Overnight – Stocks grind higher as Trump lays ground to TACO on trade deals

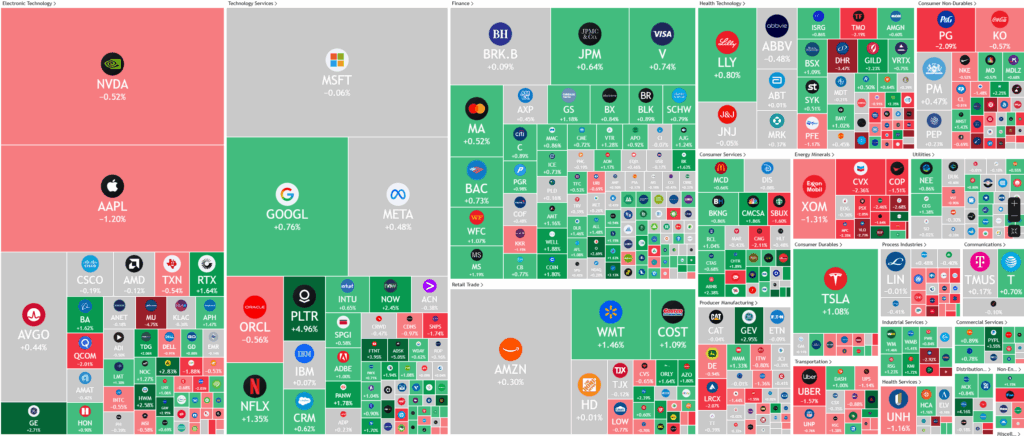

Stocks eked out a gain Monday as President Donald Trump said he was open to negotiating on trade including with major trading partners such as the European Union, laying the ground for yet another TACO (Trump Always Chickens Out)

President Trump heightened trade tensions by announcing a 30% tariff on goods from Mexico and the European Union, but also indicated a willingness to negotiate, describing the letters outlining the tariffs as both deals and invitations for further talks. He emphasized that his administration remains open to discussions, particularly with European officials who are expected to visit Washington soon. This is an immediate softening of his threat, just 36 hours earlier, instead distracting the market with threats on Russia and sending weapons to Ukraine that “NATO will pay for”.

At the same time, US customs duty collections have reached record highs, with projections that tariff revenues could become a major source of government income by the end of the year. This economic backdrop coincides with the start of a new corporate earnings season, as major banks and several prominent companies prepare to release their quarterly results. Notably, some companies have already reported stronger-than-expected earnings, and leadership changes at others have drawn investor attention.

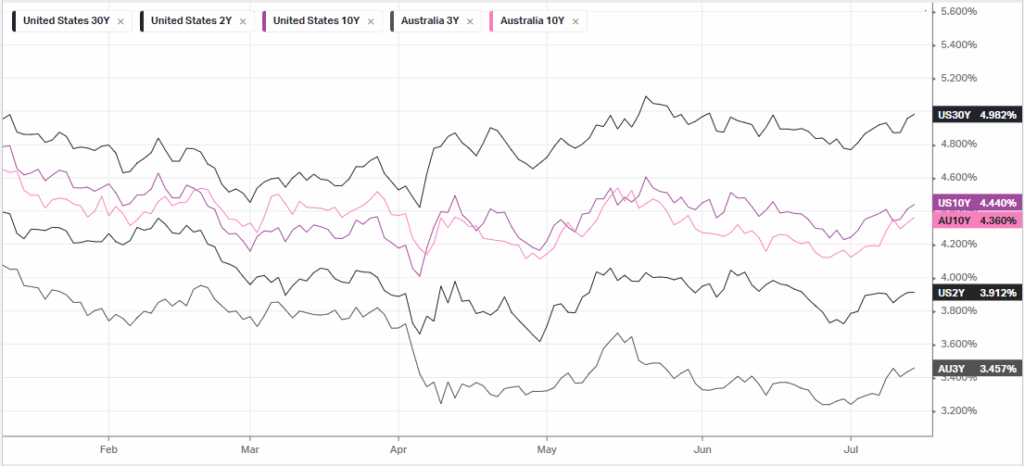

Market focus is also on the upcoming June Consumer Price Index report, which is expected to show a moderate rise in inflation. The results will be closely watched for signals about the Federal Reserve’s next move on interest rates, with a rate cut seen as more likely in September.

