Overnight – Tariff uncertainty sees shift to real assets as silver hits fresh 15 year highs

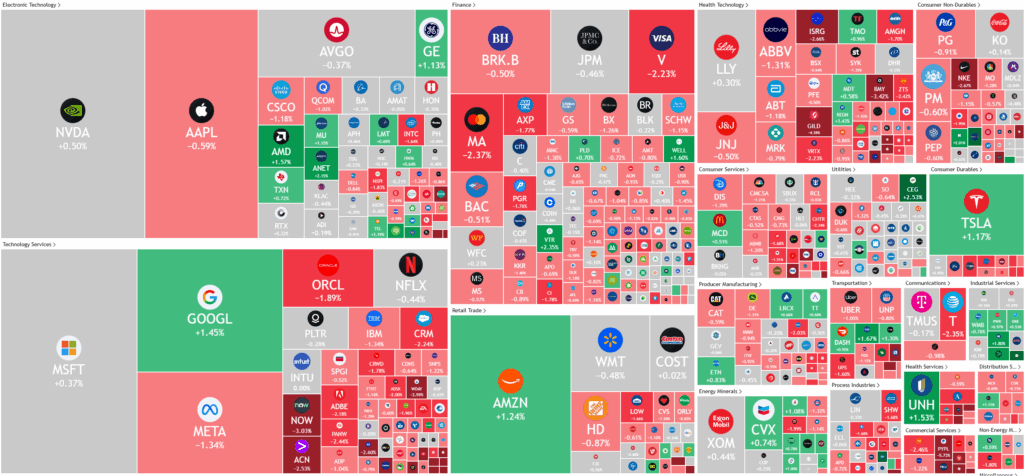

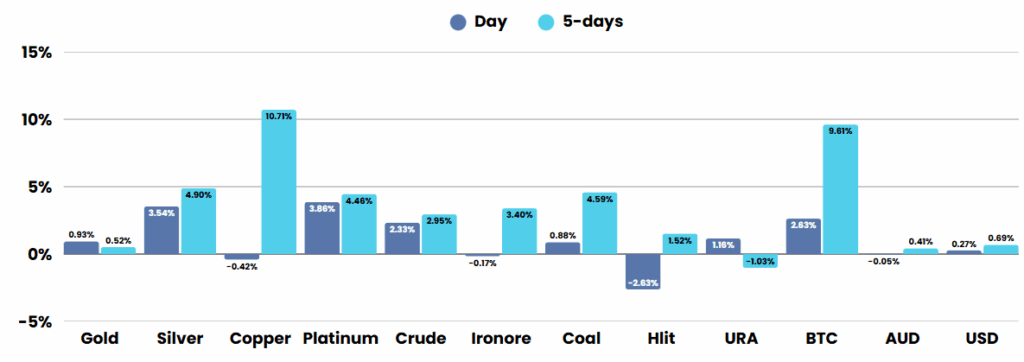

Stocks edged lower Friday, as Trump uncertainty drove investors to real assets as Silver hit fresh 15 year highs by 4.5%

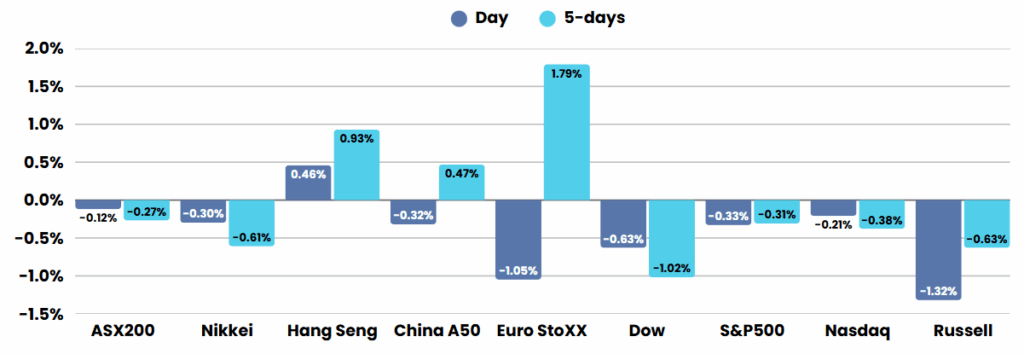

Global equity markets displayed cautious, with mixed performances driven by a blend of geopolitical developments and monetary policy expectations. In the US, indices lagged due to tariff-related uncertainties. European markets showed resilience, shrugging off concerns over potential trade disruptions following President Trump’s recent tariff announcements targeting Canada, the EU, and Mexico..

