Overnight – Stocks eek out a small gain to close the quarter at another record

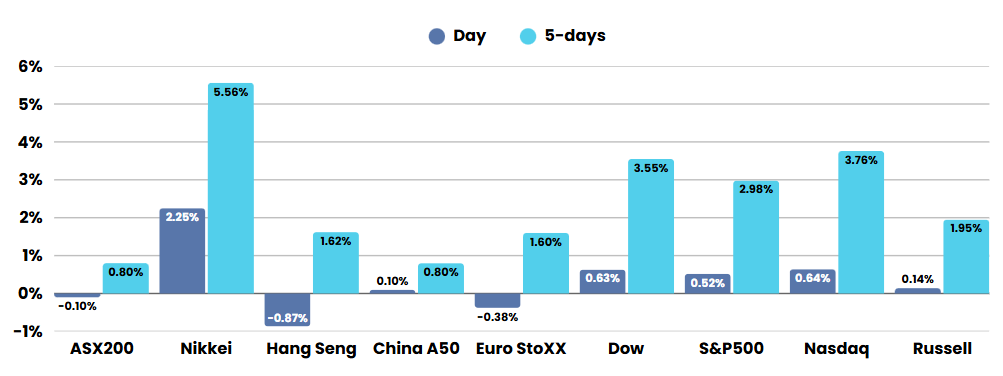

Stocks closed higher overnight, to cap for strong gains for the second quarter as fears over global trade wars recede and bets on sooner rate cuts heat up.

