Overnight – investors bet on ceasefire, uranium heads to decade highs

Stocks kicked off the week on a strong note, as investors bet on a quicker resolution to the Israel-Iran conflict, while uranium ETF broke to 10 years highs

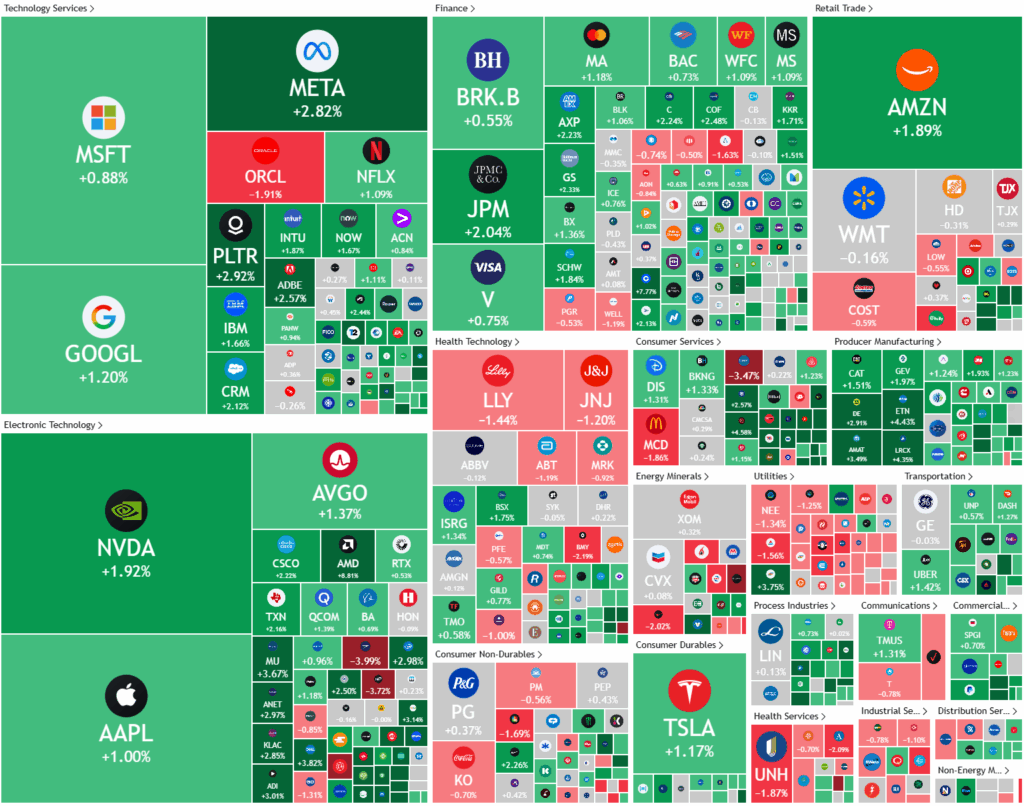

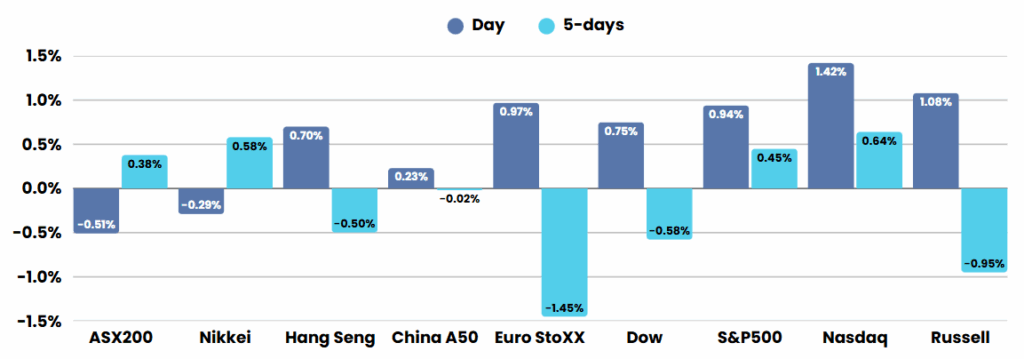

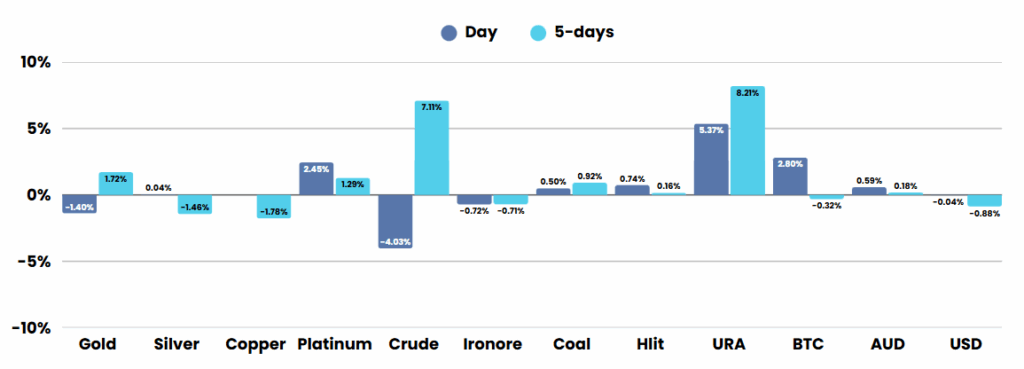

Market sentiment was buoyed by reports suggesting Iran might be seeking a ceasefire, though Tehran later denied reaching out to Middle Eastern intermediaries to press the U.S. for intervention. Despite the conflicting headlines, hopes for de-escalation pushed oil prices lower and sparked a risk-on mood across equities, lifting the Dow Jones Industrial Average by 317 points (0.8%) and the Nasdaq Composite by 1.4%.

The geopolitical backdrop remains uncertain, with The Wall Street Journal and Reuters initially reporting that Iran had asked Qatar, Saudi Arabia, and Oman to encourage President Trump to broker an immediate ceasefire with Israel. Tehran’s denial did little to dampen investor optimism, as the prospect of reduced hostilities continued to weigh on crude prices and support global risk assets. The market’s focus, however, is quickly shifting to monetary policy, with the Federal Reserve’s two-day meeting set to begin Tuesday.

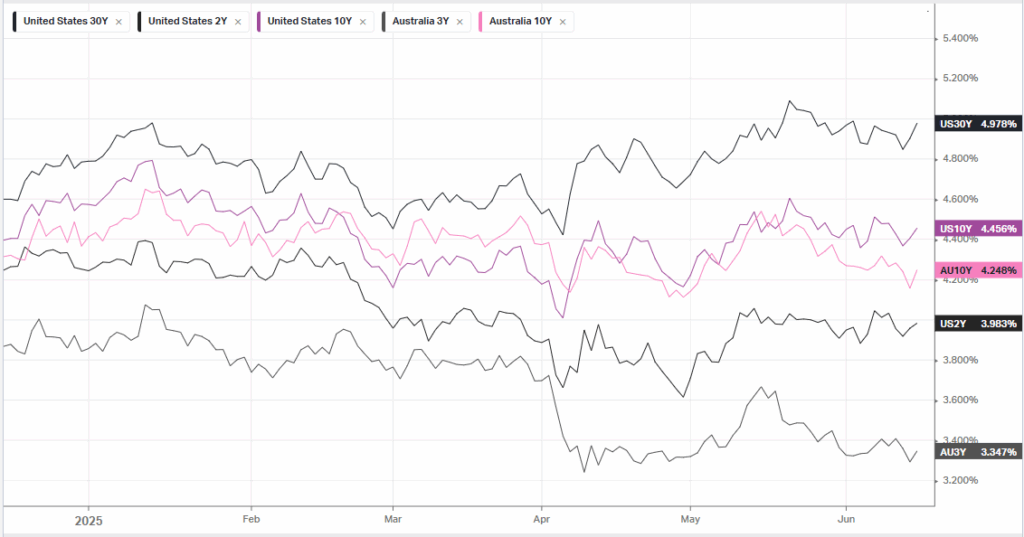

Investors are widely expecting the Fed to leave interest rates unchanged at around 4.5% when the meeting concludes Wednesday, but all eyes will be on any hints about future policy direction. Softer U.S. inflation data and signs of a cooling economy have fuelled speculation that the central bank could soon pivot toward rate cuts, despite its recent