As an investor in the fast-paced world of software companies, you’ve likely seen stocks skyrocket on promises of rapid growth. But not all growth is created equal—some companies expand quickly while hemorrhaging cash, while others churn out profits but struggle to innovate.

How do you separate the sustainable winners from the flash-in-the-pan risks? Enter the Rule of 40, a straightforward benchmark that combines revenue growth and profitability into one powerful indicator. Widely used by venture capitalists and public market investors, it’s become essential for assessing software-as-a-service (SaaS) businesses.

In this investor education post, we’ll break down the Rule of 40: what it is, how to calculate it, why it matters, common pitfalls, and how it applies across different company stages. We’ll also examine real-world examples from GitLab, Palantir, and Salesforce to illustrate its practical use. Whether you’re a novice or seasoned investor, this guide will help you apply the metric thoughtfully.

What Is the Rule of 40?

The Rule of 40 is a simple heuristic for evaluating the financial health of software companies, particularly those focused on growth over immediate profits. It measures whether a company is striking the right balance between expanding revenue and generating earnings.

The core formula is:

Revenue Growth Rate (%) + Profit Margin (%) ≥ 40%

- If the sum exceeds 40, the company is generally viewed as healthy, efficiently balancing expansion and efficiency.

- If it’s below 40, it might signal inefficient growth or insufficient profits to support slower scaling.

Why the Rule of 40 Matters for Investors

At its heart, the Rule of 40 addresses a fundamental question: Is this company’s growth efficient enough to justify the investment risk? It acts as a balancing act between two competing priorities—revenue expansion and profitability.

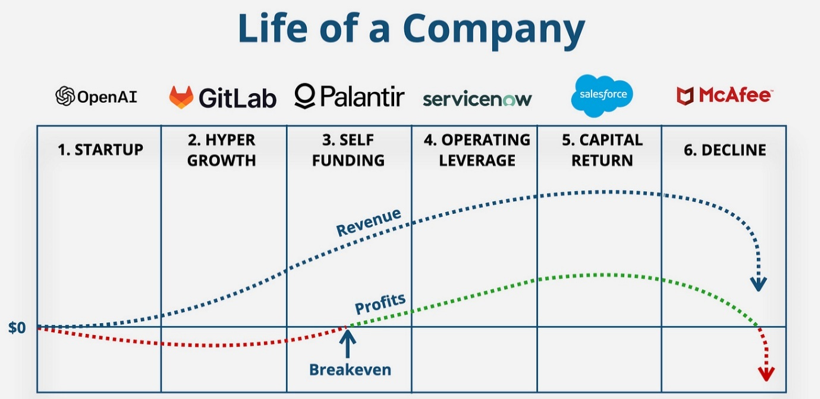

However, context is crucial. Growth and profits don’t carry equal weight at every stage of a company’s lifecycle:

- Early-stage startups might prioritize rapid growth, even at the expense of profits (e.g., burning cash to capture market share).

- Mid-stage companies need to show scaling efficiency.

- Mature firms should focus on profitability and reinvention to avoid stagnation.

Without this nuance, a low score might unfairly penalize a promising young company, while a high score could mask issues in an established one.

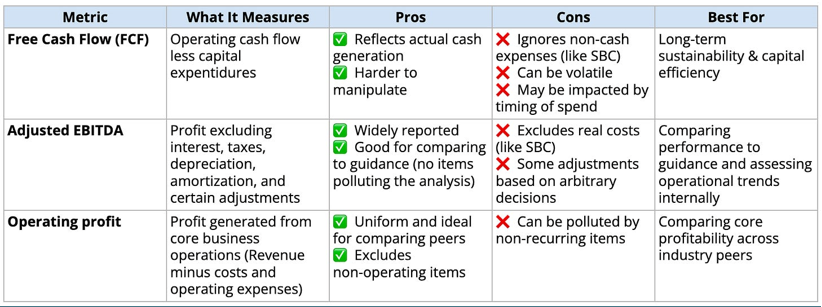

Choosing the Right Profitability Metrics: A Comparison

Profit margin isn’t one-size-fits-all. Investors often debate which metric best captures a company’s true efficiency. Here’s a breakdown of popular options:

Choosing the Right Profitability Metrics: A Comparison

Profit margin isn’t one-size-fits-all. Investors often debate which metric best captures a company’s true efficiency. Here’s a breakdown of popular options:

The Origins and Importance of the Rule of 40

The Rule of 40 was popularized by venture capitalist Brad Feld as a quick “health check” for SaaS companies. It emphasizes the need to pair aggressive growth with financial discipline, helping investors identify businesses on sustainable paths.

Recent research underscores its value:

- A McKinsey & Company study found that only about one-third of software companies consistently met the Rule of 40 between 2011 and 2021.

- Bain & Company reported that just 16% sustained it for more than five years.

