Overnight – Stocks recover as softer inflation overrides geopolitical issues

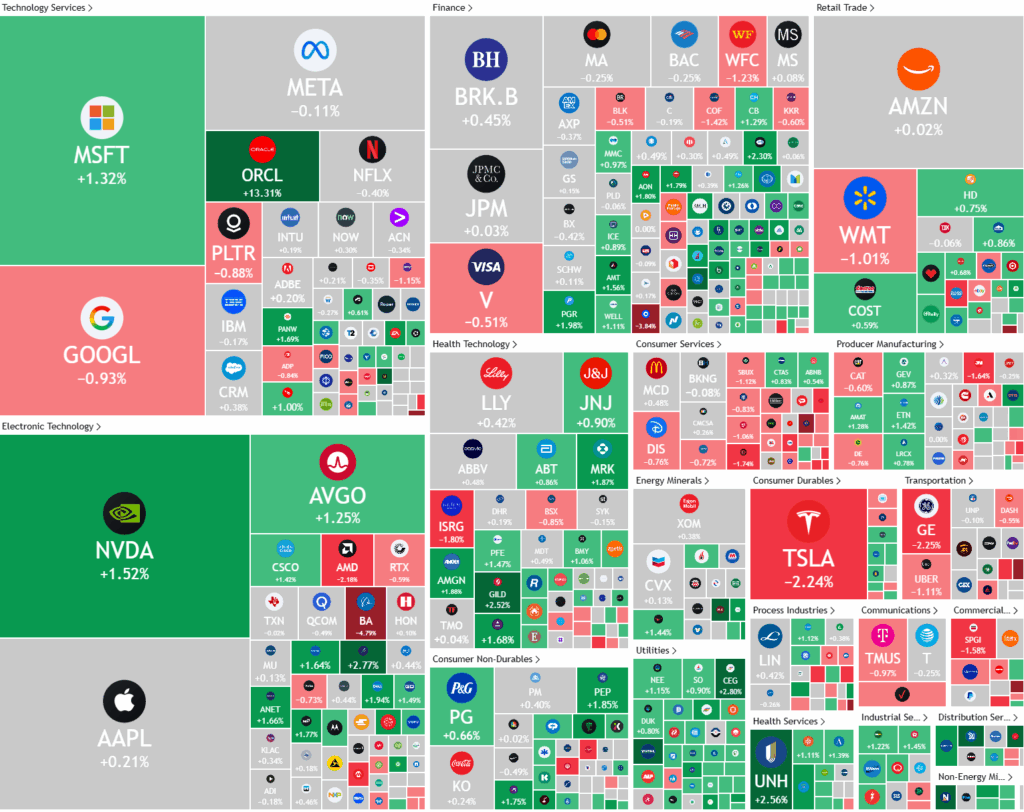

Stocks recovered from early losses due to middle east tensions, to finish slightly higher, underpinned by an Oracle-led rally in big tech and further signs of cooling inflation.

Shares in Oracle surged to record highs after the company raised its annual revenue growth target, citing strong demand from clients leveraging artificial intelligence. CEO Safra Catz announced that Oracle expects total revenue for its 2026 fiscal year to reach at least $67 billion, reflecting an annual growth rate of approximately 16.7%, up from the previous guidance of 15%. Deutsche Bank highlighted the company’s robust outlook, noting Oracle’s expectation to more than double its backlog to $138 billion, underscoring the momentum in its cloud and AI-driven business.

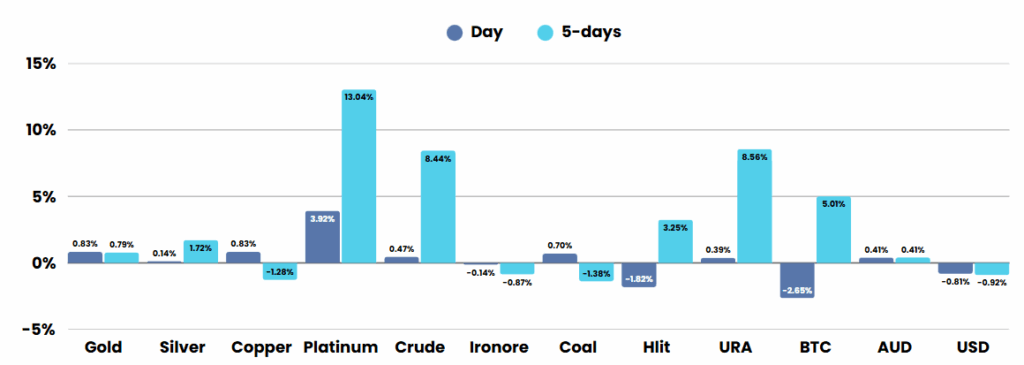

In contrast, Boeing’s stock slumped following the crash of an Air India 787-8 Dreamliner shortly after takeoff, which also negatively impacted GE Aerospace, the engine supplier for the aircraft. Meanwhile, Chime Financial made a strong debut on the public markets, surging 39% above its IPO price, signaling continued investor appetite for high-growth fintech entrants. Broader market sentiment was influenced by a cooler-than-expected May producer price index, with inflation data showing restrained price increases due to lower service costs, though economists anticipate renewed inflationary pressures later in the year.

