What's Affecting Markets Today

Asia-Pacific Markets Advance on Fed Cut Hopes, China Inflation Data

Asia-Pacific equities rose on Wednesday, buoyed by optimism for a potential Federal Reserve rate cut and the release of August inflation figures from China. The S&P/ASX 200 in Australia edged 0.16% higher, while Japan’s Nikkei 225 gained 0.72% and the Topix added 0.53%. Mainland China’s CSI 300 advanced 0.22% and Hong Kong’s Hang Seng Index jumped 1.16% to its highest level since late 2021, led by a 1.76% rise in the Hang Seng Tech Index.

China’s consumer prices fell 0.4% year on year in August, missing expectations of a smaller decline, while the producer price index dropped 2.9%, in line with forecasts. Tech suppliers rallied after Apple’s product launch, with Foxconn up 1.2% and Samsung 1.4%, though Apple’s shares slipped 1.48% overnight.

South Korea’s Kospi climbed 1.5% to a near two-year high, while the Kosdaq rose 0.53%. Indonesia’s Jakarta Composite rebounded 0.81% after a three-day slump, and Singapore’s Straits Times Index surged 1% to a record 4,341. In India, the Nifty 50 rose 0.42% and the Sensex gained 0.5%.

ASX Stocks

ASX 200 8,833.80 (+0.35%)

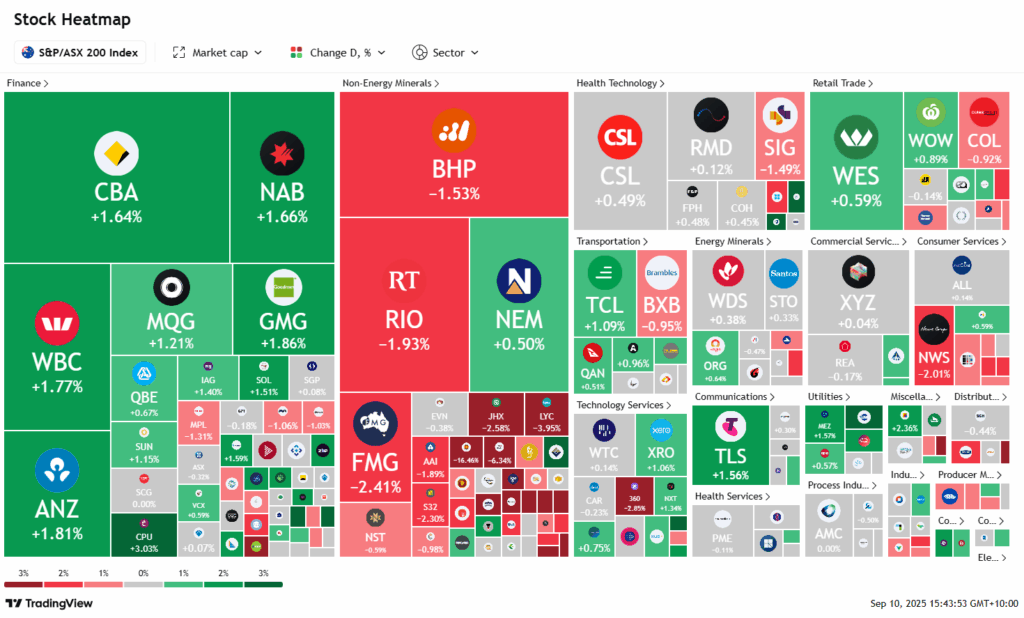

ASX Rises Despite Commodity Weakness

The Australian sharemarket lifted modestly on Wednesday afternoon, tracking Wall Street gains, even as heavy losses in miners weighed on sentiment. The S&P/ASX 200 added 23.7 points, or 0.3 per cent, to 8827.2 at 2pm AEST, with banks offsetting a commodities rout.

Lithium stocks led the decline after news that China’s CATL would restart operations at its Yichuna mine. Pilbara Minerals and Liontown plunged more than 15 per cent, IGO slid 12 per cent, and Mineral Resources fell nearly 7 per cent. Broader resource names were also weaker, with BHP down 1.5 per cent and Rio Tinto off 1.6 per cent, despite iron ore prices reaching US$107 a tonne. Gold miners buckled even as bullion hit a fresh high above US$3670 an ounce, with Bellevue, Perseus and Northern Star retreating.

Banking stocks provided support. Commonwealth Bank rose 1.6 per cent, Westpac climbed 1.4 per cent, and NAB added 1.3 per cent after announcing job cuts. Judo Bank outperformed, rallying 3.4 per cent on a Citi upgrade to “buy.”

Iluka dropped 14 per cent on plans to halt WA production, while Vulcan Energy and Metcash also traded lower.

Leaders

CU6 – Clarity Pharmaceuticals Ltd (+7.26%)

MCY – Mercury NZ Ltd (+6.54%)

TLX – Telix Pharmaceuticals Ltd (+4.78%)

C79 – Chrysos Corporation Ltd (+4.69%)

MP1 – Megaport Ltd (+4.26%)

Laggards

LTR – Liontown Resources Ltd (-15.79%)

PLS – Pilbara Minerals Ltd (-15.00%)

BFL – BSP Financial Group Ltd (-13.43%)

IGO – IGO Ltd (-13.26%)

ILU – Iluka Resources Ltd (-12.91%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!