These stats highlight how rare—and rewarding—it is for companies to achieve long-term balance, making the metric a valuable tool for spotting high-quality investments.

Company Lifecycle Stages and the Rule of 40

Software companies evolve through distinct phases, and the Rule of 40’s implications shift accordingly. Common stages include:

- Startup: Heavy investment in product and market fit; growth trumps profits.

- Hypergrowth: Rapid scaling; aim for improving margins.

- Self-Sustaining: Balanced operations; consistent Rule of 40 scores.

- Operating Efficiency: Focus on margins and capital returns.

- Mature/Decline: Reinvent or optimize to maintain scores.

Evaluate scores relative to the stage—early companies might score below 40 temporarily, while mature ones should exceed it steadily.

Pitfalls to Avoid When Using the Rule of 40

While powerful, the Rule of 40 isn’t foolproof:

- Over-Reliance on Adjustments: Aggressive exclusions (e.g., SBC or one-time costs) can inflate scores artificially.

- Ignoring Context: A score alone doesn’t account for market conditions, competition, or intangibles like leadership.

- SaaS-Specific Bias: It’s most effective for recurring revenue models; less so for hardware or one-off sales.

- Short-Term Focus: Volatility in quarterly data can mislead—use trailing 12-month figures for stability.

Always pair it with qualitative analysis, such as product moats or management quality.

The Rule of 40 in the AI Era

AI is reshaping software, boosting growth through features like premium tools and usage-based pricing. However, it also drives up costs for talent and infrastructure. The Rule of 40 helps cut through the hype by revealing:

- Whether margins are improving amid AI adoption.

- If early AI wins translate to sustainable revenue.

In AI-driven markets, growth alone isn’t enough—efficiency remains key.

Real-World Examples Across Growth Stages

Let’s apply the Rule of 40 to three companies at different lifecycle phases, using recent financial data.

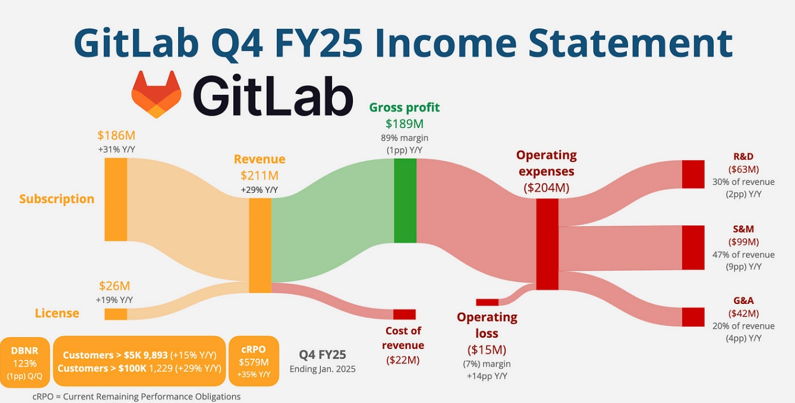

Early-Stage: GitLab (GTLB)

GitLab, a DevOps platform, is in hypergrowth mode. In Q4 FY25:

- Revenue Growth: High (specific figures show strong Y/Y increases, though exact % not detailed here).

- Profitability: Still investing heavily, with negative margins common.

- Rule of 40 Score: Below 40 currently, but trending toward it.

For early-stage firms like GitLab, the focus is on growth potential and margin expansion (e.g., via enterprise upsells). A sub-40 score is acceptable if progress is evident.

Watch for: Margin gains from scaling products like GitLab Dedicated and enterprise traction.

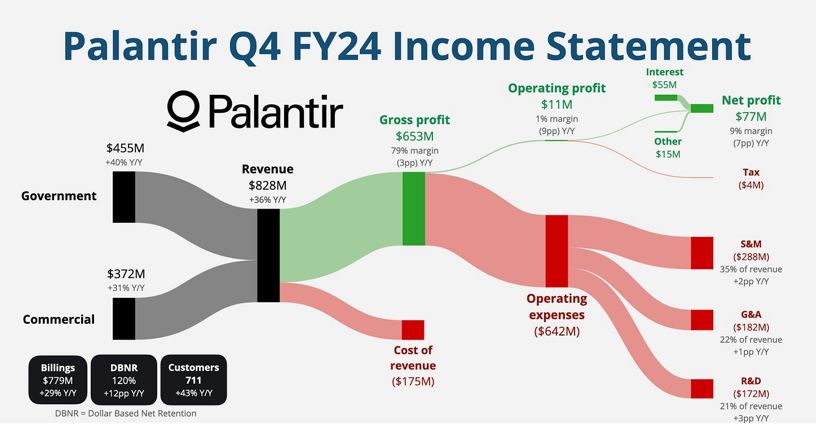

Mid-Stage: Palantir (PLTR)

Palantir, an AI and data analytics leader, is scaling efficiently. In Q4 FY24:

- Revenue Growth: 36% Y/Y.

