What's Affecting Markets Today

Asia-Pacific Markets Retreat as BoJ Holds Rates, Trade Tensions Rise

Asia-Pacific markets mostly declined on Thursday as investors digested the Bank of Japan’s decision to hold short-term interest rates steady at 0.5% for the fourth consecutive meeting. The move, while widely expected, signaled the central bank’s cautious stance amid growing global uncertainty.

The Japanese yen strengthened, and government bond yields climbed following the decision. Capital Group’s Hiroaki Amemiya described the BoJ’s position as a “delicate balancing act,” highlighting rising domestic wages and consumption as positives, despite headwinds from U.S. tariffs.

Market sentiment was also weighed by heightened trade tensions, with the U.S. imposing blanket 15% tariffs on South Korean imports and 25% duties on goods from India. South Korean auto stocks dropped sharply, with Kia falling 5.25% and Hyundai Motor down 3.48%.

In contrast, Hanwha Ocean surged over 16%, hitting its highest level since 2015, following news of a potential U.S.-Korea trade deal and planned investments at its U.S.-based shipyard.

Meanwhile, Samsung Electronics rose modestly despite missing Q2 profit expectations. Chinese and Hong Kong markets opened lower, with the Hang Seng down 0.91%.

ASX Stocks

ASX 200 8,741.9 (-0.17%)

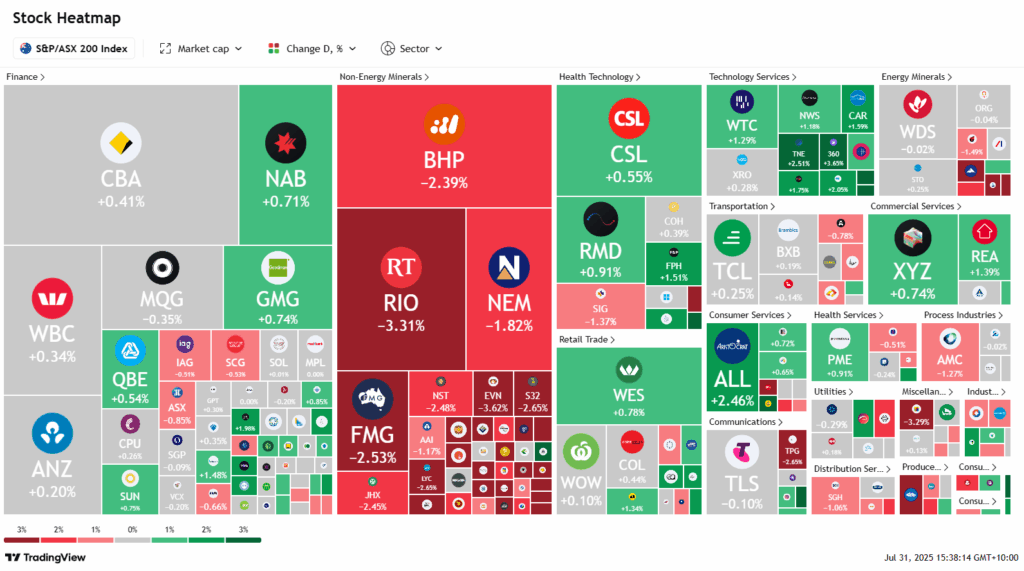

ASX Edges Lower as Commodities Weigh, Beach Energy and Flight Centre Slide

The ASX slipped slightly in afternoon trade, with the S&P/ASX 200 Index down 0.2%, or 13.4 points, to 8743 at 2.10pm AEST, rebounding from an intraday low of 8701.30. Weaker commodity prices weighed on the market after copper fell nearly 20% overnight—its sharpest drop since 1988—on news that US tariffs would apply only to semi-finished imports.

Major miners were among the heaviest drags, with BHP falling 2.2%, Fortescue down 2.6%, and Rio Tinto shedding 3% following a weaker-than-expected half-year result. Mineral Resources plunged 9.1% after a trading update led to broker downgrades.

In contrast, tech stocks outperformed, led by gains in US mega caps. Life360 rose 3.4% and WiseTech gained 1.1%. Banks also helped pare losses, with Westpac and CBA up 4%, NAB rising 1%, and ANZ edging up 0.2%.

Beach Energy fell 9.2% after flagging a $674 million impairment. Flight Centre dropped 8.9% on guidance downgrade concerns. Cettire plunged 22.1% on fears US tariff changes will impact global logistics and sales.

Leaders

DRO Droneshield Ltd (+17.67%)

NEU Neuren Pharma (+4.09%)

TUA Tuas Ltd (+3.94%)

360 LIFE360 Inc (+3.81%)

SDR Siteminder Ltd (+3.63%)

Laggards

CIA Champion Iron Ltd (-12.29%)

OBM Ora Banda Mining Ltd (-10.54%)

BPT Beach Energy Ltd (-8.72%)

MIN Mineral Resources Ltd (-8.06%)

VUL Vulcan Energy (-7.92%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!