Overnight – Stocks stumble into Jackson Hole and NVDA Earnings

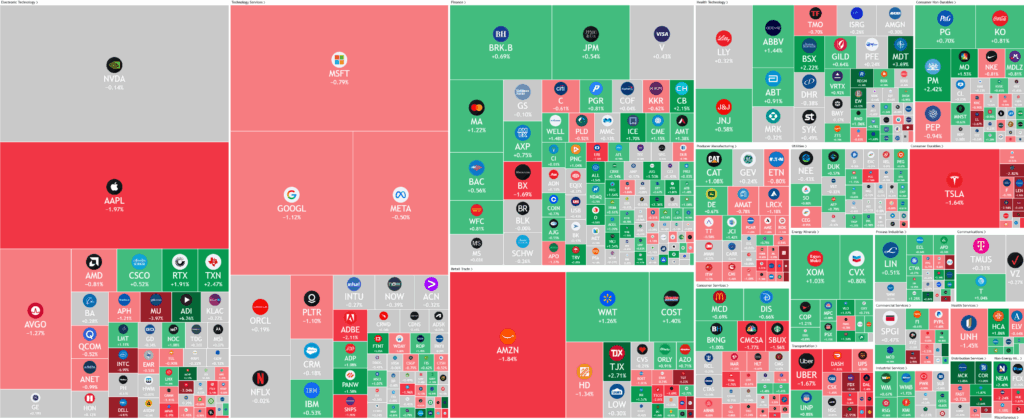

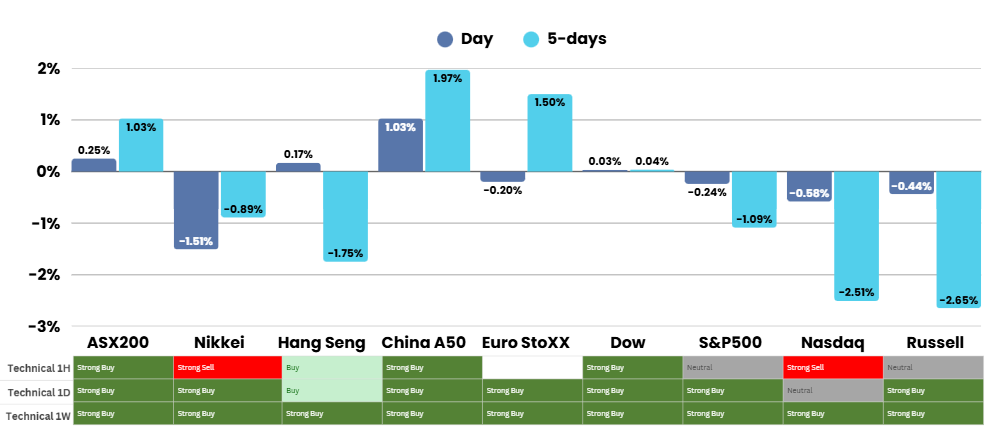

Stocks closed lower for a fourth straight session overnight, as big tech stocks continued to stumble ahead of the Jackson Hole Symposium and chipmaker Nvidia’s results due next week.

