What's Affecting Markets Today

Asia-Pacific Markets Edge Higher Amid Trade Talks and Data Releases

Asia-Pacific equities mostly advanced on Monday as investors digested fresh economic data and developments in global trade negotiations.

China’s June manufacturing PMI showed a third consecutive month of contraction, heightening expectations for further stimulus to offset the drag from ongoing US-China trade tensions. The CSI 300 was flat, while Hong Kong’s Hang Seng Index declined 0.45%.

Japan’s Nikkei 225 gained 1.48%, reaching an 11-month high, supported by solid industrial output figures. The broader Topix rose 0.77%. South Korea’s Kospi added 0.82%, and the Kosdaq edged up 0.31%. Australia’s S&P/ASX 200 climbed 0.59%.

Indian markets were little changed in early trade, with the Nifty 50 and BSE Sensex both flat.

On Wall Street, all three major US benchmarks closed higher on Friday. The S&P 500 rose 0.5% to a record 6,173.07, while the Nasdaq also reached an all-time high. The Dow Jones Industrial Average advanced nearly 1%.

Markets have rebounded sharply in June following April’s selloff, but uncertainty surrounding trade policy remains a key risk to sustained momentum.

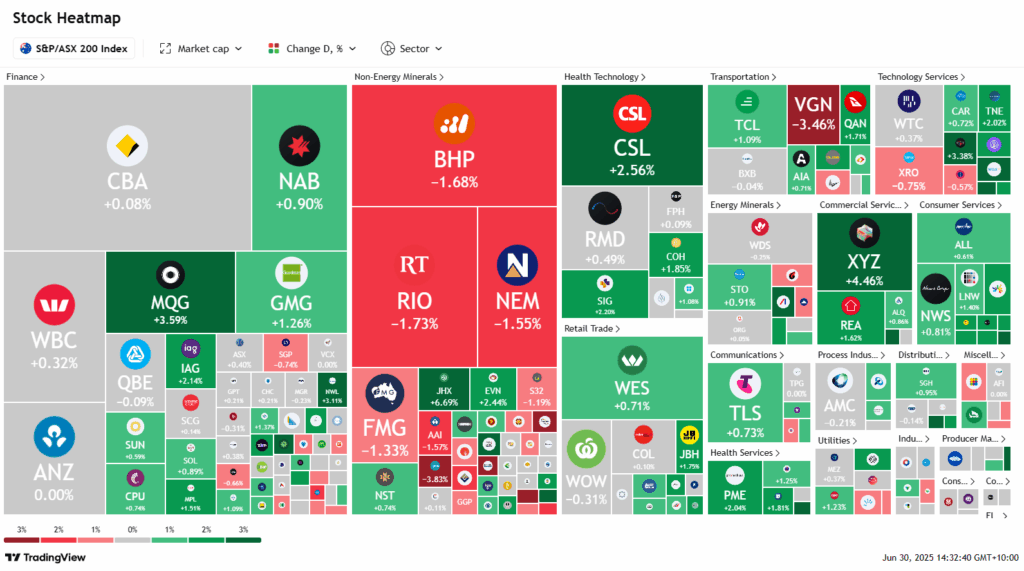

ASX Stocks

ASX 200 8,557.7 (+0.51%)

ASX Rallies on Trade Optimism; CSL, James Hardie Lead Gains

The Australian sharemarket rose on Monday, with the S&P/ASX 200 up 60.7 points, or 0.7%, to 8574.9 by 2:10pm AEST. The rally followed gains on Wall Street, where the S&P 500 closed at a record high amid optimism around US trade talks.

Health and tech sectors led local advances. CSL, Pro Medicus, and Sigma Healthcare rose over 2%, while Cochlear added 1.8%. NextDC climbed 3.7%, and Macquarie Group gained 3%.

In contrast, iron ore majors BHP, Rio Tinto, and Fortescue each fell around 1.5% as investors locked in profits ahead of the financial year-end.

James Hardie surged 6.2% after Azek shareholders approved a $14b takeover, facilitating James Hardie’s primary listing shift to New York.

Newly listed biotech Tetratherix jumped 13%, while DroneShield dropped 5.5% after profit-taking from last week’s 33% rally.

NIB rose 8.9% after UBS upgraded the stock to “buy” with a $7.85 target. Superloop added 2% after lifting full-year earnings guidance to $91m.

Eight of eleven sectors traded higher.

Leaders

NHF Nib Holdings Ltd (+8.58%)

JHX James Hardie Industries Plc (+6.16%)

A4N Alpha HPA Ltd (+5.59%)

XYZ Block, Inc (+4.50%)

ADT Adriatic Metals Plc (+4.17%)

Laggards

LTR Liontown Resources Ltd (-5.90%)

VUL Vulcan Energy Resources Ltd (-5.24%)

DYL Deep Yellow Ltd (-4.52%)

LYC Lynas Rare Earths Ltd (-4.45%)

SX2 Southern Cross Gold (-4.12%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!