Overnight – Investors take some money off the table as inflation figures loom

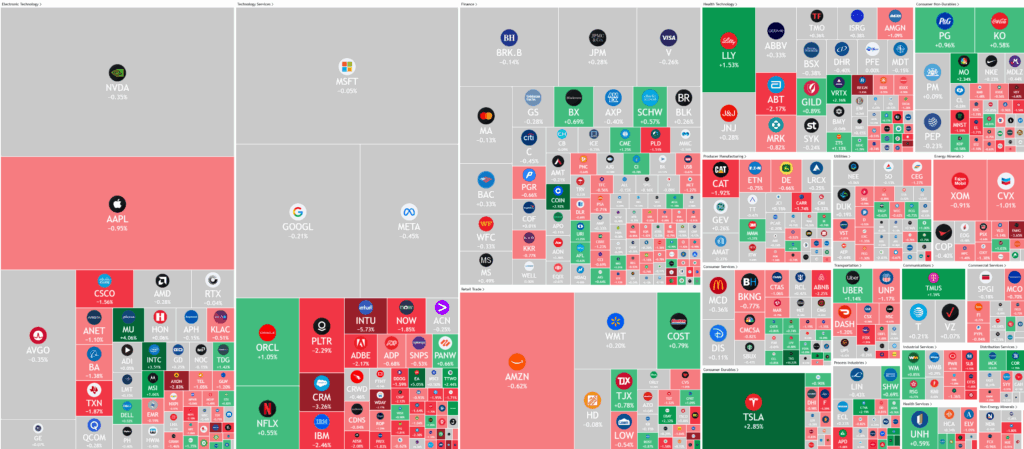

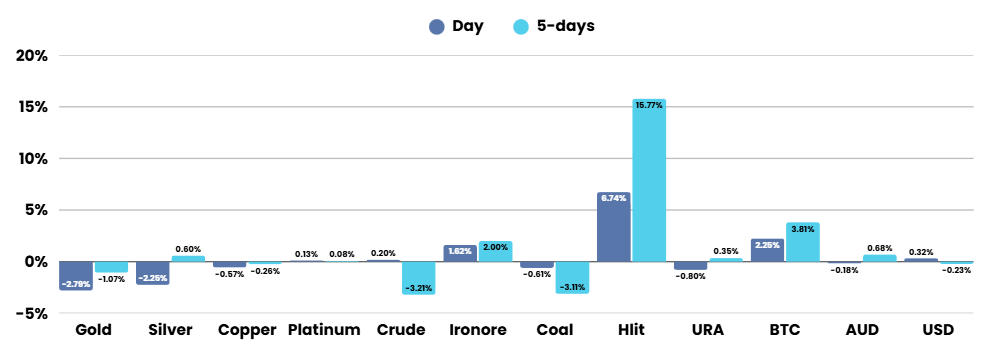

Stocks headed lower overnight as investors awaited key inflation prints due later in the wee and digested reports that President Donald Trump had extended the deadline for China tariffs by 90 days.

President Trump has extended the deadline for China tariffs by 90 days, pushing it to November 9—just one day before the original August 12 cutoff. This decision ensures that uncertainty over U.S.-China trade relations will persist, affecting global markets and diplomatic discussions. Meanwhile, Trump is scheduled to meet Russian President Vladimir Putin in Alaska on August 15, marking the first in-person summit between active leaders of the two countries since Biden met with Putin in June 2021. The meeting carries significant weight, as a primary agenda item is ending the war in Ukraine.

