What's Affecting Markets Today

Vietnam stocks hit 3-year high ahead of U.S. trade deal details

Vietnamese equities climbed to their highest level in over three years as markets anticipated further details of a new U.S.-Vietnam trade agreement announced by former President Donald Trump on Wednesday.

In a post on Truth Social, Trump stated that the U.S. would impose a 20% tariff on imports from Vietnam, while Vietnam would implement a “ZERO Tariff” in return. The announcement comes as the 90-day tariff reprieve nears its expiration, raising investor interest in the bilateral agreement’s potential implications.

The Vietnam Index rose 0.3%, reaching its highest level since April 2022, according to LSEG data.

Elsewhere in Asia, Japan’s Nikkei 225 fell 0.15% and the broader Topix index lost 0.21%. South Korea’s Kospi gained 0.77%, and the tech-heavy Kosdaq advanced 0.5%.

Australia’s S&P/ASX 200 edged 0.13% higher, supported by strength in resources stocks.

In contrast, Hong Kong’s Hang Seng index declined 0.64%, while China’s CSI 300 managed a modest 0.14% gain as sentiment remained cautious amid ongoing economic headwinds.

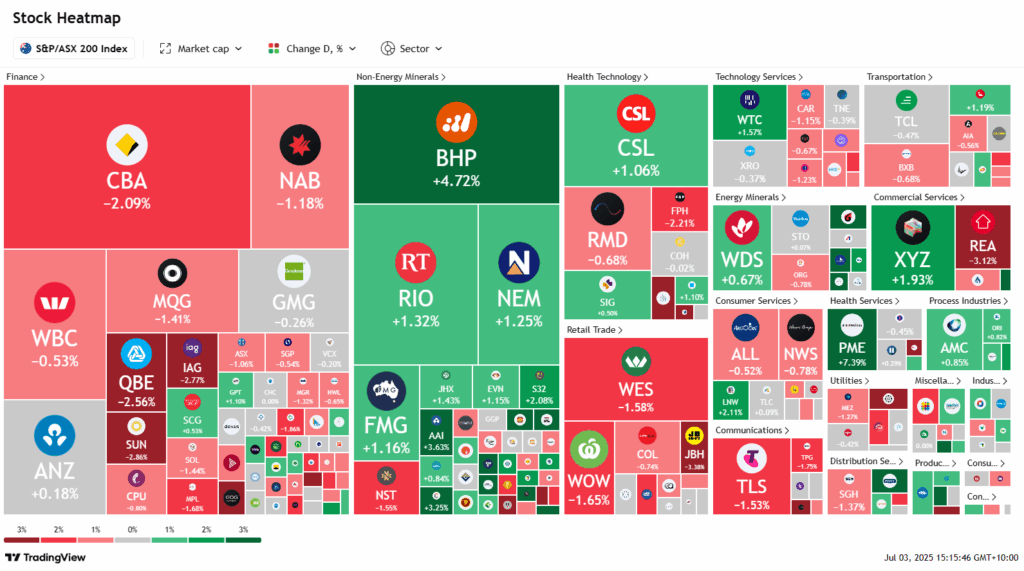

ASX Stocks

ASX 200 8,587.0 (-0.12%)

ASX edges lower as CBA slides; GemLife debuts strongly

The ASX retreated on Thursday, with the S&P/ASX 200 falling 20.7 points or 0.2% to 8577 by 2pm AEST. The decline followed a record close on Wednesday, as profit-taking in the big four banks, led by a 1.6% fall in Commonwealth Bank, weighed on the index. National Australia Bank slipped 1.2%, and Westpac lost 0.5%.

Housing developer GemLife made a strong ASX debut, rising 5.8% to trade at $4.37 by mid-afternoon. Meanwhile, iron ore giants rallied on news Beijing would curb low-price competition and cut industrial overcapacity. BHP rose 4.5%, Rio Tinto 1%, and Fortescue 1.2%. Lithium miners also gained, with Pilbara Minerals up 8.5% and Mineral Resources climbing 6.4%.

Pro Medicus surged 8.5% after securing nearly $200 million in new US contracts. Domino’s Pizza, which plunged 16% on Wednesday after its CEO’s resignation announcement, slipped a further 1% despite early gains. G8 Education fell 7% amid ongoing fallout from criminal charges against a former employee, prompting Macquarie to lower its target price.

Leaders

SMR Stanmore Resources Ltd (+10.93%)

PLS Pilbara Minerals Ltd (+8.58%)

WHC Whitehaven Coal Ltd (+8.47%)

RPL Regal Partners Ltd (+8.37%)

PME Pro Medicus Ltd (+7.36%)

Laggards

GEM G8 Education Ltd (-7.21%)

BOE Boss Energy Ltd (-5.52%)

VAU Vault Minerals Ltd (-4.17%)

JBH JB Hi-Fi Ltd (-3.52%)

MSB Mesoblast Ltd (-3.28%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!