Overnight – Stocks edge higher as Investors ignore higher inflation

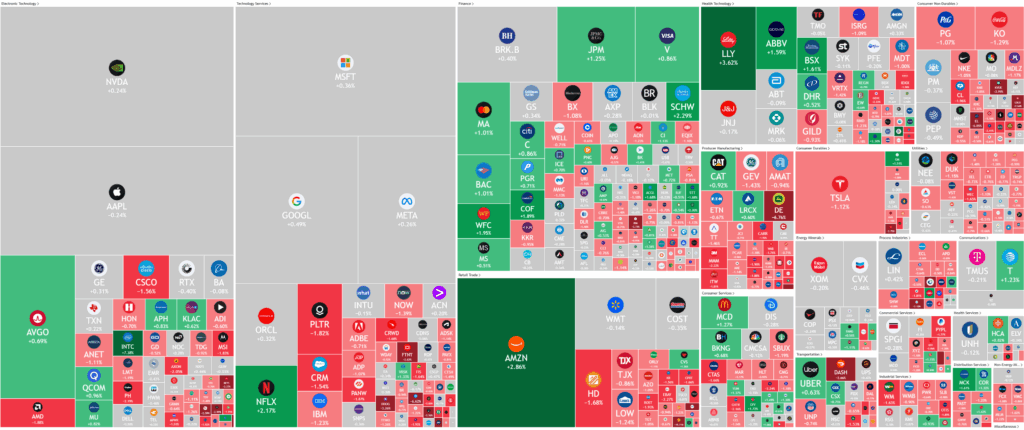

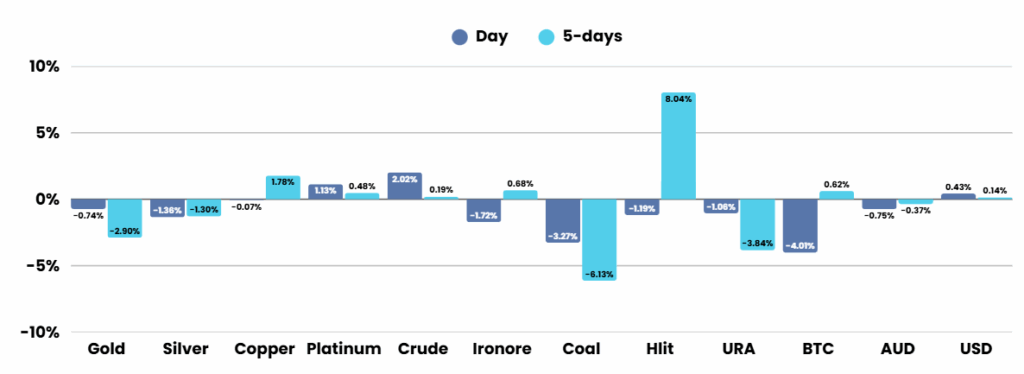

Stocks were lucky to eking out a small gain overnight as investors had their selective hearing on full power as inflation numbers came in much higher than expected .

The standout move came from Intel, which soared over 7% after reports that the Trump administration is in talks with the chipmaker regarding a possible government equity stake. Intel’s surge not only lifted chipmakers but also helped the broader tech sector recover from earlier losses, even as overall market gains were limited by new inflation concerns.

