What's Affecting Markets Today

Asia-Pacific Markets Mixed as Investors Weigh Ceasefire, Fed Comments

Asia-Pacific markets traded mixed on Wednesday as investors assessed the durability of a U.S.-brokered ceasefire between Israel and Iran and fresh signals from the Federal Reserve on interest rates.

Australia’s S&P/ASX 200 was flat, while Japan’s Nikkei 225 edged up 0.11% and the broader Topix slipped 0.13%. South Korea’s Kospi rose 0.31%, while the tech-heavy Kosdaq declined 0.21%. Hong Kong’s Hang Seng advanced 0.66%, and China’s CSI 300 ended flat.

Market sentiment was buoyed by optimism that the ceasefire, brokered by U.S. President Donald Trump, would hold. However, caution remained following comments from Fed Chair Jerome Powell, who reiterated the central bank’s commitment to controlling inflation. Powell indicated that the Fed was in a position to pause and assess how tariffs might influence the economic outlook before adjusting policy.

On Wall Street, major U.S. indices closed sharply higher. The Dow jumped 1.19%, the S&P 500 rose 1.11%, and the Nasdaq Composite gained 1.43%. The Nasdaq 100 closed at a record high of 22,190.52, up 1.53%.

ASX Stocks

ASX 200 8,558.0 (+0.03%)

ASX Flat as Miners Weigh; DroneShield Soars on European Defence Deal

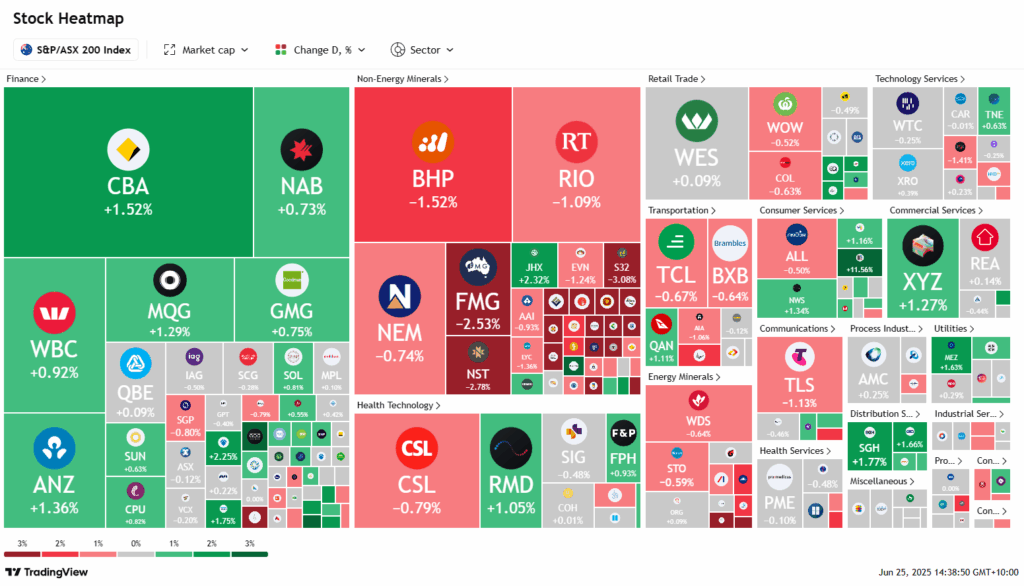

The S&P/ASX 200 Index was little changed on Wednesday, down just 1 point to 8554.2 by 2pm AEST, as weakness in mining and energy stocks offset gains in banks and tech. Investor sentiment remained cautious amid geopolitical uncertainty surrounding the Israel-Iran ceasefire.

Mining stocks declined, led by Fortescue (-2.6%), BHP (-1.5%) and Rio Tinto (-1%), following a pullback in iron ore prices. Gold miners including Northern Star (-2.8%) fell alongside weaker bullion, while Woodside and Santos dipped nearly 1% on profit-taking.

Commonwealth Bank hit a record high of $192, up 1.6%, while ANZ gained 1.9% after soft inflation data lifted rate cut expectations.

DroneShield surged 24% after securing a $61.6 million European military contract. Virgin Australia rose 3.4% on its second day of trade. Greatland Gold slipped 1.1%.

Pinnacle fell 3.4% after founder Ian Macoun sold $77 million in shares. Humm jumped 8% following a takeover bid from Chairman Andrew Abercrombie’s family office. Star Entertainment rose 6% as Bally’s and Mathieson moved closer to control. Xero entered a trading halt pending a $3.9 billion acquisition of Melio Payments.

Leaders

DRO – Droneshield Ltd (+24.37%)

CKF – Collins Foods Ltd (+11.97%)

LNW – Light & Wonder Inc (+11.29%)

SRG – SRG Global Ltd (+7.75%)

GQG – GQG Partners Inc (+7.69%)

Laggards

EMR – Emerald Resources NL (-10.79%)

PNR – Pantoro Gold Ltd (-6.45%)

SMR – Stanmore Resources Ltd (-5.99%)

MIN – Mineral Resources Ltd (-5.87%)

DVP – Develop Global Ltd (-5.85%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!