What's Affecting Markets Today

Asia-Pacific Markets Mixed as Tariff Uncertainty and China Deflation Weigh

Asia-Pacific equities traded mixed on Wednesday after U.S. President Donald Trump confirmed tariffs on copper imports will take effect August 1, with no extension. Trump also flagged further sector-specific duties, including a potential 200% tariff on pharmaceutical imports, which he said could come into force within 18 months.

The announcements added to investor caution, particularly amid signs of continued deflation in China. The country’s producer price index fell 3.6% year-on-year in June—the sharpest drop in nearly two years—highlighting ongoing weakness in industrial demand. Meanwhile, the consumer price index rose just 0.1%, its first positive reading after four months of declines.

Hong Kong’s Hang Seng Index slipped 0.83% by mid-morning, while the CSI 300 in mainland China traded flat. Japan’s Nikkei 225 edged down 0.15%, though the Topix rose 0.19%. South Korea’s Kospi gained 0.43% and the Kosdaq climbed 0.44%.

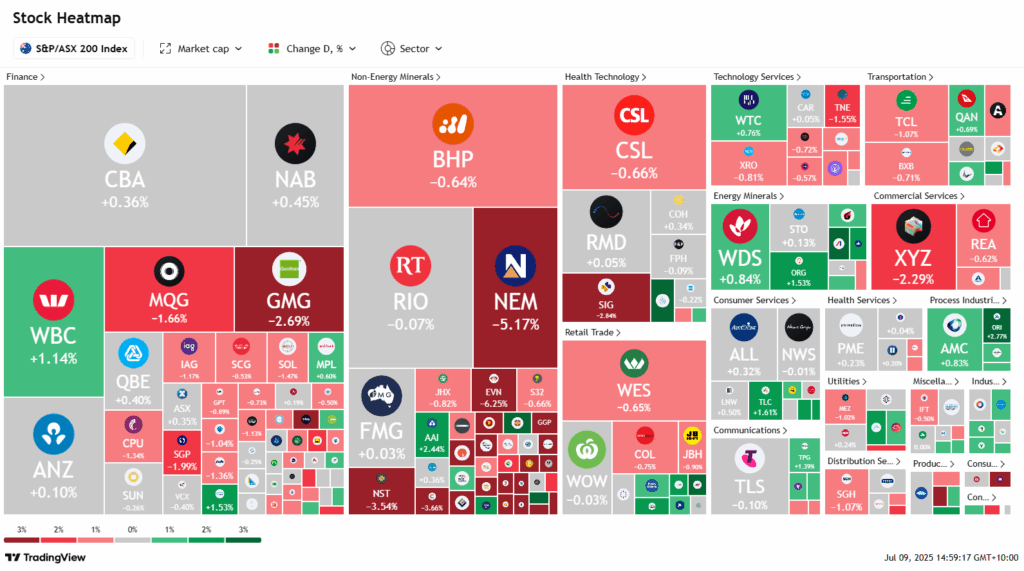

Australia’s S&P/ASX 200 dropped 0.43%, weighed down by commodities and property stocks following Trump’s trade threats and the RBA’s surprise decision to hold rates steady.

ASX Stocks

ASX 200 8,561.2 (-0.35%)

ASX Dips on Copper Tariff Threats; Telix Surges on US Approval

The ASX fell on Wednesday, with the S&P/ASX 200 Index down 27.1 points, or 0.3%, to 8563.6 by 2pm AEST. The market was rattled by escalating trade tensions after former US President Donald Trump pledged a 50% tariff on copper imports, sending copper futures as low as $US9553.50 a tonne before recovering slightly.

Copper-exposed miners led declines. Sandfire Resources fell 3.3%, Capstone Copper 3.5%, and Evolution Mining—also a gold producer—slid 6.4%. In contrast, diversified giants BHP and Rio Tinto remained resilient due to their broader commodity exposure.

Gold miners also weakened amid softer bullion prices, with Newmont down 5%, Northern Star 2.9%, and Perseus 2.6%.

Rate-sensitive REITs declined after the RBA held the cash rate at 3.85%. Goodman Group fell 2.3%, Stockland 1.8%, and Mirvac 1.1%.

In corporate news, Telix Pharmaceuticals soared 6% after securing a permanent US Medicare code for its prostate cancer imaging agent. Orica rose 2.6% on the appointment of Vik Bansal as chairman. A2 Milk fell 3.5% after Citi downgraded its rating to neutral.

Leaders

VUL Vulcan Energy Resources Ltd (+7.32%)

SMR Stanmore Resources Ltd (+6.19%)

TLX Telix Pharmaceuticals Ltd (+5.62%)

CU6 Clarity Pharmaceuticals Ltd (+5.11%)

LTR Liontown Resources Ltd (+4.93%)

Laggards

LIC Lifestyle Communities Ltd (-36.51%)

PNR Pantoro Gold Ltd (-10.12%)

RSG Resolute Mining Ltd (-8.03%)

PDN Paladin Energy Ltd (-8.01%)

BOE Boss Energy Ltd (-7.58%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!