What's Affecting Markets Today

Asia-Pacific Markets Mixed as China Profits Improve

Asia-Pacific equities traded mixed on Wednesday, diverging from Wall Street, as investors weighed fresh Chinese industrial profit data and looming U.S. tariffs on India.

China’s industrial profits slipped 1.5 per cent in July from a year earlier, showing marked improvement after months of steeper declines. Meanwhile, Indian markets were closed for a holiday as additional U.S. tariffs of 25 per cent on exports to the U.S. took effect, raising total duties to 50 per cent.

Japan’s Nikkei 225 edged higher, supported by a sharp rally in Nikon shares, which surged over 20 per cent after reports that EssilorLuxottica may increase its stake in the company. The broader Topix index slipped 0.3 per cent.

South Korea’s Kospi fell 0.17 per cent, while the small-cap Kosdaq lost 0.16 per cent. Australia’s S&P/ASX 200 rose 0.15 per cent.

Hong Kong’s Hang Seng gained 0.27 per cent, while the CSI 300 rose 0.4 per cent, snapping a four-day winning streak. The index is up more than 13 per cent this year, though economists warn of “irrational exuberance.”

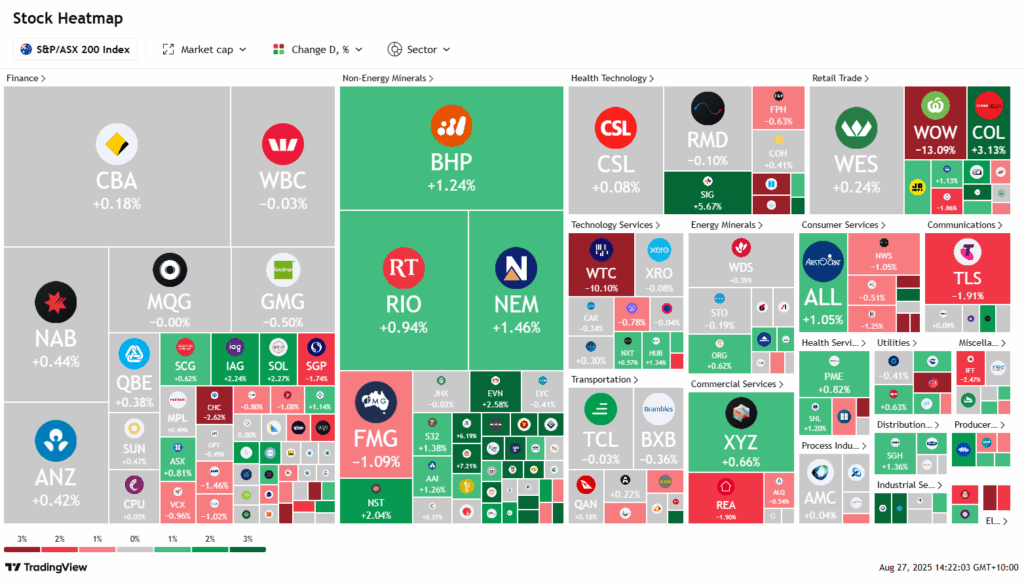

ASX Stocks

ASX 200 8,950.6 (+0.17%)

ASX Edges Higher as Earnings Misses Weigh

The Australian sharemarket ended slightly higher on Wednesday, with gains in resources offset by weak consumer staples and tech earnings. The S&P/ASX 200 rose 10.6 points, or 0.1 per cent, to 8946.2 at 2:01pm AEST, recovering from a dip after hotter-than-expected inflation data.

July’s CPI indicator rose 2.8 per cent, well above forecasts of 2.3 per cent, driven by electricity and housing. Analysts noted the report may temper expectations for further Reserve Bank rate cuts this year.

Materials led seven of 11 sectors higher, with Northern Star, Evolution Mining and Newmont all up over 1.5 per cent, while BHP and Rio Tinto each added 1 per cent. Utilities also advanced, led by APA Group and Origin Energy.

Consumer staples slumped 4.5 per cent, dragged by a 12.9 per cent fall in Woolworths after a dividend cut. Coles gained 3.1 per cent following an upgrade.

Big movers included SiteMinder (+21.9pc), Tabcorp (+22.8pc), Lovisa (+14.1pc) and Worley (+10.2pc). Domino’s plunged 19.1 per cent, while WiseTech lost 10.3 per cent and Flight Centre shed 4.2 per cent.

Leaders

TAH Tabcorp Holdings Ltd (+22.54%)

SDR Siteminder Ltd (+22.20%)

LOV Lovisa Holdings Ltd (+14.14%)

WOR Worley Ltd (+10.15%)

LTR Liontown Resources Ltd (+8.33%)

Laggards

DMP Domino’s PIZZA Enterprises Ltd (-19.22%)

WOW Woolworths Group Ltd (-12.94%)

EBO Ebos Group Ltd (-12.26%)

DRO Droneshield Ltd (-11.20%)

WTC Wisetech Global Ltd (-10.26%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!