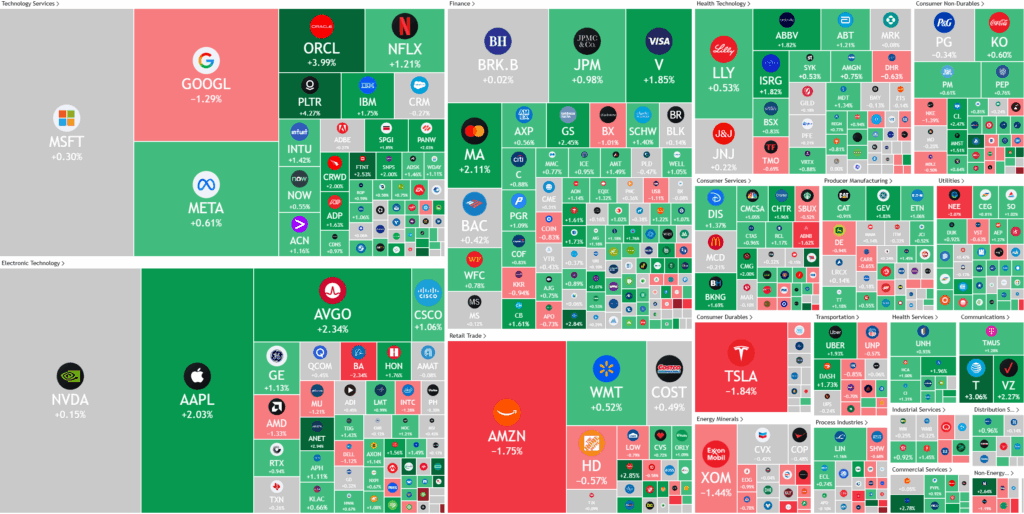

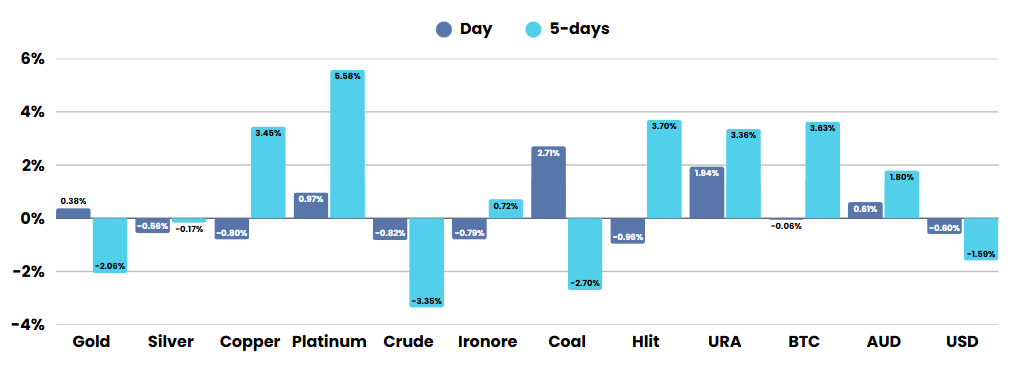

All three major US stock indices are poised for significant monthly gains, buoyed by positive developments in global trade negotiations. Optimism surged after the U.S. and China announced progress toward a trade agreement ahead of President Trump’s July 9 deadline, and Canada withdrew its planned digital services tax on tech firms just before implementation, in an effort to revive talks with the Trump administration. Canadian Prime Minister Mark Carney and President Trump are now set to negotiate a trade deal by July 21. Meanwhile, notable corporate moves—such as Meta’s recruitment of AI talent from OpenAI, Oracle’s new multi-billion dollar cloud deals, and Robinhood’s expansion into crypto offerings—have further propelled market sentiment.

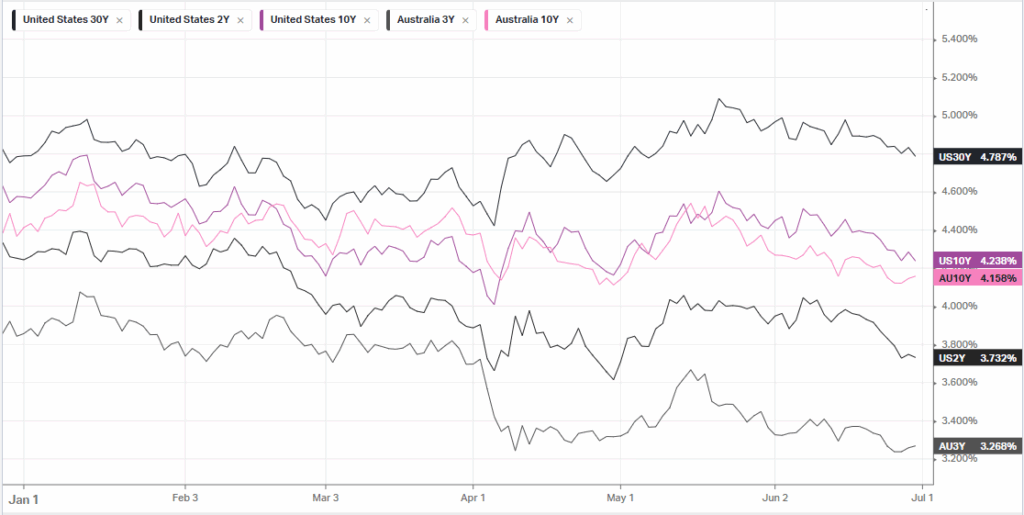

Investor confidence has also been supported by growing expectations of a Federal Reserve interest rate cut, following weaker-than-anticipated inflation and consumer spending data. The potential removal of inflationary tariffs is seen as a possible catalyst for the Fed to lower rates, with Chair Jerome Powell signalling a dovish stance if inflation remains subdued. Financial markets have now priced in a roughly 74% chance of a rate cut by September, though some anticipate the move could come as early as July. The upcoming June nonfarm payrolls report, expected to show a slight slowdown in job growth, is the next key economic indicator being closely watched.

On the legislative front, the U.S. Senate narrowly advanced President Trump’s sweeping “One Big Beautiful Bill,” which combines tax cuts, domestic spending changes, and border security measures. The bill, estimated by the Congressional Budget Office to add $3.3 trillion to the federal deficit over the next decade, faces a contentious week of debate and further challenges in the House, where concerns over fiscal impact and the legislative timeline persist. The House, controlled by Republicans, previously passed its own version of the bill, setting the stage for high-stakes negotiations as lawmakers aim to finalize the package before the July 4 holiday.

ASX SPI 8531 (-0.05%)

With EOFY in the rearview mirror, the ASX is likely to have a subdued day, with fund managers breathing a sigh of relief as they window-dressed yesterdays close to make financial year numbers look favorable for bonus time.

Now we move into the new FY, we expect to see some risk off, and the focus to shift to whether China can pull off an economic recovery and if Trump can make it look like there is progress on over 100 trade deals that need to be done. July is seasonally a quiet but good month for markets, but historically a good month to take off risk into the September/October lull.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.