Overnight – Everything is positive! Bulls party into 4thof July

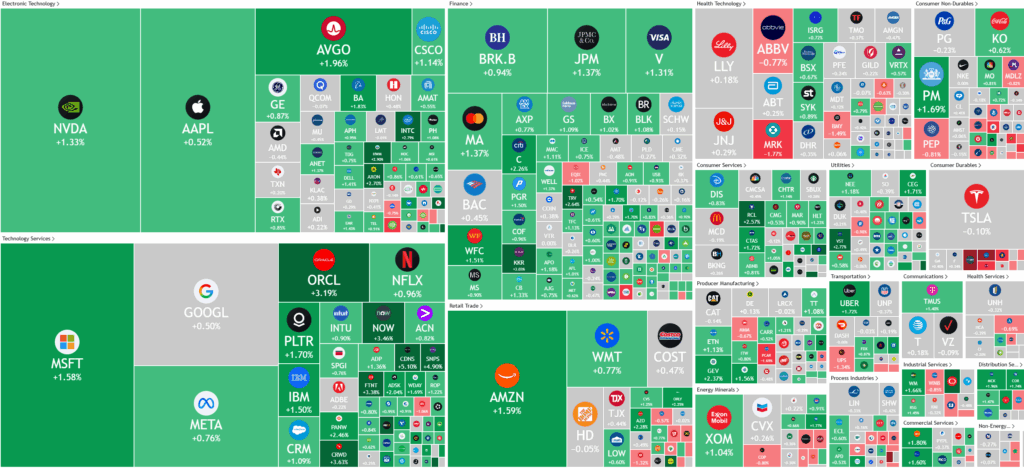

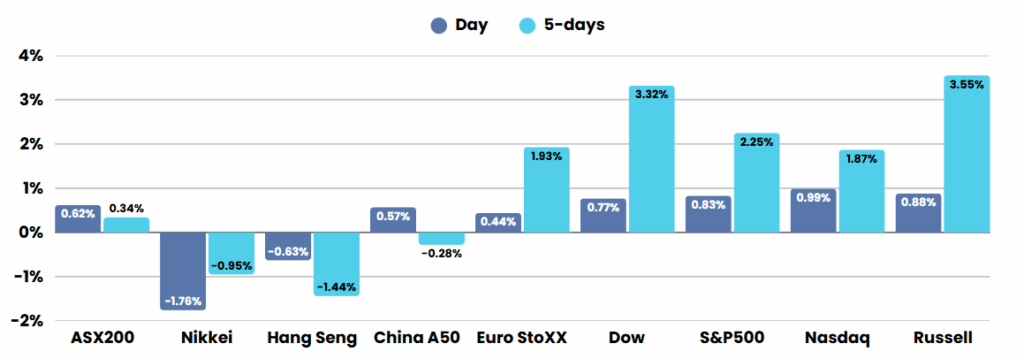

Stocks closed at another record Thursday in a holiday-shortened session, a day ahead of the Independence Day holiday, as investors digested a stronger monthly jobs report pointing to underlying strength in the economy and chip stocks rallied after the U.S. eased restrictions on China.

The June nonfarm payrolls report showed the economy added 147,000 jobs, surpassing economists’ expectations of 111,000, with gains in state government and healthcare offsetting declines in the federal workforce. The unemployment rate edged down to 4.1%, and average hourly earnings growth slowed to 0.2% for the month, suggesting limited wage-driven inflationary pressures. New jobless claims also fell to a six-week low, indicating continued labor market resilience.

Federal Reserve policymakers are closely monitoring labor data as they weigh the impact of tariffs and the potential need for interest rate adjustments. While Fed Chair Jerome Powell has advocated a cautious approach, he indicated the central bank could lower borrowing costs at upcoming meetings if warranted. President Trump has continued to pressure the Fed for rate cuts, citing ongoing trade tensions and economic uncertainty. The Fed’s dual mandate of maximum employment and stable prices remains central to its policy decisions amid these developments.

Trade policy developments also contributed to positive market sentiment. President Trump announced a new trade agreement with Vietnam, imposing tariffs on Vietnamese imports and rerouted goods, marking the third such deal ahead of a key July 9 deadline for reciprocal tariffs. Recent agreements with China and Canada, along with progress toward a deal with India, have fueled optimism for further trade resolutions. However, analysts at UBS caution that the administration is likely to maintain an aggressive tariff stance, with the effective U.S. tariff rate now six times higher than at the start of the year.

In corporate news, Tripadvisor shares rose following reports of a significant stake taken by activist investor Starboard Value. Datadog gained after being added to the S&P 500 index, while CrowdStrike jumped on a price target upgrade driven by AI-related demand for cybersecurity. Chip stocks, led by NVIDIA, surged after the U.S. Commerce Department lifted certain export restrictions to China as part of the recent trade agreement. Meanwhile, markets are watching the progress of President Trump’s tax-cut and spending bill, which advanced in the House and is projected to significantly increase the national debt and reduce health insurance coverage for millions.

ASX SPI 8611 (+0.31%)

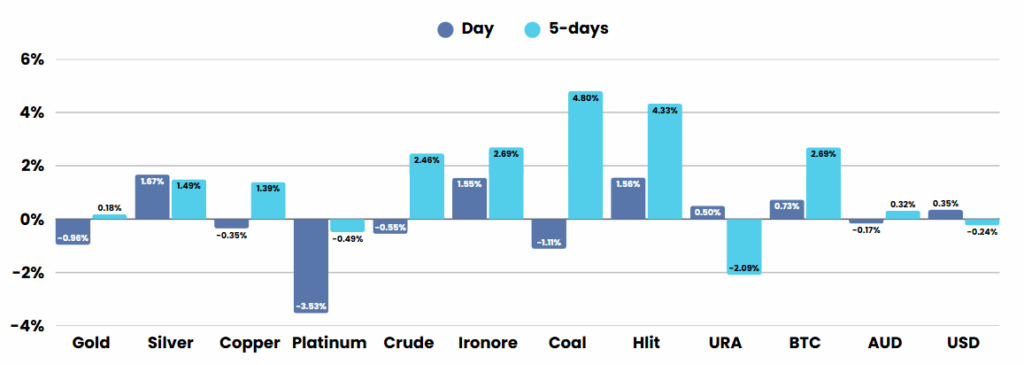

Should be another strong day, albeit a quiet one leading into the 4th of July holiday which will dampen global market activity. Expect another solid day from the materials sector with iron ore making a good comeback from the lows and copper continuing to consolidate just under record highs

You can now listen & Watch to the Pre Market Pulse

Be Alert, But Not Alarmed: Cracks Showing in Credit Markets

With so much happening in AI, precious metals, geopolitics & US politics, it’s easy to get caught up in the day-to-day noise. But one thing that is very important to monitor is the subtle yet significant shift is emerging in credit markets that’s worth keeping on your radar.