- Profitability: FCF margin of 44% (trailing 12 months); GAAP operating margin of 11% FY24.

- Rule of 40 Score: 80 (using FCF) or 47 (using operating margin).

Palantir’s strong score reflects AI demand and profitability milestones (e.g., S&P 500 inclusion after consistent profits). Mid-stage companies must maintain high scores through durable growth and margin stability.

Watch for: Commercial momentum, European expansion, and margin resilience as growth normalizes.

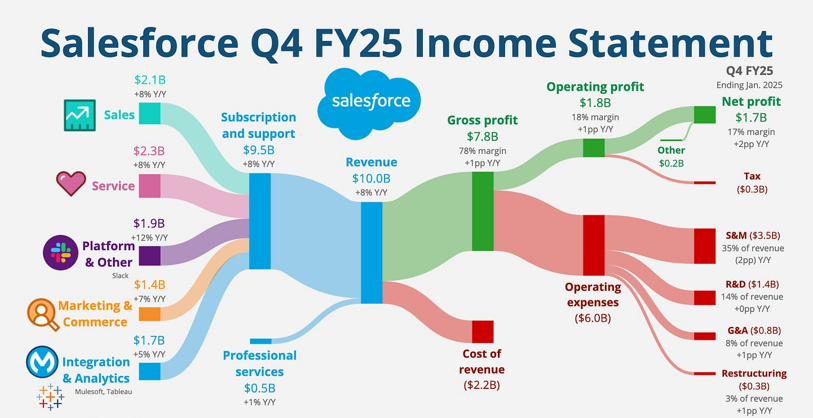

Mature-Stage: Salesforce (CRM)

As a CRM giant, Salesforce emphasizes efficiency in maturity.

- Revenue Growth: Slower but steady (e.g., mid-teens %).

- Profitability: Strong margins from scale.

- Rule of 40 Score: Typically above 40, driven by operational discipline.

Mature firms like Salesforce use the metric to highlight reinvention (e.g., AI integrations) or cost controls. Declining scores could signal complacency.

Watch for: New growth drivers and sustained efficiency.

How to Calculate the Rule of 40

Calculating the Rule of 40 is straightforward, but it requires reliable financial data from company reports:

- Determine Revenue Growth Rate: This is the year-over-year percentage increase in revenue. For example, if revenue grew from $100 million to $130 million, the growth rate is 30%.

- Select a Profit Margin Metric: Common options include free cash flow (FCF) margin, adjusted EBITDA margin, or GAAP operating margin. Divide the chosen profit figure by revenue and multiply by 100 for the percentage.

- Add Them Up: Sum the two percentages and compare to 40.

Always use the same time period (e.g., trailing 12 months or fiscal year) for both metrics to ensure accuracy.

Strategies to Improve a Rule of 40 Score

Companies (and investors evaluating them) can boost scores by:

- Enhancing Net Revenue Retention (NRR): Upsell to existing customers for efficient growth.

- Boosting Sales Efficiency: Reduce customer acquisition costs (CAC) and shorten payback periods.

- Adopting Product-Led Growth: Let the product drive adoption to cut marketing expenses.

- Optimizing Gross Margins: Automate and scale infrastructure for better profitability.

- Innovating Monetization: Introduce usage-based pricing or premium features.

Top performers add revenue faster than costs, creating compounding value.

Practical Insights: Strengths, Limitations, and Final Thoughts

The Rule of 40 simplifies complex financials into a snapshot of sustainability, making it ideal for screening investments. It highlights tradeoffs, tracks evolution, and pairs well with broader analysis.

Strengths:

- Simple and comparable across companies.

- Emphasizes balanced, long-term value.

- Endorsed by investors and operators.

Limitations:

- Best for SaaS; less applicable elsewhere.

- Vulnerable to metric manipulation.

- Overlooks non-financial factors like moats or leadership.

In summary, the Rule of 40 is a valuable starting point for investor due diligence—but always dig deeper. By understanding its nuances, you’ll be better equipped to spot software stocks poised for enduring success. Happy investing!

Got a question about this article? Ask the Team at MPC

ASK A QUESTION

GENERAL ADVICE WARNING:

Recommendations and reports managed and presented by MPC Markets Pty Ltd (ABN 33 668 234 562), as a Corporate Authorised Representative of LeMessurier Securities Pty Ltd (ABN 43 111 931 849) (LemSec), holder of Australian Financial Services Licence No. 296877, offers insights and analyses formulated in good faith and

Opinions and recommendations made by MPC Markets are GENERAL ADVICE ONLY and DO NOT TAKE INTO ACCOUNT YOUR PERSONAL CIRCUMSTANCES, always consult a financial professional before making any decisions.