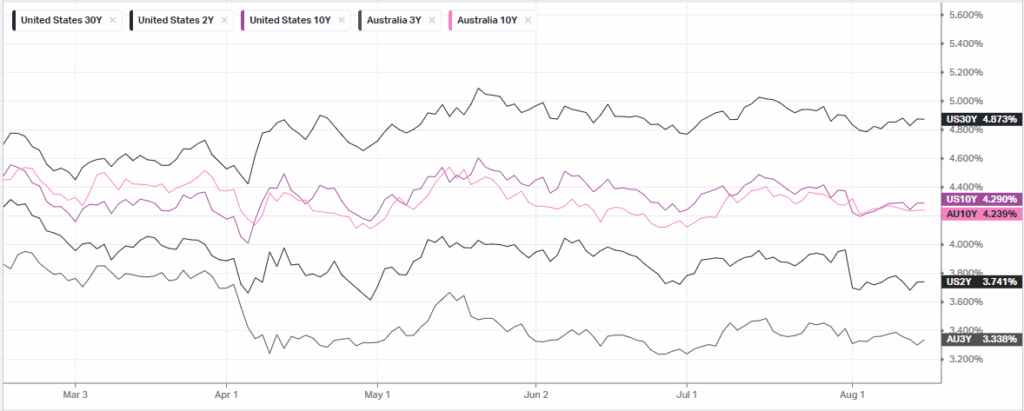

The inflation picture intensified as the Producer Price Index (PPI) for July showed a sharper-than-expected jump, rising 0.9% month-over-month and 3.3% year-over-year—the fastest annual increase since February. Notably, over three-quarters of July’s advance stemmed from a 1.1% spike in services costs, the largest since March 2022. These hotter-than-expected inflation figures diminished the likelihood of a large Federal Reserve rate cut in September, with market odds for such a move declining from 97% to 90%.

On the labor front, U.S. jobless claims fell by 3,000 to a seasonally adjusted 224,000 for the week ending August 9, continuing the trend of historically low layoffs and signaling ongoing resilience in the labor market despite other signs of cooling. This figure came in below market expectations of 228,000, reflecting robust job retention even as broader hiring momentum softens.

Corporate Earnings

- Deere & Co (-6%) – Deere & Company reported a significant drop in third-quarter 2025 profit, with net income falling 26% year-over-year to $1.289 billion ($4.75 per share), while net sales declined 9% to $10.36 billion. The company surpassed analysts’ earnings expectations despite these declines, aided by disciplined cost management and inventory controls. Deere also warned that tariff-related expenses are now forecasted to reach $600 million for the year, up from previous estimates, further pressuring margins. Ongoing weak demand—stemming from lower crop prices, cautious farmer spending, and favored equipment rentals—compounded these challenges, leading the company to cut the upper end of its annual profit guidance to $5.25 billion. Shares fell about 7–8% following the report, as investors reacted to the company’s lower outlook and the persistent impact of tariffs.

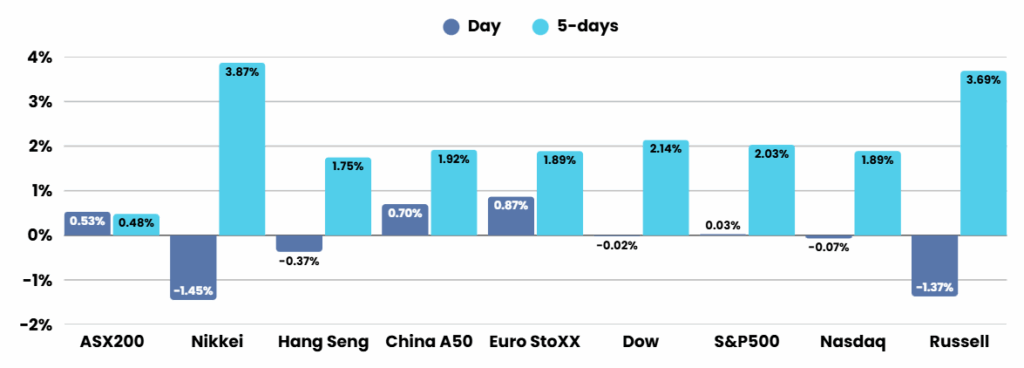

ASX SPI 8838 (+0.01%)

We expect a quiet day on the ASX with a potential “risk off” sentiment leading into Trump-Putin meeting over the weekend.

Corporate Earnings

- Cochlear’s FY25 results met or slightly missed the consensus on profit and services sales, with brokers emphasizing the solid implant volume performance but remaining cautious on service revenue and margin trends. The consensus sees upside potential contingent on successful product launches (Nexus, Kanso 3) and better-than-expected growth in developed markets, though near-term challenges and competition continue to weigh on sentiment.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.