Overnight – Stocks mixed again as record run slows

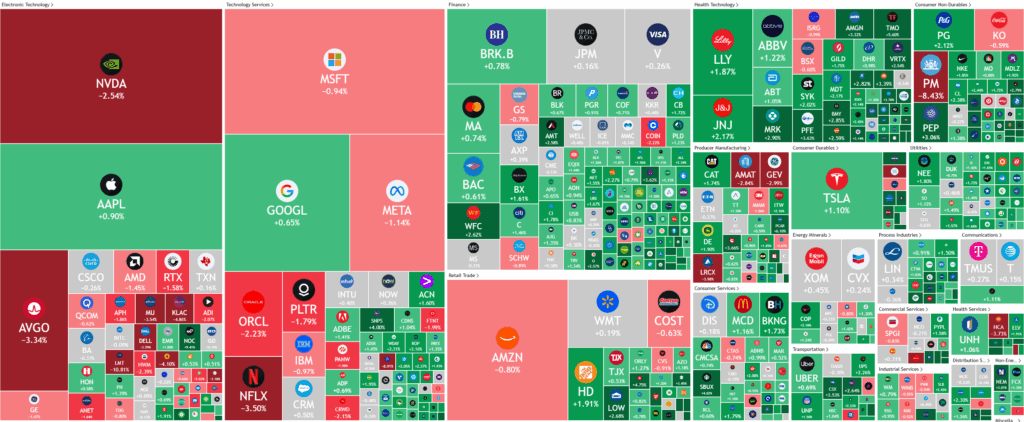

Stocks were mixed yet again overnight as investors waiting on Google and Telsa earnings and chip stocks dragged due to a delay to the Stargate AI project

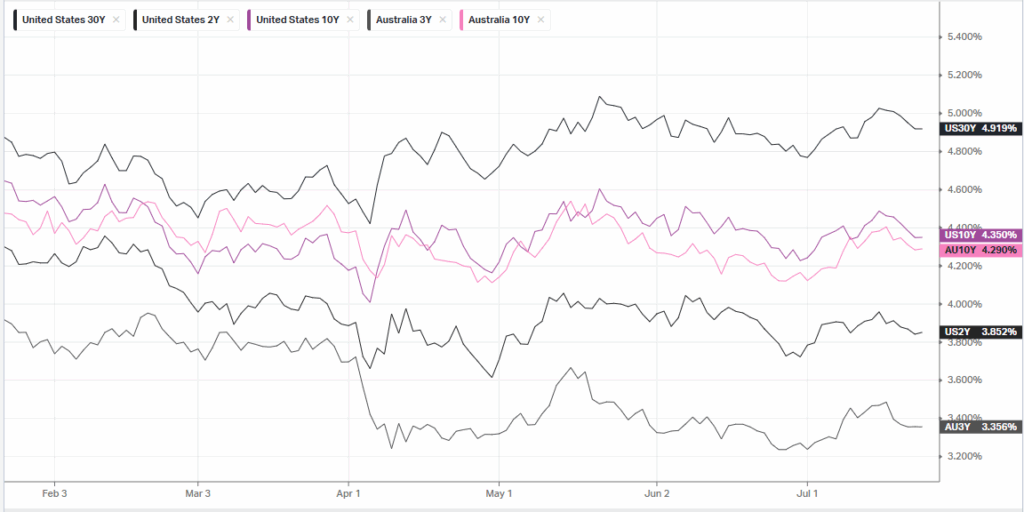

Market sentiment remains fragile as Wall Street’s record-setting streak has slowed, with additional anxiety stemming from President Trump’s announcement of steep tariffs—ranging from 20% to 50%—set to impact major U.S. trading partners from August 1. The tariffs, coupled with duties on copper and threatened hikes on pharmaceuticals, have heightened concerns about inflation and global trade tensions. The Federal Reserve, citing tariffs as a key reason, is expected to hold interest rates steady at its upcoming meeting, while Chair Jerome Powell’s scheduled remarks come during a period of particular sensitivity for financial market

Chipmakers, notably NVIDIA, Broadcom, and AMD, saw their shares decline following news that the much-anticipated $500 billion Stargate AI infrastructure project—a joint venture between SoftBank and OpenAI—had hit roadblocks. Originally heralded as a transformative initiative expected to supercharge the United States’ AI capacity through massive, immediate investment and a wide buildout of new data centers, the project has now been scaled back to just one smaller facility, dampening prior optimism. This scaling down has weighed on semiconductor stocks and contributed to caution across the broader tech sector.