Bank stocks will kick off earnings tomorrow with Wells Fargo, Citi, & JP Morgan, with the sector firm on expectations of “solid but unspectacular” earnings results.

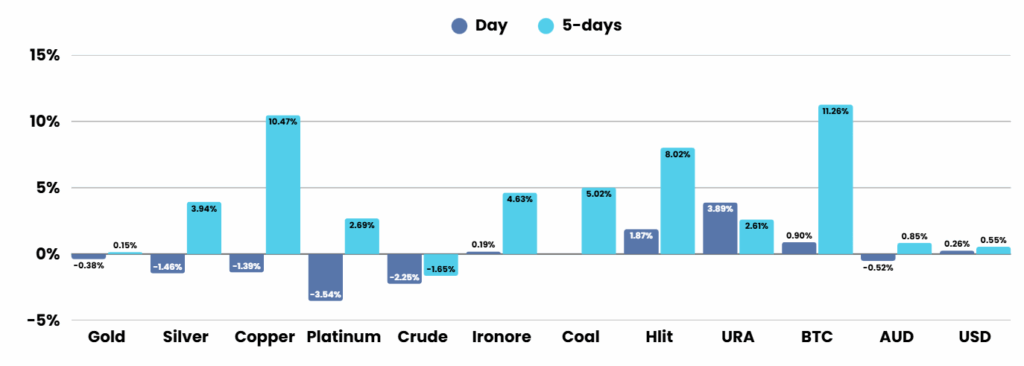

Meanwhile, cryptocurrency stocks have surged alongside record-breaking gains in bitcoin, fueled by increased investment in spot-bitcoin ETFs and optimism about the regulatory environment as Capitol Hill discusses Crypto regulation this week

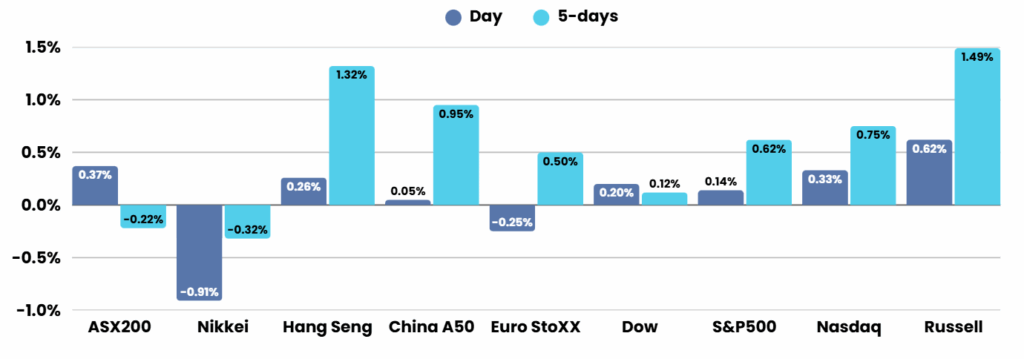

ASX SPI 8600 (+0.60%)

The ASX is looking at a positive day with the banks and broader market likely to bounce on hopes Trump will “chicken out” on trade deals, softening his stance just 36 hours after threatening the EU.

focus will be on the prime minister and his visit to China this week. There’s one data print in AU, Westpac-Melbourne Institute Consumer Sentiment measure, while Chinese GDP will be closely watched as the PBOC has committed to maintaining a minimum 5% GDP growth via stimulus

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.