What's Affecting Markets Today

Asia-Pacific Markets Mixed as Investors Digest US Tariffs, Jobs Data and OPEC+ Decision

Asia-Pacific markets traded mixed on Monday as investors responded to the latest US tariff increases and a weaker-than-expected US jobs report, which triggered renewed bets on a Federal Reserve rate cut as early as next month. Wall Street ended lower on Friday, setting a cautious tone for the region.

In Japan, the Nikkei 225 dropped 2.05% to 39,969.79, while the Topix fell 1.81% to 2,895.54, weighed down by financials and exporters amid a weaker yen. Chinese markets also opened lower, with the Hang Seng Index slipping 0.23% and the CSI 300 falling 0.42%.

Indian equities bucked the trend, with the Nifty 50 up 0.35% and the BSE Sensex rising 0.23% in early trade.

Oil prices dipped marginally after OPEC+ announced another significant output increase. Brent crude eased 0.2% to $69.53 per barrel, while WTI slipped 0.1% to $67.27.

Spot gold edged 0.22% lower to $3,355.37 per ounce after climbing last week on expectations of looser Fed policy following the soft US jobs print.

ASX Stocks

ASX 200 8,651.2 (-0.15%)

ASX Flat as Gold Miners Offset Losses in Financials and Energy

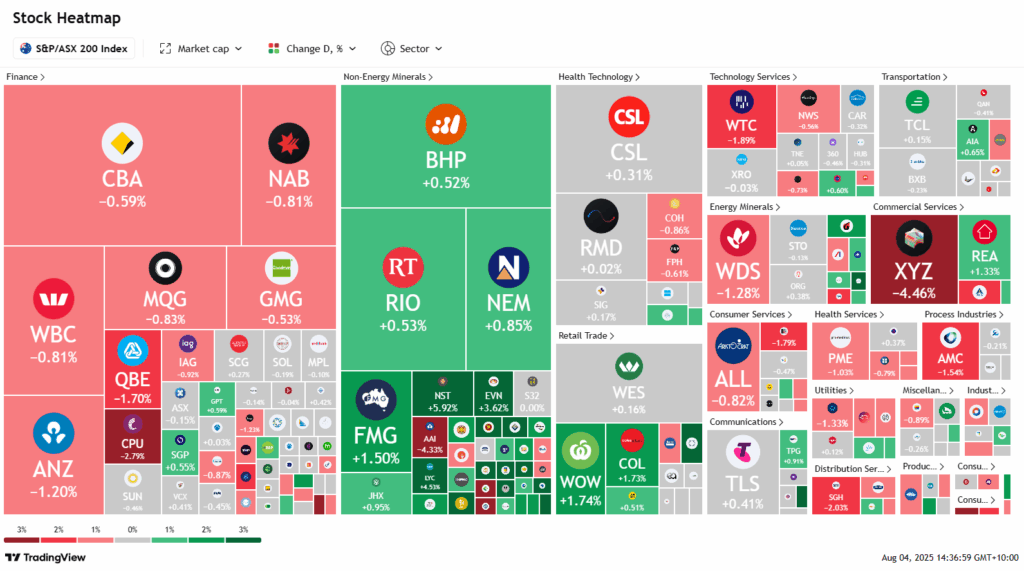

The Australian sharemarket erased earlier losses to trade flat on Monday afternoon, supported by gains in gold and materials stocks. The S&P/ASX 200 index was down just 1.3 points to 8660.70 at 2:10pm AEST, recovering from an intraday low of 8630.90.

Gold miners led the rally after weaker-than-expected US payroll data raised the likelihood of a Federal Reserve rate cut. Gold surged 2.3% to $US3359.20/oz. Bellevue Gold soared 7.1%, Northern Star climbed 6%, Evolution Mining gained 3.8%, and Newmont added 1%.

Financials were the weakest sector as investor concerns over the US economy weighed on sentiment. ANZ fell 1.1%, NAB dropped 0.9%, Westpac declined 0.6%, and CBA slipped 0.3%. Energy also lagged as Brent crude dipped below $US70/bbl. Woodside and Ampol both shed 1.2%.

Materials were bolstered by a 0.5% lift in iron ore prices. Fortescue gained 1.5%, BHP rose 0.6%, and Rio Tinto advanced 0.5%.

In corporate news, Beach Energy rose 3.5% after tripling its dividend despite an annual loss. WiseTech fell 2% after completing its $3.25b e2Open acquisition. BlueScope eased 1% amid updates on the Whyalla steelworks bid.

Leaders

CYL Catalyst Metals Ltd (+9.84%)

WA1 WA1 Resources Ltd (+7.47%)

BGL Bellevue Gold Ltd (+7.10%)

VAU Vault Minerals Ltd (+6.76%)

PNR Pantoro Gold Ltd (+6.48%)

Laggards

XYZ Block, Inc (-4.48%)

FCL Fineos Corporation Holdings Plc (-4.44%)

AAI Alcoa Corporation (-4.07%)

CSC Capstone Copper Corp (-3.58%)

JDO Judo Capital Holdings Ltd (-3.38%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!