What's Affecting Markets Today

Asia-Pacific Markets Mixed as Korea Holds Rates, Trump Confirms Tariffs

Asia-Pacific markets traded mixed on Thursday as investors weighed the Bank of Korea’s rate decision and escalating trade tensions following U.S. President Donald Trump’s tariff announcement. Trump confirmed a 50% tariff on Brazilian imports and copper will take effect on August 1, adding to global trade uncertainty.

South Korea’s central bank held its benchmark rate at 2.5%, an almost three-year low, in line with expectations. The decision comes amid a fragile economic backdrop, with GDP contracting 0.2% quarter-on-quarter in Q1, weighed down by weak construction and slowing exports.

Singapore’s Straits Times Index defied regional caution, climbing 0.47% to a record 4,077.41—its fourth consecutive day of gains.

In Japan, the Nikkei 225 opened 0.45% lower and the Topix lost 0.54%. South Korea’s Kospi rose 0.24% while the Kosdaq gained 0.44%. Australia’s ASX 200 advanced 0.51% as risk sentiment improved following dovish signals from the U.S. Federal Reserve.

Traders remain alert to shifting central bank policies and rising geopolitical and trade risks heading into August.

ASX Stocks

ASX 200 8,596.9 (+0.70%)

ASX Gains Despite Trump’s Tariff Shock; Property, Banks Lead Rebound

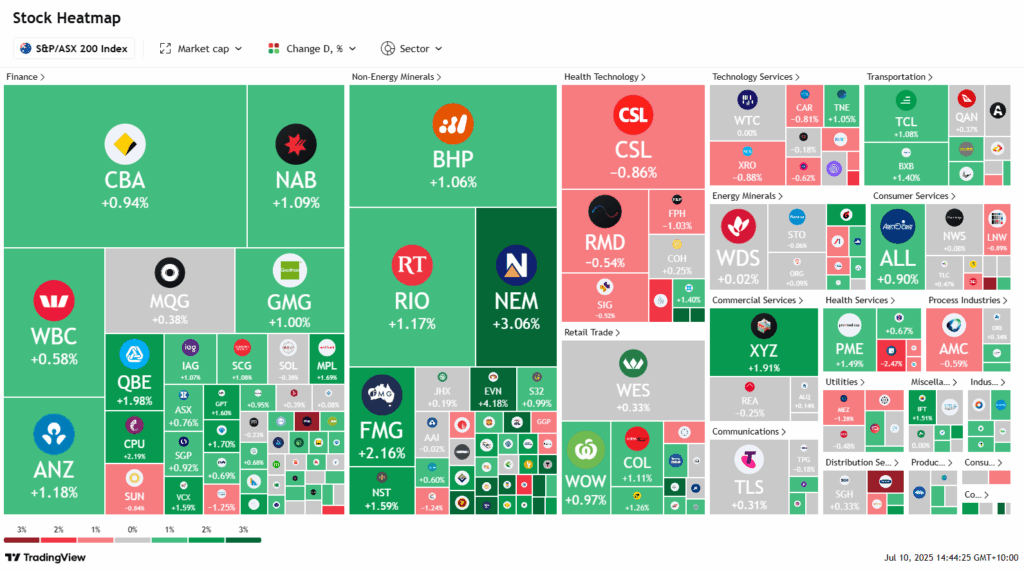

The ASX rose on Thursday, tracking Wall Street gains after the US Federal Reserve signalled rate cuts remain on the table. The S&P/ASX 200 climbed 0.6% to 8591.7 by 2:18pm AEST, with retail, property, banks and miners driving the rebound.

Risk appetite returned despite US President Donald Trump announcing a 50% tariff on Brazilian imports and confirming copper tariffs will take effect from August 1. Sandfire Resources fell 1.6%, while Capstone Copper and Aeris Resources dropped 1.2% and 5.1% respectively.

Real estate stocks rebounded as Charter Hall rose 1.8%, GPT 1.3%, Scentre 1.1%, and Vicinity 1%. The major banks also advanced, with NAB up 1%, ANZ 1.2%, and CBA 1%. Retailers such as JB Hi-Fi and Woolworths rose more than 1%.

BHP, Rio Tinto and Fortescue gained on firmer iron ore prices. Gold miners rallied on a $30 jump in the gold price to $US3330/oz, with Evolution up 4% and Newmont 3.1%.

Among laggards, Telix fell 2.5%, CSL lost 0.8%, and Imricor sank 14.8% on regulatory delays.

Leaders

RPL Regal Partners Ltd (+6.97%)

CU6 Clarity Pharmaceuticals Ltd (+5.24%)

OBM Ora Banda Mining Ltd (+5.04%)

LTR Liontown Resources Ltd (+5.00%)

LOV Lovisa Holdings Ltd (+4.96%)

Laggards

DMP Domino’s Pizza Enterprises Ltd (-3.51%)

NXG Nexgen Energy (Canada) Ltd (-3.31%)

REH Reece Ltd (-2.72%)

TLX Telix Pharmaceuticals Ltd (-2.70%)

OML Ooh!Media Ltd (-2.68%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!