What's Affecting Markets Today

Asia-Pacific Markets Rise Despite U.S.-India Trade Tensions; India Equities Slip

Asia-Pacific markets traded higher Tuesday, shrugging off fresh U.S.-India trade tensions after former U.S. President Donald Trump announced plans to significantly increase tariffs on Indian exports. Trump criticised India’s resale of Russian oil at a profit, calling out its trade practices on social media.

India’s markets opened lower, with the Nifty 50 down 0.42% and the BSE Sensex off 0.31%. The rupee weakened 0.15% to 87.792 against the U.S. dollar. India’s foreign ministry defended its energy strategy, accusing the U.S. and EU of hypocrisy, citing the EU’s €67.5 billion trade with Russia in 2024.

Elsewhere in the region, mainland China’s CSI 300 gained 0.32% and Hong Kong’s Hang Seng Index rose 0.24%, tracking broader market optimism.

Japanese shares advanced, led by Mitsubishi Heavy Industries after securing a $6.5 billion Australian navy contract.

Meanwhile, Bank of Japan meeting minutes revealed some members see scope to resume rate hikes if global trade friction eases. However, most supported holding rates steady due to U.S. tariff risks and modestly higher inflation.

ASX Stocks

ASX 200 8,763.8 (+1.15%)

ASX Eyes Best Gain in Two Weeks as Rate-Sensitive Sectors Surge

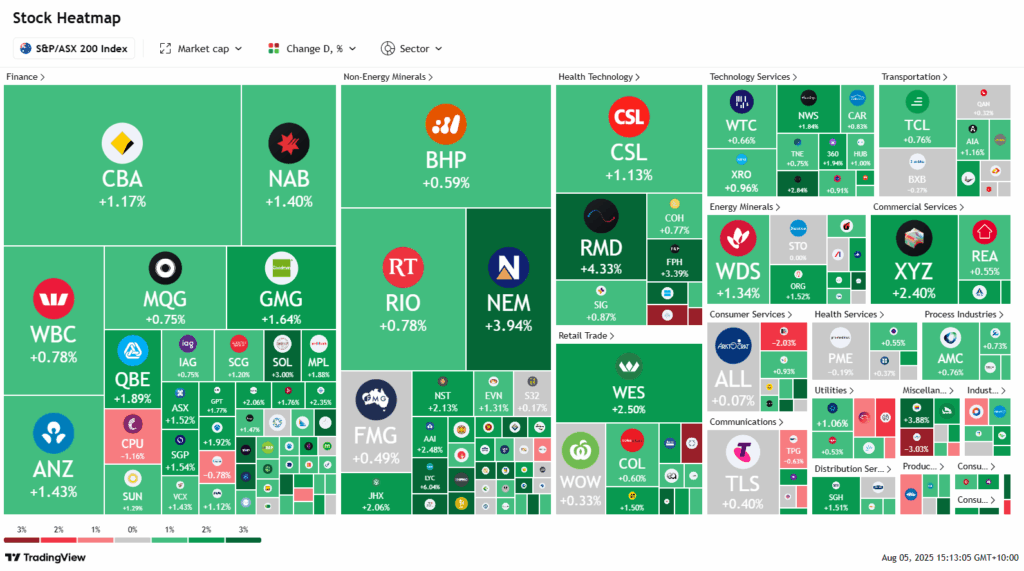

The Australian sharemarket rallied on Tuesday, with the S&P/ASX 200 Index advancing 1.1% or 97.7 points to 8761.40 by 2:05pm AEST. The index tracked Wall Street gains amid growing expectations of a US interest rate cut in September, with markets now pricing in a total of 63 basis points of easing by year-end.

All 11 ASX sectors traded higher, led by technology, consumer discretionary, and real estate—each up 1.6%. Key movers included Wesfarmers (+2.5%), Charter Hall (+1.9%), Life360 (+1.4%), and JB Hi-Fi (+1.4%). Gold extended gains for a third session, reaching US$3375.65/oz. Newmont climbed 3.9% and Northern Star 1.9%.

Iluka Resources surged 9.4% and Lynas rose 5.7% following speculation that Australia may introduce a rare earth floor price. Major banks rebounded, with ANZ and NAB up 1.4%, Westpac 0.9%, and CBA gaining 1.3% after announcing $130 million in provisions related to Bankwest’s digital transition.

Credit Corp soared 15% after reporting a 16% rise in FY profit to $94.1 million. In contrast, Telix Pharmaceuticals sank 11.9% on rising operating expenses.

Leaders

CCP Credit Corp Group Ltd (+16.58%)

ILU Iluka Resources Ltd (+9.59%)

DRO Droneshield Ltd (+7.96%)

CDA Codan Ltd (+6.55%)

IEL Idp Education Ltd (+5.77%)

Laggards

TLX TELIX Pharmaceuticals Ltd (-12.08%)

AFI Australian Foundation Investment (-3.03%)

NEU Neuren Pharmaceuticals Ltd (-2.66%)

EDV Endeavour Group Ltd (-2.52%)

MAF MA Financial Group Ltd (-2.37%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!