Corporate Earnings

- RTX Corporation -1.58% – delivered a strong second quarter in 2025, reporting $21.6 billion in revenue—a 9% year-over-year increase—and adjusted EPS of $1.56, both exceeding analyst estimates. Despite robust commercial aftermarket and defense demand, the company cut its 2025 profit forecast due to escalating U.S. tariffs, with CFO Neil Mitchill estimating a $500 million headwind for the year. As a result, RTX now expects full-year adjusted EPS of $5.80–$5.95, down from its prior $6.00–$6.15 guidance; nevertheless, the company raised its 2025 sales outlook to $84.75–$85.5 billion, reflecting sustained demand for aircraft maintenance, new engines, and defense systems.

- Northrop Grumman +9.43% – stock rose after the defense company raised its annual profit forecast, betting on sustained demand for its military aircraft and defense systems as geopolitical tensions simmer.

- Coca-Cola -1% – after the soft drinks giant grapples with tariff-driven headwinds, even while it reported better-than-expected second-quarter profit and said it expects to post adjusted per-share earnings growth at the high end of its prior guidance.

- General Motors -8.13% – stock fell after the auto giant’s second-quarter profit declined significantly from last year due to weaker performance in its crucial North American market.

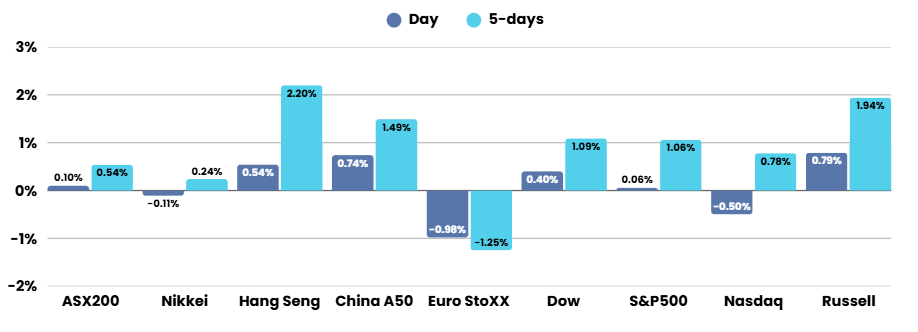

ASX SPI 8681 (+0.46%)

After a year of passive capital flowing into the financials and missing the rest of the market, investors are clearly seeing value in other sectors of the market with the materials sector and names like CSL finally seeing inflows after a year of being ignored.

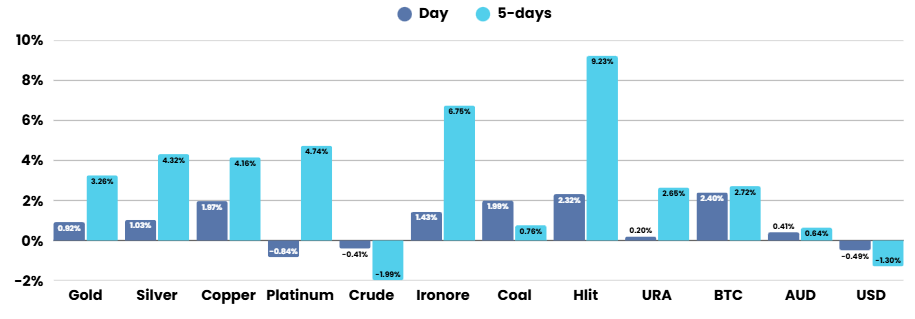

We expect this run to continue as iron ore hit 5-month highs, US Copper made a fresh record (London up 1.4%), gold got within 0.2% of record highs, Silver hit its highest level since October 2011, just short of $40 and a resurgence in lithium sparked sharp rallies.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.