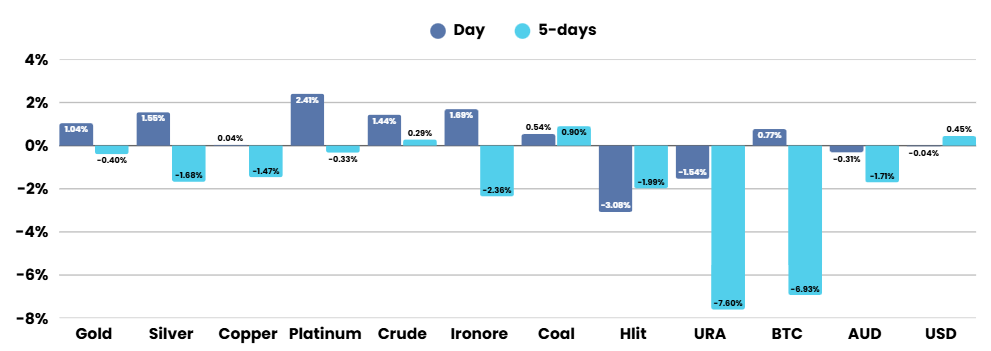

Tech stocks remained under pressure, with megacaps like Apple and Amazon dragging the broader sector lower. NVIDIA also saw weakness, initially tumbling 3.5% before paring losses to close roughly flat, as investors took a cautious stance ahead of its upcoming earnings report. The broader selloff highlights market unease around the durability of tech’s growth and investor positioning as uncertainty builds around both earnings momentum and monetary policy.

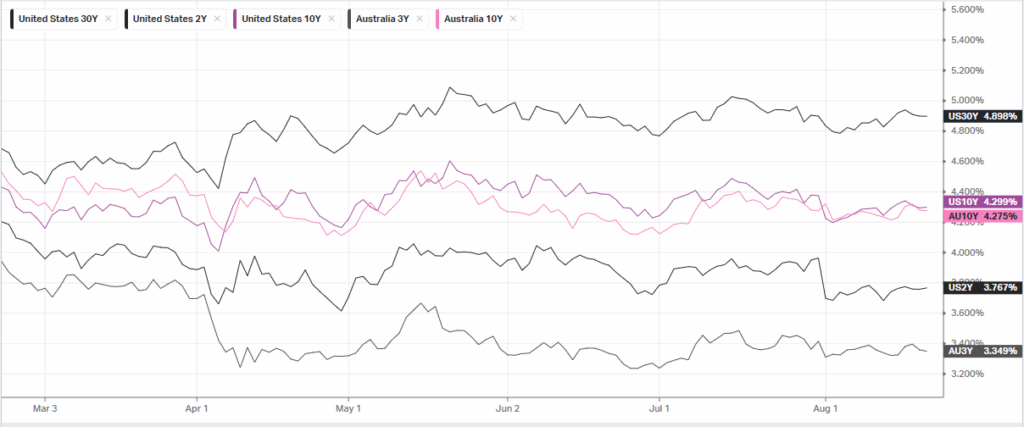

On the policy front, the Federal Reserve signalled a “wait and see” stance according to the minutes from its late-July meeting. Policymakers reiterated concerns that tariffs imposed by the Trump administration could add upward pressure to inflation, making it premature to commit to aggressive rate cuts. Chair Jerome Powell is set to deliver a pivotal speech at the Jackson Hole symposium, which markets will closely watch for signals of policy direction. Expectations are building for a possible September cut as recent labour and inflation data showed signs of cooling.

Meanwhile, political pressure on the Fed intensified as President Trump criticized Powell for being “too late” in easing rates and escalated his demands for Fed Governor Lisa Cook’s resignation amid mortgage fraud allegations. Trump’s moves underscore his determination to reshape the Fed with more rate-cut-friendly policymakers ahead of next year’s leadership transition. This political backdrop has added an extra layer of uncertainty for investors already nervous about inflation risks, tariffs, and rate trajectories.

In corporate earnings, retail remained in focus with a mixed batch of results and leadership developments. Target shares slipped after naming Michael Fiddelke as its new CEO amid ongoing sales struggles, while Estee Lauder tumbled on weak profit guidance tied to sluggish Chinese and U.S. demand plus tariff pressures. Conversely, Lowe’s and TJX outperformed with strong results and upbeat outlooks, showing more resilience in consumer spending on home projects and discount retail. Semiconductor firm Analog Devices also rallied on strong earnings and guidance, with Jefferies noting that overall, U.S. companies delivered their biggest earnings beats in over three years, significantly outpacing analyst expectations in the second quarter.

ASX SPI 8902 (+0.25%)

After a huge 2 days of earnings, the market takes a small breather with GMG, NST, BXB, SHL, TLX, WHC the focus today. So far the pattern has been very typically “Australian” with fund managers and investors punishing any companies that have missed with extreme prejudice, and barely rewarding those who beat. The pages of financial news are firmly focused on the bad news stories, with the winners from earning season a footnote in the press.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.