What's Affecting Markets Today

Asia-Pacific Markets Mixed as Geopolitical Risks Mount

Asia-Pacific equity markets traded mixed on Wednesday as escalating tensions between Israel and Iran weighed on investor sentiment. U.S. President Donald Trump intensified concerns after calling for Iran’s “unconditional surrender” in a Truth Social post, prompting speculation of possible U.S. military action. Former and current officials confirmed to NBC News that Trump is considering a strike on Iran, amplifying market caution.

Japan’s Nikkei 225 rose 0.47%, and the Topix gained 0.4%, supported by a smaller-than-expected 1.7% year-on-year decline in May exports. The data offered a mild reprieve following the Bank of Japan’s warning that trade headwinds could moderate economic growth and erode corporate profits.

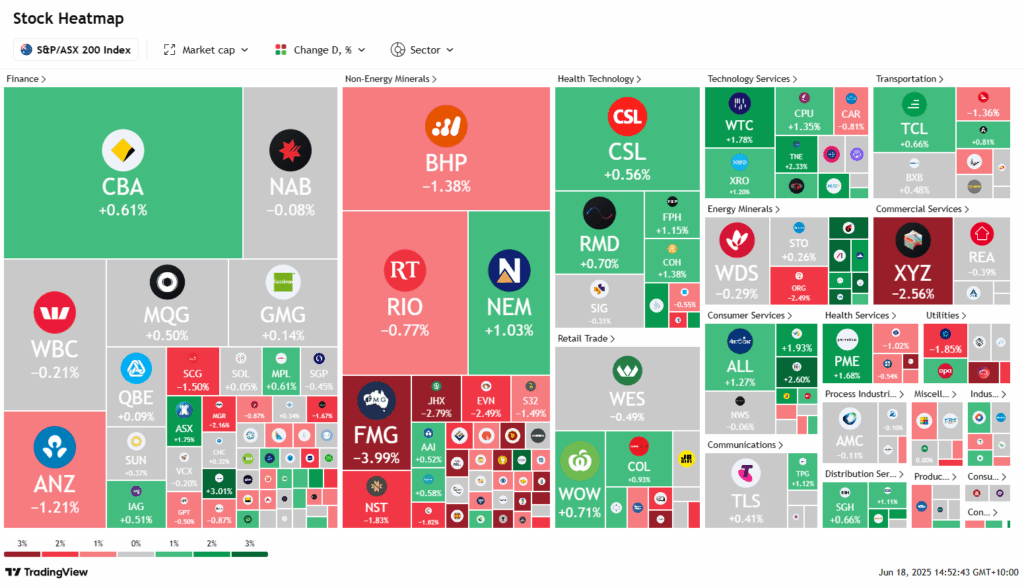

South Korea’s Kospi climbed 0.7%, while the Kosdaq added 0.66%. Meanwhile, Australia’s S&P/ASX 200 was flat, as gains in energy and uranium stocks were offset by weakness in iron ore miners and gold producers.

Hong Kong’s Hang Seng Index slipped 0.87% amid lingering concerns over China’s property sector, while mainland China’s CSI 300 edged up 0.18%, reflecting modest gains in consumer and tech stocks.

ASX Stocks

ASX 200 8,535.4 (-0.06%)

ASX Wavers as Iron Ore Miners Slide; Oil Rises on Geopolitical Tensions

The ASX 200 fluctuated on Wednesday, inching up just one point to 8542.3 by 2pm AEST, as a sharp sell-off in materials offset gains in other sectors. Investors remained cautious amid escalating tensions in the Middle East, with oil prices surging to five-month highs after Donald Trump demanded Iran’s “unconditional surrender,” stoking fears of broader US involvement.

Iron ore miners led declines, tracking a slump in Singapore iron ore futures below $US93/tonne. Citi’s downgrade of its 12-month price forecast to $US90 and soft Chinese demand weighed on sentiment. BHP fell 1.4%, Fortescue 4%, and Mineral Resources 5.1%. Gold stocks also slipped, with Northern Star down 2.3% and Evolution 2.5%.

In contrast, uranium stocks rallied. Boss Energy rose 3.1% after confirming Honeymoon mine met production guidance, while Deep Yellow jumped 4.2%.

NextDC reversed early losses to trade 0.1% higher after securing a $2.2 billion refinancing facility. Karoon Energy added 0.7% on new Brazil acreage, and Ooh!Media rose 3.3% after a UBS upgrade with 20% upside potential.

Leaders

BGP Briscoe Group Australasia Ltd (+8.42%)

VEA Viva Energy Group Ltd (+4.61%)

DYL Deep Yellow Ltd (+3.92%)

YAL Yancoal Australia Ltd (+3.61%)

OML Ooh!Media Ltd (+3.42%)

Laggards

CYL Catalyst Metals Ltd (-8.70%)

VUL Vulcan Energy Resources Ltd (-5.31%)

MIN Mineral Resources Ltd (-4.90%)

PNR Pantoro Gold Ltd (-4.70%)

SNZ Summerset Group Holdings Ltd (-4.58%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!