What's Affecting Markets Today

Asia-Pacific Markets Mixed as Trump Renews Tariff Threats; RBI Holds Rates

Asia-Pacific markets traded mixed on Wednesday, tracking overnight losses on Wall Street amid renewed tariff concerns and softer U.S. economic data. Investor sentiment was weighed by comments from U.S. President Donald Trump, who announced plans to impose fresh tariffs on semiconductors to encourage domestic production. The official announcement is expected within a week.

The move pressured Asian chipmakers. Japan’s Renesas Electronics dropped 3.68%, Tokyo Electron lost 3.46%, and South Korea’s SK Hynix and Samsung Electronics declined 2.09% and 1.43% respectively. Taiwan’s TSMC fell 2.17%.

In India, the Reserve Bank of India held its benchmark rate steady at 5.5%, following a 50 basis point cut in June. The central bank also shifted to a “neutral” stance, citing limited policy space for further easing.

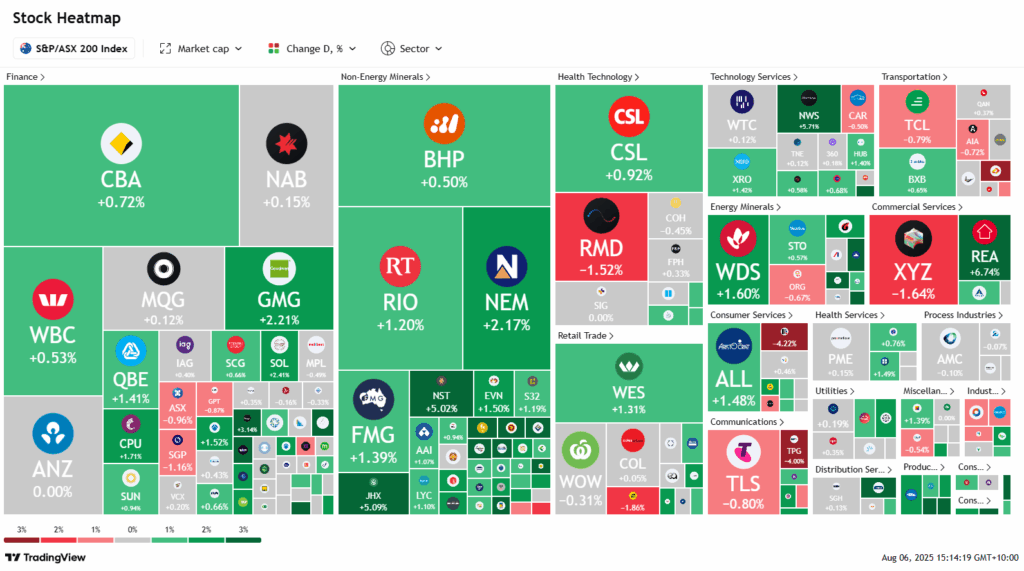

Australian equities led regional gains, with the S&P/ASX 200 hitting a record high of 8824 in early trade. Major banks including Commonwealth Bank (+1.0%) and Westpac (+0.74%) advanced, while BHP rose 0.28%.

Meanwhile, Cathay Pacific shares slipped 0.58% ahead of earnings and reports of a Boeing aircraft order.

ASX Stocks

ASX 200 8,831.0 (+1.15%)

ASX Rallies to Record High on Strength in Miners, Energy Stocks

The Australian sharemarket surged to a record high on Wednesday, driven by broad gains across sectors, particularly materials and energy. The S&P/ASX 200 rose 0.6% to 8823.30 by 2:10pm AEST, having touched an intraday record of 8824 earlier in the session.

Weaker-than-expected US services data raised hopes of Federal Reserve rate cuts, lifting sentiment and driving gold prices towards $US3400 an ounce. Gold miners outperformed, with Northern Star up 4.9%, Newmont advancing 2.3%, and West African Resources climbing 6.1% on upgraded production forecasts.

Energy stocks also gained as Brent crude rose 0.7% to $US68.12. Woodside added 1.2% and Santos 0.5%.

Financials were mixed, with NAB flat and ANZ retreating. ASX Ltd fell 1.1% after misreporting TPG Capital’s bid for Infomedia.

Communication services gained, led by REA Group (+6.2%) and News Corp (+6.4%) on strong earnings. Pinnacle Investment surged 8.4% after posting a 49% jump in annual profit.

Lindian Resources soared 38.3% following a rare earths deal with Iluka, which rose 0.8%. Utilities was the only sector to finish lower.

Leaders

IEL Idp Education Ltd (+14.25%)

PNI Pinnacle Investment (+9.64%)

CYL Catalyst Metals Ltd (+7.63%)

SMR Stanmore Resources Ltd (+6.57%)

REA REA Group Ltd (+6.51%)

Laggards

PDI Predictive Discovery Ltd (-5.11%)

LNW Light & Wonder Inc (-4.09%)

TPG TPG Telecom Ltd (-3.46%)

AZJ Aurizon Holdings Ltd (-3.23%)

CKF Collins Foods Ltd (-2.29%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!