messaging that rates will remain steady in the near term. The Fed’s decision comes amid mounting political pressure from President Trump and ongoing uncertainty over the impact of his trade tariffs, which Barclays warns could reignite inflation later this year.

On the corporate front, Roku shares surged after announcing an exclusive partnership with Amazon Ads, forming what the companies call the largest authenticated Connected TV footprint in the U.S. United States Steel also jumped following White House approval of its tie-up with Japan’s Nippon Steel. Meanwhile, Sarepta Therapeutics tumbled on news of a second patient death linked to its gene therapy for muscular dystrophy. As the G7 summit gets underway in Canada, trade tensions remain in focus, with Canadian Prime Minister Mark Carney vowing to push for peace and security, but warning of possible retaliation if U.S. steel and aluminum tariffs persist.

URA ETF broke to a 10 year high overnight as Uranium stocks have been buoyed globally as commodities fund Sprott, bought $100m of physical uranium to add to their physical uranium fund, which is usually followed by rally in the space.

ASX SPI 8565 (+0.05%)

The local market is likely to hold ground from yesterdays surprising gains. Oil and Gold stocks may remain under pressure as investors bet on a quick fix for the middle east, expect the best gains in the tech sector and uranium stocks.

Worldwide, there is a significant short position (traders betting on the stock falling) in the uranium miners, which needs to be bought back. This should keep the likes of Boss Energy BOE and Paladin PDN supported

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.