Overnight – Stocks lower on Fed and Tariff uncertainty

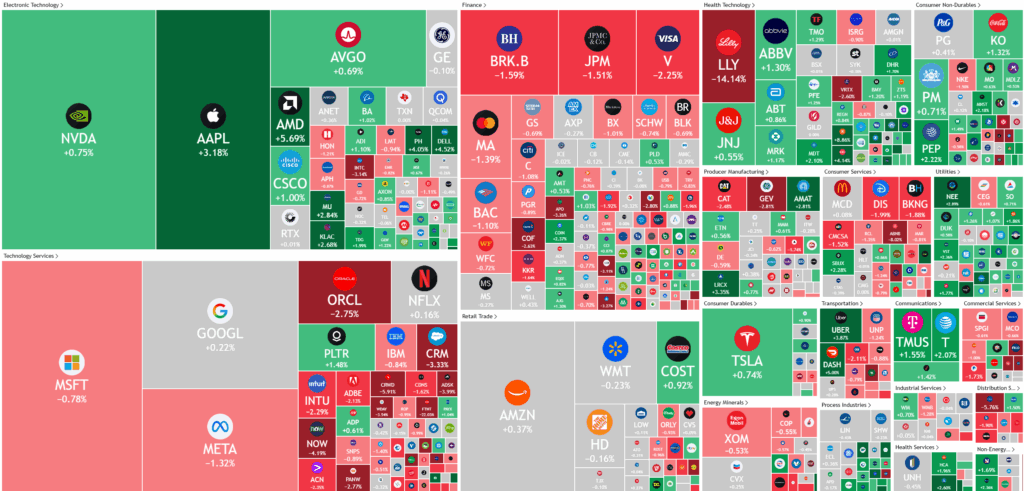

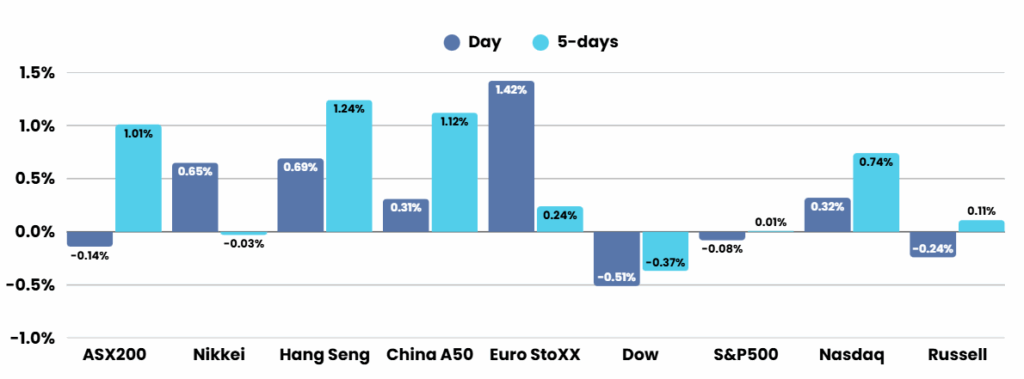

Stocks closed slightly lower after clawing back losses late into the close as investors weighed reports of shake up at the Federal Reserve and ongoing strength in tech stocks.

Federal Reserve Governor Christopher Waller is emerging as the leading candidate to replace Jerome Powell as chair of the Federal Reserve. This consideration is backed by President Trump’s advisers, who value Waller’s emphasis on forecasting over reactive policy and his deep understanding of the central bank’s operations. Meanwhile, Trump is reportedly planning to nominate Stephen Miran, a major architect of the ‘America first’ economic strategy, to fill Adriana Kugler’s seat on the Fed Board, pointing toward a more administration-aligned central bank in coming years.

