What's Affecting Markets Today

Asia Markets Decline; HSBC Sees BoJ October Rate Hike Amid Geopolitical Tensions

Asian markets opened broadly lower on Friday, with investor sentiment weighed down by geopolitical tensions and softer economic data. Japan’s Nikkei 225 fell 0.24% and the Topix dropped 0.55%, while South Korea’s Kospi was flat and the Kosdaq declined 0.48%. Australia’s ASX 200 shed 0.41%.

In Japan, July inflation in Tokyo eased to 2.9%, down from 3.1% in June and below the 3.0% forecast, reinforcing expectations of a gradual policy shift. Nonetheless, HSBC expects the Bank of Japan to raise rates by 25 basis points to 0.75% in October, citing a U.S.-Japan trade deal as a catalyst for renewed growth and policy normalization.

Meanwhile, geopolitical tensions escalated in Southeast Asia. Thailand’s SET Index was flat after border clashes with Cambodia resulted in civilian casualties. In response, Bangkok expelled Cambodia’s envoy and launched an F-16 strike. Cambodia’s CSX remained closed.

Chinese equities also retreated. The CSI 300 fell 0.16%, Hong Kong’s Hang Seng lost 0.53%, and the Hang Seng Tech Index dropped 1.07%.

ASX Stocks

ASX 200 8,6669.20 (-0.45%)

ASX Slips; Woodside Rallies; Miners Weigh on Market

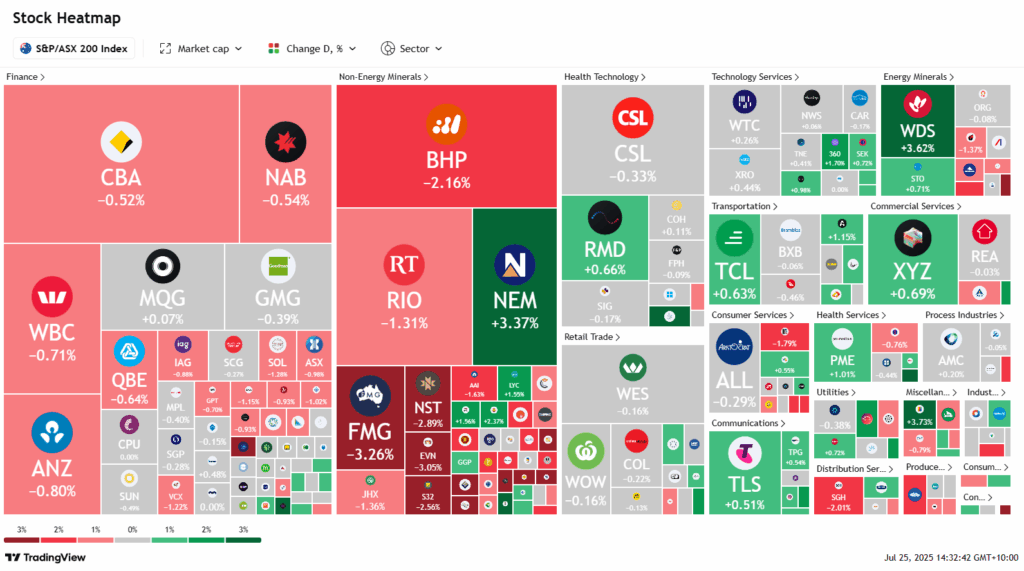

The ASX edged lower on Friday despite positive cues from Wall Street, where Alphabet’s earnings lift supported tech stocks. As of 2:05pm AEST, the S&P/ASX 200 Index was down 33.7 points, or 0.4%, to 8675.7, with six of 11 sectors trading higher.

On Wall Street, the S&P 500 rose 0.1% and the Nasdaq gained 0.2%, led by Nvidia and Amazon. Alphabet advanced, while IBM slid 7%, weighing on the Dow, alongside losses in Honeywell and UnitedHealth.

Locally, energy outperformed as oil rallied on technical support. Woodside climbed 4%, and Santos added 1%. Major miners declined as iron ore prices fell—BHP lost 2%, Fortescue 3.3%, and Rio Tinto 1.2%. Gold stocks also retreated: Northern Star dropped 2.8%, Evolution 3.3%, and Perseus 2.2%. Newmont bucked the trend, rising 3.7% on better-than-expected quarterly earnings.

Notable movers included KMD Brands (+4.4%) on a CFO appointment, Regal Partners (+6.8%) following strong FUM growth, and Icetana (+21.5%) on a quarterly revenue update. Steadfast fell 1% after announcing its CFO’s retirement.

Leaders

RPL Regal Partners Ltd (+6.39%)

NXG Nexgen Energy (Canada) Ltd (+4.79%)

REG Regis Healthcare Ltd (+4.73%)

TLX TELIX Pharmaceuticals Ltd (+4.39%)

WDS Woodside Energy Group Ltd (+4.06%)

Laggards

DRO Droneshield Ltd (-8.01%)

AMP AMP Ltd (-5.69%)

GTK Gentrack Group Ltd (-4.94%)

CIA Champion Iron Ltd (-4.75%)

PNR Pantoro Gold Ltd (-4.46%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!