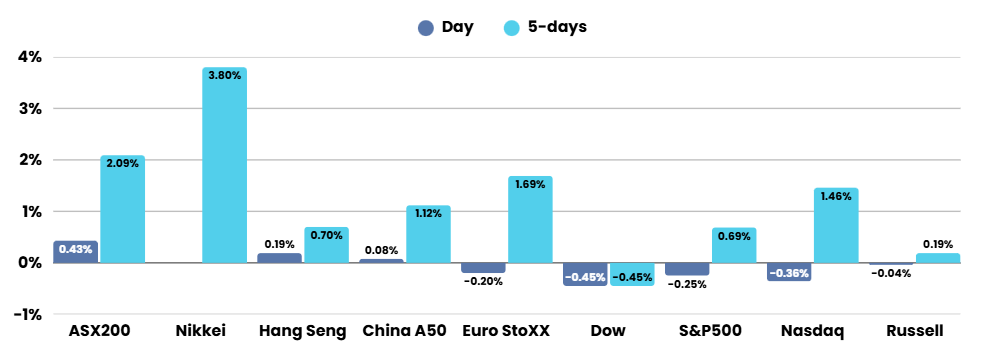

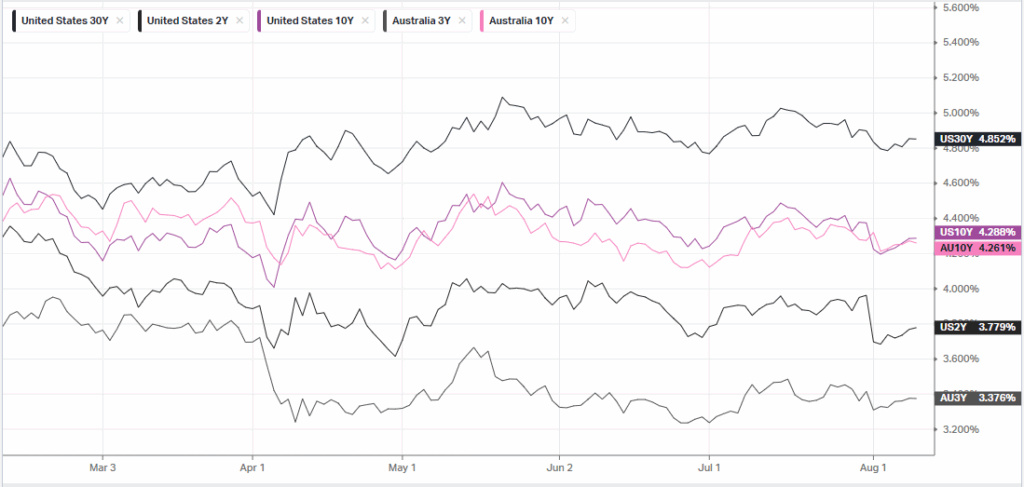

Financial markets responded positively last week, with the Nasdaq Composite reaching a new intraday high and the S&P 500 approaching its all-time closing peak. However, this upbeat momentum faces a test as multiple economic indicators are slated for release, including July’s consumer price index (CPI) on Tuesday, producer prices on Thursday, and retail sales plus consumer sentiment on Friday. The disappointing July jobs report, compounded by downward revisions for prior months, has heightened expectations for the Federal Reserve to cut interest rates at its next meeting. Persistently high inflation, above the Fed’s 2% target, continues to be a concern, particularly as new tariffs may put additional upward pressure on domestic prices. Analysts expect July’s core CPI to rise 0.3% month-on-month, or 3.0% year-on-year, a figure that could motivate the Fed to lower rates if labor market weakness endures.

In the corporate realm, Micron Technology’s stock rose after the company increased its Q4 fiscal 2025 projections, attributing the boost to stronger pricing and efficient operations. Meanwhile, Nvidia and Advanced Micro Devices (AMD) remain under scrutiny following reports that both firms are poised to remit 15% of their AI-related revenue from China sales to the U.S. government. This move could have major implications for their international business strategies as U.S.-China technology tensions persist.

Corporate Earnings

- CoreWeave +7% – after the JPMorgan more than doubled its price target on the stock to $135 from $66, citing hte ongoing prospect of the cloud infrastructure company to continue to win new business.

ASX SPI 8782 (-0.18%)

The ASX will be all about the RBA decision today with the interest rate sensitive stocks in focus. The RBA is widely expected to cut the cash rate target by 25 basis points to 3.60 per cent at its Tuesday policy meeting. The policy decision will be released at 2.30pm, as well as the latest Statement on Monetary Policy. Governor Michele Bullock is scheduled to hold a press conference starting at 3.30pm.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.