What's Affecting Markets Today

Asia-Pacific Markets Mostly Higher as Tariff Concerns Ease

Asia-Pacific equities mostly rose on Friday, tracking Wall Street gains after White House Press Secretary Karoline Leavitt signaled flexibility on the July tariff deadlines, easing investor concerns. Leavitt said the July 8 and 9 deadlines for reimposing tariffs were “not critical” and could potentially be extended, calming markets previously rattled by trade uncertainty.

Japan’s Nikkei 225 surged 1.59% to a six-month high, surpassing 40,000 for the first time since January 7. The broader Topix index advanced 1.3%. Tokyo’s core CPI (excluding fresh food and fuel) rose 3.1% year-on-year in June, down from 3.6% in May and below Reuters’ forecast of 3.3%.

Mainland China’s CSI 300 gained 0.31%, and Hong Kong’s Hang Seng Index edged up 0.1%, despite data showing Chinese industrial profits fell 9.1% in the first five months of the year.

South Korea’s Kospi fell 0.76%, while the Kosdaq slipped 0.57%.

Australia’s S&P/ASX 200 was flat as investors weighed macroeconomic signals and commodity price movements. Overall, markets responded positively to signs of tariff de-escalation.

ASX Stocks

ASX 200 8,538.7 (-0.14%)

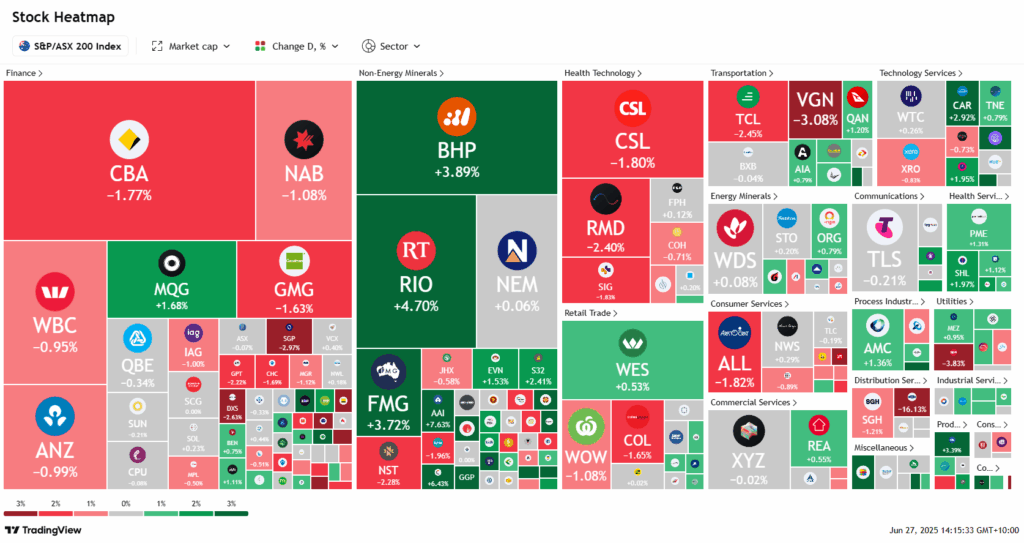

ASX Slips as Bank and Consumer Stocks Weigh; BHP, Lithium Miners Rally

The S&P/ASX 200 fell 0.08% to 8543.8 by early afternoon Friday, paring early gains as strength in iron ore and lithium stocks was outweighed by losses in financials and consumer staples. Seven of 11 sectors declined.

Iron ore miners led gains after Singapore futures rose 1.4% to US$94.65/tonne on improved Chinese steel market sentiment. BHP jumped 4.2%, Rio Tinto climbed 4.8%, and Fortescue rose 3.8%. ANZ’s Daniel Hynes cited falling steel and port inventories as supportive for prices.

Lithium stocks rallied for a second day following Vanguard’s substantial stake in Pilbara Minerals. PLS advanced 5.9%, IGO rose 5% after announcing board changes, and Mineral Resources added 2.2% despite a Macquarie downgrade.

Reece plunged up to 16.5% after guiding for a FY25 EBIT decline to $548–$558 million and confirming Ross McEwan’s board exit.

CBA dropped 1.7% to below $188, while ANZ, NAB, and Westpac fell ~1%. CSL, ResMed, and Sigma declined around 2%.

Breville gained 2.8% after a Jarden upgrade. Woolworths fell 1.2%, and Coles slid 1.7%.

Leaders

DVP – Develop Global Ltd (+10.30%)

AAI – Alcoa Corporation (+7.68%)

CSC – Capstone Copper Corp (+7.16%)

NEU – Neuren Pharmaceuticals Ltd (+6.46%)

PLS – Pilbara Minerals Ltd (+6.27%)

Laggards

REH – Reece Ltd (-15.55%)

WEB – WEB Travel Group Ltd (-4.23%)

DRO – Droneshield Ltd (-4.18%)

APA – APA Group (-3.60%)

GOZ – Growthpoint Properties Australia (-3.25%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!