What's Affecting Markets Today

Asia-Pacific Markets Mostly Higher as Investors Weigh China Data, Geopolitical Risks

Asia-Pacific equities mostly advanced on Friday as investors digested economic data from China and monitored rising geopolitical tensions between Israel and Iran. U.S. President Donald Trump is expected to decide within two weeks whether to support Israeli military action against Tehran, keeping markets on edge.

Hong Kong’s Hang Seng Index rose 1.15%, while China’s CSI 300 added 0.24% after the People’s Bank of China left its loan prime rates unchanged at 3.0% for the 1-year and 3.5% for the 5-year terms, in line with expectations.

Japan’s Nikkei 225 edged up 0.12%, though the broader Topix slipped 0.17%. Japan’s core inflation accelerated to 3.7% in May—its highest since January 2023—exceeding economists’ forecasts and April’s 3.5% reading.

South Korea’s Kospi climbed 1.19%, breaching the 3,000-point mark for the first time in 42 months, while the Kosdaq gained 1.01%.

Australia’s S&P/ASX 200 narrowed earlier losses, down 0.2% in afternoon trade.

India’s Nifty 50 opened 0.21% higher, and the BSE Sensex gained 0.29% in early trading.

ASX Stocks

ASX 200 8,507.30 (-0.19%)

ASX Dips as Banks Weigh; Betr Tables Bid for PointsBet

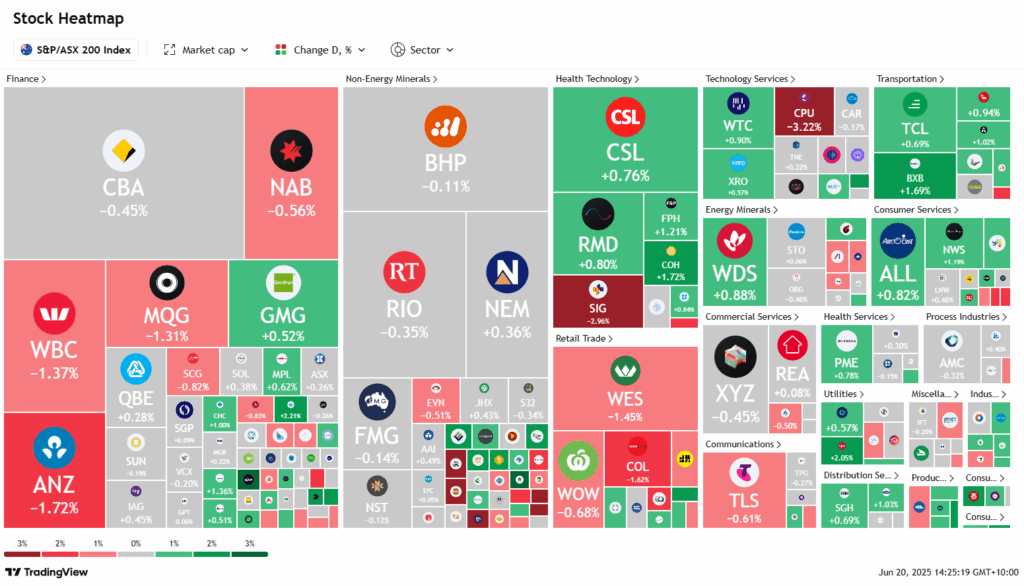

The ASX edged lower on Friday afternoon, with the S&P/ASX 200 slipping 16 points, or 0.2%, to 8507.7 by 2pm AEST. Losses in the big four banks outweighed modest gains in healthcare, with six of 11 sectors trading in the green.

Bank stocks dragged on the index as CBA fell 0.5%, NAB dropped 0.6%, and both Westpac and ANZ lost 1.5%. In contrast, healthcare stocks provided support, with CSL, Pro Medicus, ResMed, and Fisher & Paykel each up nearly 1%, while Cochlear rose 1.8%.

Liontown Resources gained 1.5% despite a “sell” call from Citi, which also downgraded its lithium price forecast by up to 20%. Pilbara Minerals dropped 4.5% on the news.

Betr launched an off-market, all-scrip bid for PointsBet, offering 3.81 Betr shares per PointsBet share. Both stocks remain in trading halts, with Japan’s Mixi also in contention.

Bowen Coking Coal plunged 44% on concerns it may suspend operations at its Burton Mine due to weak coal prices and high Queensland royalties. Webjet fell 1.7% following board changes.

Leaders

DRO Droneshield Ltd (+4.97%)

AX1 Accent Group Ltd (+4.85%)

ZIP ZIP Co Ltd (+4.61%)

KLS Kelsian Group Ltd (+3.92%)

IRE Iress Ltd (+3.02%)

Laggards

ZIM Zimplats Holdings Ltd (-6.51%)

MMS McMillan Shakespeare Ltd (-6.49%)

VSL Vulcan Steel Ltd (-6.46%)

FCL Fineos Corporation Holdings Plc (-4.80%)

BOE Boss Energy Ltd (-4.31%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!