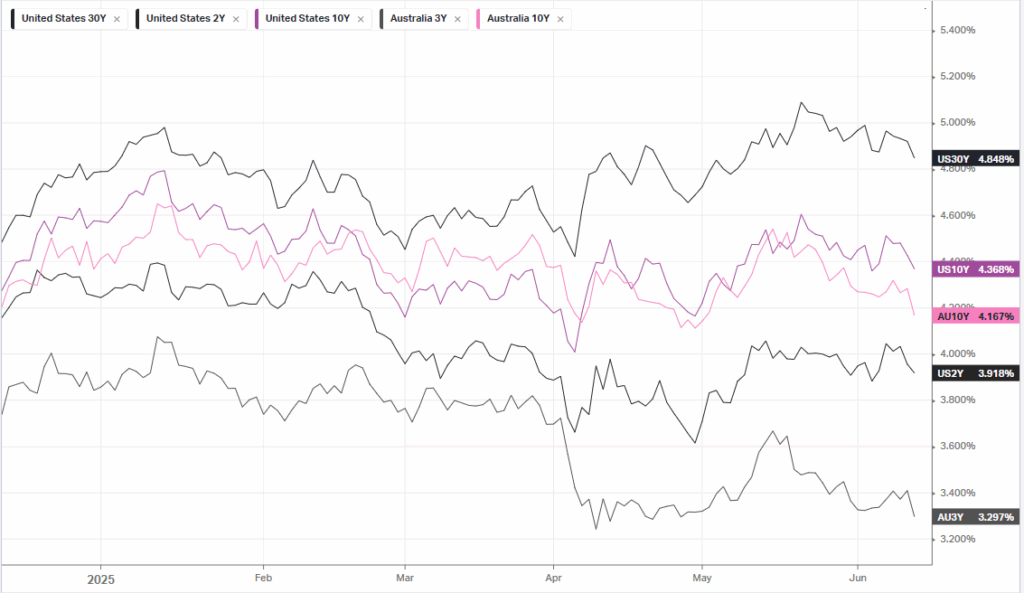

On the policy front, President Trump renewed tariff threats, warning of potential increases on auto imports and reiterating a July 9 deadline for new trade deals, which has heightened trade uncertainty. Energy markets saw oil prices pare losses amid concerns of potential supply disruptions from escalating Middle East tensions, lifting energy stocks like APA Group, Expand Energy, and EQT Corporation. The Federal Reserve is expected to maintain its current interest rate range in the upcoming meeting, with market watchers anticipating a possible rate cut in September as labor market conditions continue to ease.

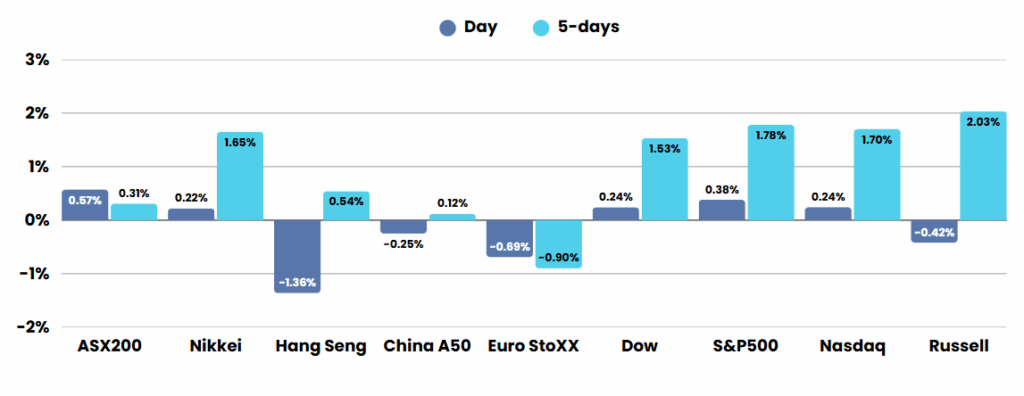

ASX SPI 8622 (+0.53%)

Australian shares are poised to open higher after shares closed modestly higher in New York following another muted price report, though there are signs that the US labour market is starting to lose momentum.

Later on Friday, both Germany and France will release consumer price index data. The University of Michigan will release a preliminary June sentiment report at midnight.

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.