cloud and AI-driven growth strategy and concerns about its heavy capital expenditures.

ASX SPI 8622 (+0.23%)

The local market is likely to remain fairly stable as commodities and energy are likely to buoy the market.

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.