Read the Weekend Edition

In this week’s episode of Bulls vs Bears from MPC Markets, the Mark & Jonathan dive into recent market highlights, commodity trends, stock picks, and geopolitical impacts on trading. They share insights from media appearances, discuss Trump-era tariffs, and provide a bullish outlook for the coming week amid US earnings season. Key focuses include copper, silver, Tesla, and emerging AI influences in markets.

Takeaways

- Technical issues can happen to anyone, even experts.

- Market trends are influenced by earnings upgrades and downgrades.

- Trump’s comments can create volatility in the market.

- Nvidia’s market cap reaching four trillion is significant.

- Tesla is shifting from a car company to a passenger service.

- Healthcare sector struggles indicate broader economic issues.

- Commodities like silver and copper are experiencing price fluctuations.

- Earnings season can lead to market optimism or pessimism.

- Economic policies can have immediate effects on market sentiment.

- Social media plays a role in shaping market discussions.

Resources & Mentions

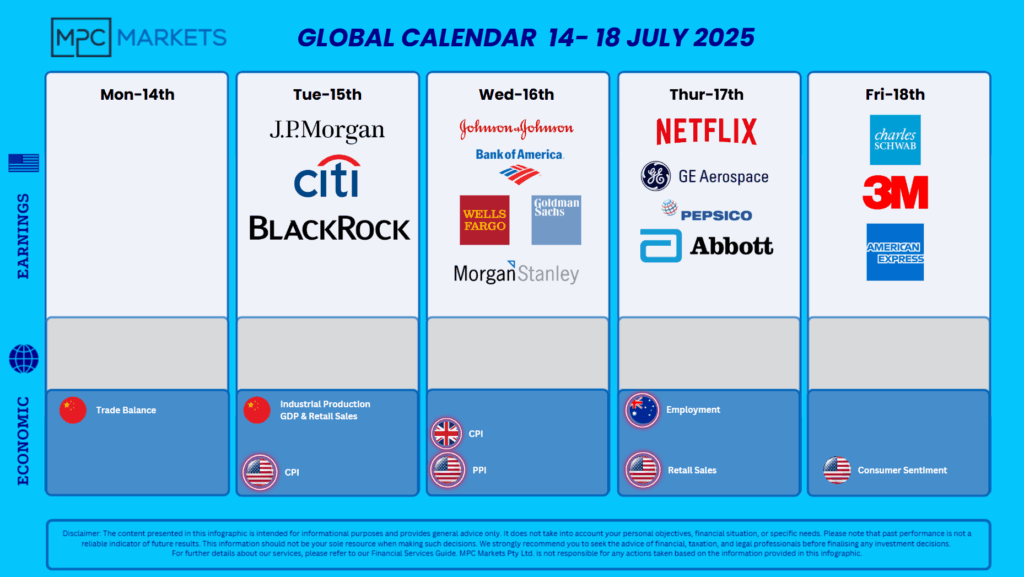

- Stocks Discussed: Stanmore, Coronado, PLS (Pilbara Minerals), Liontown, MinRes, Capstone Copper (CSC), Macmahon (MAC), BHP, Rio Tinto, Polymetals (POL), Nvidia, MP Materials, Tesla, UnitedHealth, Moderna, Johnson & Johnson.

- Commodities: Copper, silver, platinum, lithium, Bitcoin, iron ore.

Watch Bulls vs Bears