What's Affecting Markets Today

Asia-Pacific Markets Weaken as Fed Holds Rates; Geopolitical Tensions Weigh on Sentiment

Asia-Pacific equities retreated on Thursday, as investors assessed the U.S. Federal Reserve’s latest policy decision and rising geopolitical risks.

Japan’s Nikkei 225 slipped 0.74% while the broader Topix lost 0.61%. South Korea’s Kospi declined 0.34%, with the Kosdaq little changed. In Hong Kong, the Hang Seng index fell 0.48%, while mainland China’s CSI 300 was flat.

Investor caution remained elevated amid escalating tensions in the Middle East. U.S. President Donald Trump reconvened his national security team for a second time in two days to evaluate a possible military response against Iran, following the country’s ongoing conflict with Israel.

The U.S. Federal Reserve left interest rates unchanged at 4.25%–4.50%, in line with expectations. Fed Chair Jerome Powell reiterated the central bank’s wait-and-see approach, noting it would assess the inflationary impact of newly imposed tariffs before adjusting policy.

Despite persistent inflation concerns, the Fed maintained guidance for two potential rate cuts later this year. Markets are also watching for interest rate decisions from Taiwan and the Philippines later in the day.

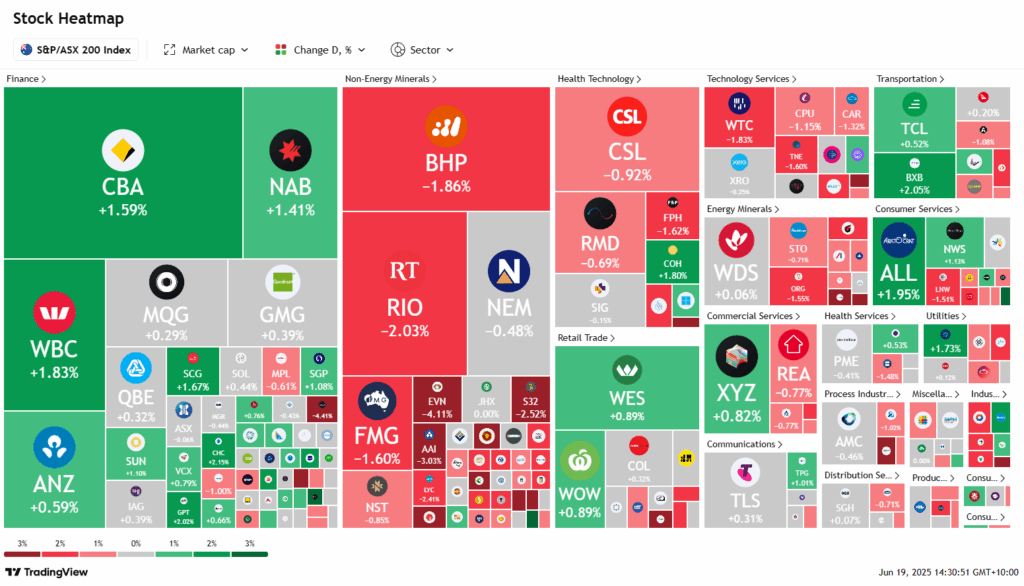

ASX Stocks

ASX 200 8,536.9 (+0.06%)

ASX Flat as Jobs Data Misses; Wisetech Falls on Board Changes

The ASX 200 hovered around the flat line on Thursday, down just one point to 8530.2 by 2pm AEST, as investors weighed weaker-than-expected jobs data, falling iron ore prices, and geopolitical risks.

Australian employment unexpectedly declined by 2500 jobs in May, well below consensus expectations for a 22,500 gain. Markets showed little immediate reaction.

Iron ore continued its downward trajectory, with Singapore futures dipping 0.2% to US$92.60/t, dragging BHP (-2.0%) and Fortescue (-1.8%) lower. Gold miners were also under pressure, with Perseus down 4.6% and Evolution off 4.2%.

Utility stocks sold off broadly—Origin fell 2.3%, AGL dropped 2.0%, and Ampol declined 1.3%.

In the US, the Fed held rates steady, reaffirming expectations for two cuts this year despite tariff concerns and sticky inflation.

KMD Brands slumped as much as 5.7% before recovering slightly to -1.9%, after flagging a sharp decline in FY25 earnings due to unseasonably warm autumn weather.

WiseTech Global slipped 2.1% following news of two board departures, with Sandra Hook and Rob Castaneda announced as new directors.

Leaders

KLS – Kelsian Group Ltd (+9.11%)

ZIM – Zimplats Holdings Ltd (+5.74%)

GTK – Gentrack Group Ltd (+3.27%)

TAH – Tabcorp Holdings Ltd (+2.76%)

HMC – HMC Capital Ltd (+2.13%)

Laggards

RSG – Resolute Mining Ltd (-10.15%)

MP1 – Megaport Ltd (-7.36%)

GDG – Generation Dev Group(-6.28%)

SDR – Siteminder Ltd (-6.15%)

CIA – Champion Iron Ltd (-5.54%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!