What's Affecting Markets Today

Asia-Pacific Markets Mixed as Investors Monitor Middle East Tensions

Asia-Pacific equity markets were mostly lower in volatile Tuesday trade as investors digested escalating tensions between Israel and Iran, following U.S. President Donald Trump’s call for the evacuation of Tehran and early departure from the G7 summit.

Despite market unease, Fitch Ratings said the conflict’s current impact remains manageable within Israel’s ‘A’/Negative credit rating, while Lombard Odier’s chief economist Samy Chaar noted no signs of irreversible escalation. Still, Chaar warned that persistent uncertainty and elevated energy costs could weigh on global growth and inflation.

Japan’s Nikkei 225 rose 0.59% and the Topix gained 0.34% after the Bank of Japan left its interest rate unchanged at 0.5% and signaled a slower pace of bond purchases starting next April. South Korea’s Kospi was flat, while the Kosdaq dropped 0.53%.

Mainland China’s CSI 300 edged down 0.15%, and Hong Kong’s Hang Seng slipped 0.13%. Australia’s ASX 200 declined 0.14%, while India’s Nifty 50 and Sensex lost 0.27% and 0.37%, respectively, amid global risk aversion.

ASX Stocks

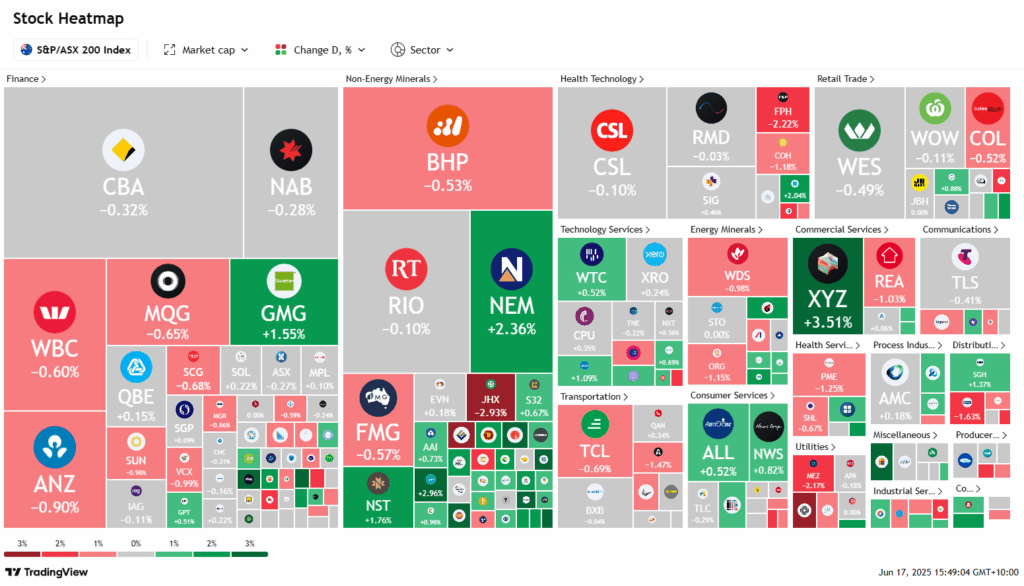

ASX 200 8,535.4 (-0.15%)

ASX Wavers as Oil Rises on Trump’s Iran Warning

The ASX 200 swung between gains and losses on Tuesday, dipping 10 points to 8538.4 by 2pm AEST, with seven of 11 sectors in decline. The market largely shrugged off Wall Street’s positive lead, as geopolitical tensions took centre stage.

Investor sentiment turned cautious after US President Donald Trump posted a call for evacuation of Tehran, fuelling fears of potential US military action in Iran amid escalating Israel-Iran conflict. Oil prices surged over 2%, gold rose to US$3398/oz, and the Australian dollar eased to US65.05¢.

Energy and gold stocks led the gains. Santos edged up 0.3% after Monday’s rally following a $30bn takeover bid by an Abu Dhabi-led consortium. Newmont and Northern Star rose 2% each.

Uranium stocks extended gains as hedge funds moved to cover short positions after the Sprott Physical Uranium Trust announced a US$100m raise. Deep Yellow added 7.3%, Boss Energy 4.7%, Paladin 5%, and Silex Systems 4.5%.

Among other movers, Life360 rose 1.6% on a UBS reiteration, while Pro Medicus, Cochlear, and Qantas posted mixed performances.

Leaders

RSG – Resolute Mining Ltd (+9.35%)

BGL – Bellevue Gold Ltd (+7.80%)

DRO – Droneshield Ltd (+6.36%)

DYL – Deep Yellow Ltd (+5.89%)

IFT – Infratil Ltd (+4.35%)

Laggards

VSL – Vulcan Steel Ltd (-7.54%)

PPC – Peet Ltd (-3.29%)

GMD – Genesis Minerals Ltd (-3.24%)

NEU – Neuren Pharmaceuticals Ltd (-3.16%)

JHX – James Hardie Industries Plc (-3.16%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!