What's Affecting Markets Today

Markets Rally as U.S.–Japan Trade Deal Unveiled; Yen and Bonds React

Asian markets surged after U.S. President Donald Trump announced a “massive” trade agreement with Japan, featuring 15% reciprocal tariffs and commitments on autos, agriculture, and energy. Trump claimed Japan would invest $550 billion in the U.S. and the U.S. would receive 90% of profits, while Japan’s Prime Minister Shigeru Ishiba confirmed a reduction in U.S. auto tariffs from 25% to 15%.

Japanese auto stocks soared—Mazda up 17%, Toyota +11%, Honda +8%, and Nissan +8%—as the Nikkei 225 jumped 3%. The deal comes amid political uncertainty in Japan following the governing coalition’s upper house loss. Media reports suggest Ishiba may resign by August, despite previously pledging to remain.

In bond markets, Japan’s 10-year yield rose 8 basis points to 1.593%, while the 30-year yield climbed to 3.12%. The yen traded at 147.15 against the U.S. dollar.

Separately, Singapore’s headline inflation held steady at 0.8% in June, its lowest in over four years, supporting expectations for monetary easing by the MAS later this month.

ASX Stocks

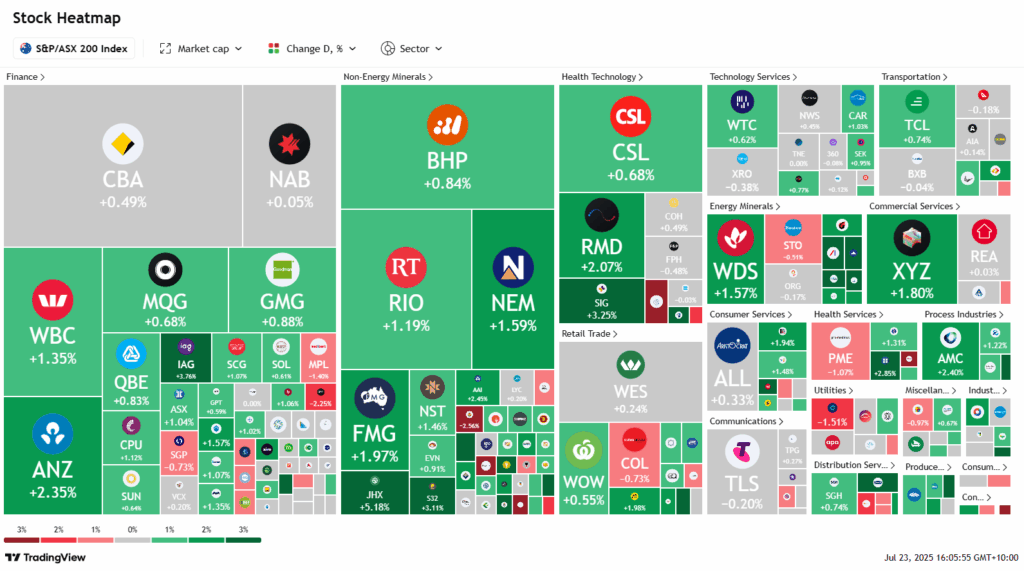

ASX 200 8,742.7 (+0.75%)

ASX Advances as Banks and Miners Rebound

The S&P/ASX 200 climbed 0.7% to 8741.80 on Wednesday afternoon, supported by gains in banks and miners. Nine of the 11 sectors traded higher, with materials leading the advance following a 2.2% rise in Singapore iron ore futures to US$105.65/t—driven by Chinese steel sector reforms and infrastructure investment.

Rio Tinto rose 1.1%, Fortescue gained 2%, and BHP added 0.9%. Energy also firmed, with Woodside Energy up 1.1% after reporting 50 MMboe in Q2 production—up 2%—and lowering full-year unit cost guidance.

Major banks rebounded from recent losses: ANZ rose 1.8%, Westpac 1.4%, NAB 0.3%, and CBA recovered 0.6% after a 9.9% drop from its recent high.

In company news, Iluka Resources gained 3% after meeting FY zircon production guidance. Ampol climbed 3.7% on stronger-than-expected EBITDA guidance of ~$640m. IAG rose 2.9% after UBS upgraded the stock to “buy”.

On the downside, Telix Pharmaceuticals slumped 13.5% following a US SEC subpoena, and Paladin Energy fell 11.6% on lower-than-expected uranium production forecasts.

Leaders

WHC – Whitehaven Coal Ltd (+6.45%)

ELD – Elders Ltd (+5.38%)

MSB – Mesoblast Ltd (+5.26%)

JHX – James Hardie Industries Plc (+5.18%)

IRE – Iress Ltd (+5.12%)

Laggards

TLX – Telix Pharmaceuticals Ltd (-14.89%)

PDN – Paladin Energy Ltd (-11.38%)

CU6 – Clarity Pharmaceuticals Ltd (-7.64%)

PYC – PYC Therapeutics Ltd (-5.11%)

SNZ – Summerset Group Holdings Ltd (-4.55%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!