What's Affecting Markets Today

Asia-Pacific Markets Mixed as Tariff Shock Weighs; Bitcoin Hits Fresh High

Asia-Pacific markets traded mixed on Monday as investors digested the impact of U.S. President Donald Trump’s weekend announcement of a 30% tariff on goods from the European Union and Mexico, effective August 1. EU and Mexican leaders signalled continued negotiations to seek lower rates.

In India, the Nifty 50 declined 0.43% while the Sensex fell 0.26% in early trade. In Japan, the yield on 10-year government bonds rose 5.5 basis points to 1.554%—approaching a two-month high—reflecting concerns over rising inflation and U.S. trade tensions.

China’s June exports rose 5.8% year-on-year in USD terms, exceeding Reuters’ forecast of 5%. Imports increased 1.1%, marking the first year-on-year growth in 2025 and suggesting a potential turnaround in domestic demand, despite falling short of the 1.3% estimate.

Bitcoin continued its rally, crossing US$120,000 for the first time and trading at US$120,732.42 as of 12:03pm SGT. Daily ETF inflows and liquidation of bearish bets have supported bullish momentum, with analysts watching for resistance near US$125,000.

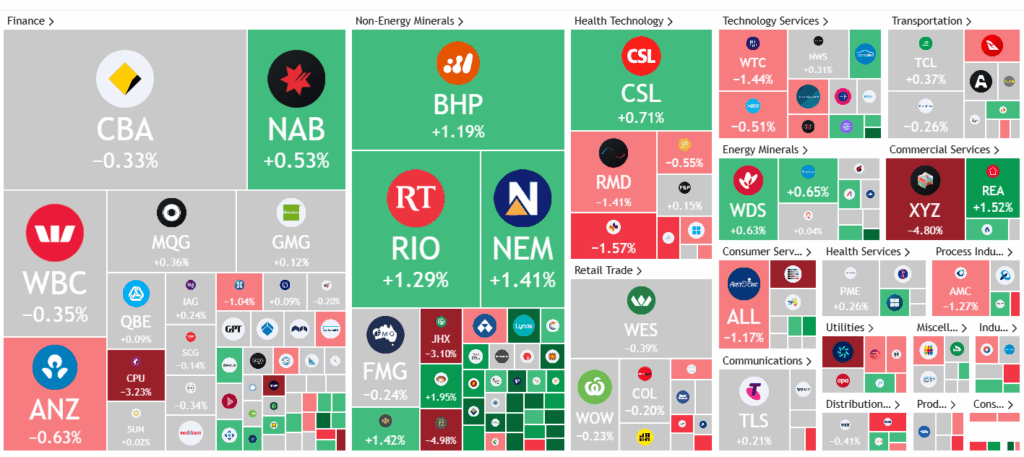

ASX Stocks

ASX 200 8,591.4 (+0.03%)

ASX Seesaws on Tariff Shock; Bitcoin Surges to US$120,000

The ASX traded in a narrow range on Monday, with the S&P/ASX 200 Index edging up 4.7 points (+0.1%) by 2:10pm AEST, following US President Donald Trump’s announcement of a 30% tariff on EU and Mexican goods, effective August 1. Gains in energy, materials, and communication services offset weakness in tech stocks.

Gold miners rose on safe-haven demand, with bullion near US$3370/oz. Northern Star (+1.1%), Evolution (+1.9%), and Newmont (+1.4%) led the sector. Bitcoin surged to a record US$120,000, driven by over US$1 billion in daily ETF inflows and liquidation of bearish bets. Analysts see resistance at US$125,000–128,000.

Uranium and energy stocks also advanced: Deep Yellow (+5%), Paladin (+3.6%), Boss Energy (+2.2%), and Silex Systems (+5.5%). Woodside and Santos posted modest gains.

Notable movers included Hansen Technologies (+11.2%) on upgraded FY25 EBITDA guidance, DroneShield (+10.1%) on expansion plans, and Abacus Storage King (+5.8%) following a sweetened takeover offer. Meanwhile, South32 (-5%) flagged cost risks, and Computershare (-3.3%) fell on a broker downgrade.

Leaders

HSN Hansen Technologies Ltd (+11.19%)

DRO Droneshield Ltd (+10.47%)

MAQ Macquarie Technology Group Ltd (+9.63%)

CU6 Clarity Pharmaceuticals Ltd (+7.12%)

PLS Pilbara Minerals Ltd (+7.10%)

Laggards

S32 South32 Ltd (-4.98%)

XYZ Block, Inc (-4.69%)

ZIP ZIP Co Ltd (-3.85%)

SDR Siteminder Ltd (-3.62%)

NAN Nanosonics Ltd (-3.57%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!