Geopolitical developments continue to cast a shadow over market sentiment. President Trump’s escalation of tariff threats, including a 30% levy on EU and Mexican imports effective August 1, has heightened uncertainty, though some investors remain hopeful for trade deal resolutions before the deadline. Tensions in the Middle East, particularly following U.S. military actions in Iran, have kept oil prices volatile, impacting energy stocks globally. Meanwhile, in Asia, South Korea’s KOSPI rose after its opposition leader’s presidential election victory, signalling potential policy shifts that could bolster investor confidence. These geopolitical undercurrents are creating a complex backdrop, with markets pricing in both risks and opportunities as trade negotiations and regional dynamics evolve.

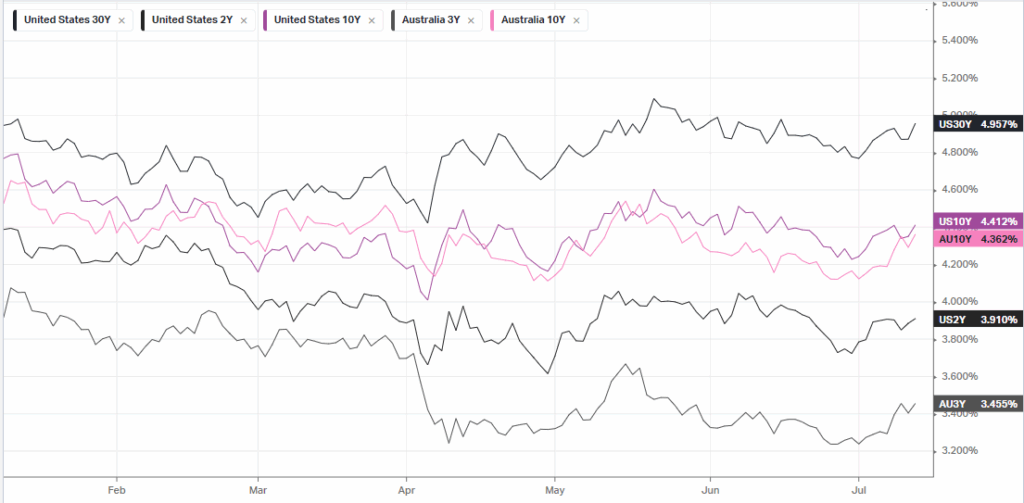

Monetary policy remains a critical focus, with the U.S. Federal Reserve signalling a conservative outlook, projecting just one rate cut for 2025. This has led to a slight uptick in U.S. Treasury yields, with the 10-year note reaching 4.39%, pressuring bond prices and influencing equity valuations. In Australia, the Reserve Bank of Australia (RBA) maintained its steady stance, with no immediate rate changes expected, supporting stability in financial stocks. However, global investors are closely watching upcoming inflation data, particularly the U.S. consumer price index, which could sway central bank decisions. The interplay between tighter monetary policy and tariff-driven inflation risks is keeping markets on edge, with investors seeking clarity on the Fed’s next moves.

Despite the tariff, geopolitical, and monetary policy uncertainty, the market seems hellbent on rallying, however the risk is strongly to the downside and the US earnings from the quarter since Liberation day, may not be as rosy as analysts think.

ASX SPI 8548 (-0.01%)

The local market is likely to head lower with multiple tariff announcements over the weekend unlikely to make investors feel comfortable about the future of the global economy.

The persistent strength in the commodities sector should help the materials sector, although Chinese industrial production numbers are likely to be watched closely for sign of recovery in the Chinese economy.

You can now listen & Watch to the Pre Market Pulse

Be Alert, But Not Alarmed: Cracks Showing in Credit Markets

With so much happening in AI, precious metals, geopolitics & US politics, it’s easy to get caught up in the day-to-day noise. But one thing that is very important to monitor is the subtle yet significant shift is emerging in credit markets that’s worth keeping on your radar.

The Scramble for Critical Minerals: A Boom for ASX Investors?

In the high-stakes world of global commodities, a new scramble is underway—one that could redefine supply chains and spark massive investment opportunities