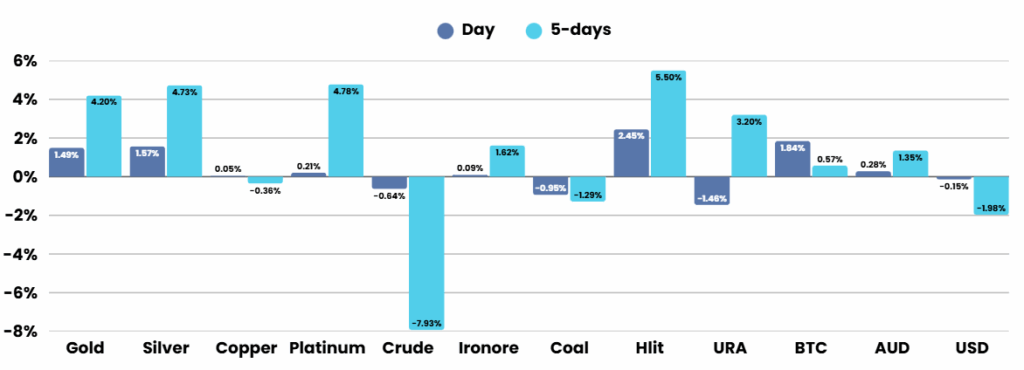

In corporate developments, Apple’s stock continued to rise after pledging an additional $100 billion investment in U.S. manufacturing, increasing its domestic commitment to $600 billion—a move seen as dovetailing with Trump’s economic objectives amid escalating trade tensions. President Trump imposed a further 25% tariff on Indian goods due to India’s continued purchases of Russian oil and threatened harsh import penalties on semiconductors not manufactured in the U.S. These policies have sparked concerns about a global economic slowdown as reciprocal tariffs begin to take effect.

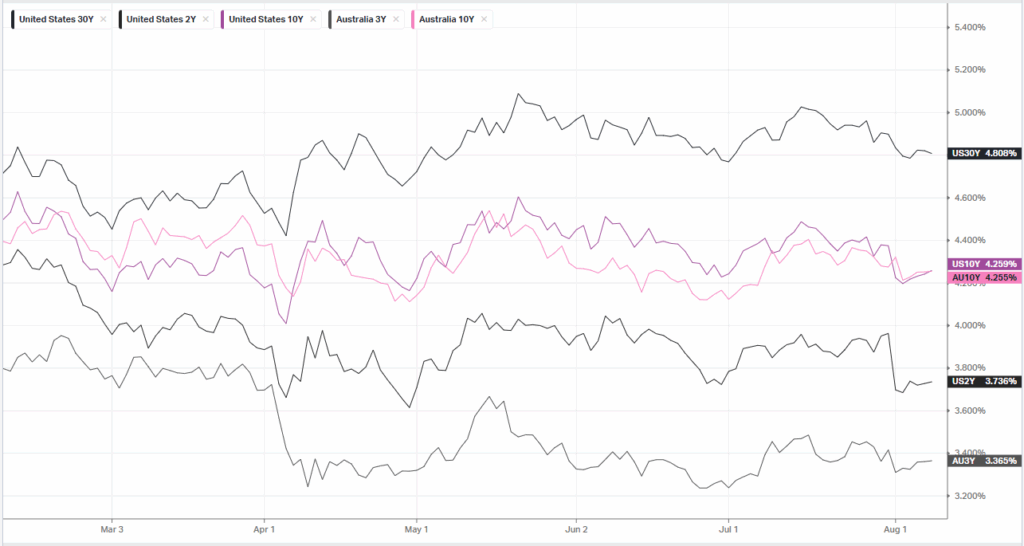

The second-quarter earnings season is closing on a positive note, with over 80% of reporting firms surpassing profit expectations. Notable outperformers include Hertz, ConocoPhillips, DoorDash, Duolingo, and Peloton, which posted strong results and optimistic forecasts. However, some companies like Eli Lilly and Airbnb faced stock setbacks after disappointing data and guidance. In labor news, higher initial and continuing jobless claims point to a softening job market, raising expectations of a Federal Reserve rate cut as soon as September, with market participants nearly certain of a policy easing in response to the cooling employment environment.

Corporate Earnings

- Block XYZ +5% – reported a rise in second-quarter income and raised its expectations for annual gross profit on Thursday, as the payments firm was helped by resilient consumer spending, lifting its shares 12% higher in extended trading.

- ConocoPhillips +0.43%- stock rose after the oil giant beat estimates for second-quarter profit, as a rise in output helped the oil and gas producer offset a hit from weak crude prices.

- DoorDash +5% – stock soared after the food delivery company forecast third-quarter gross merchandise value above expectations after topping estimates, betting on robust demand for food and grocery deliveries through its platform.

- Duolingo +13%- stock jumped after the language-learning app raised its annual revenue forecast and beat second-quarter revenue estimates, anticipating broader adoption of its AI-enhanced subscription tier among its global user base.

- Eli Lilly -14% – stock slumped after a study showed that the pharmaceutical giant’s weight-loss pill cut body weight by less than a rival treatment from Novo Nordisk

ASX SPI 8757 (-0.24%)

Th local market is in for a quiet day leading into next weeks earnings

*Trump disclaimer – Always expect the unexpected

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.