Overnight – Oracle drives market higher on rapid expansion of AI Datacentres

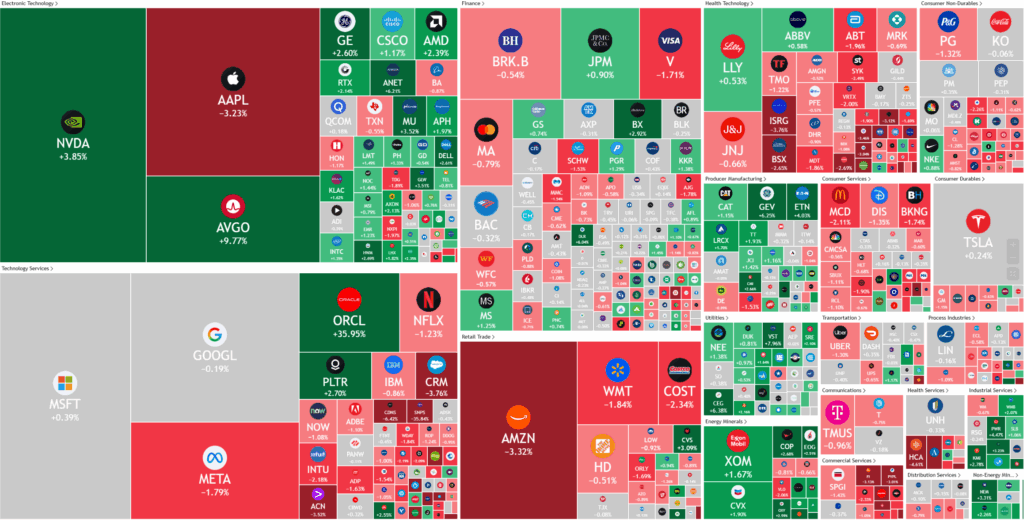

Stocks edged out another record close as Oracle led tech stocks higher following strong guidance while an unexpected cooling in wholesale inflation supported ongoing expectations for the Federal Reserve to cut interest rates next week.

In corporate earnings, Oracle surged on the back of a bullish AI-driven outlook, with its MultiCloud database revenue soaring more than 1,500% year-over-year, thanks to strong partnerships with major tech players. The company projected its Oracle Cloud Infrastructure bookings could exceed half a trillion dollars, well above expectations, with analysts attributing the growth to larger-than-anticipated contracts, including those linked to OpenAI. This momentum lifted broader AI-related stocks such as NVIDIA, Broadcom, CoreWeave, and Dell. Meanwhile, GameStop surprised with a revenue jump, Apple slipped after unveiling its iPhone 17 lineup, and both Synopsys and Chewy sank on disappointing results.

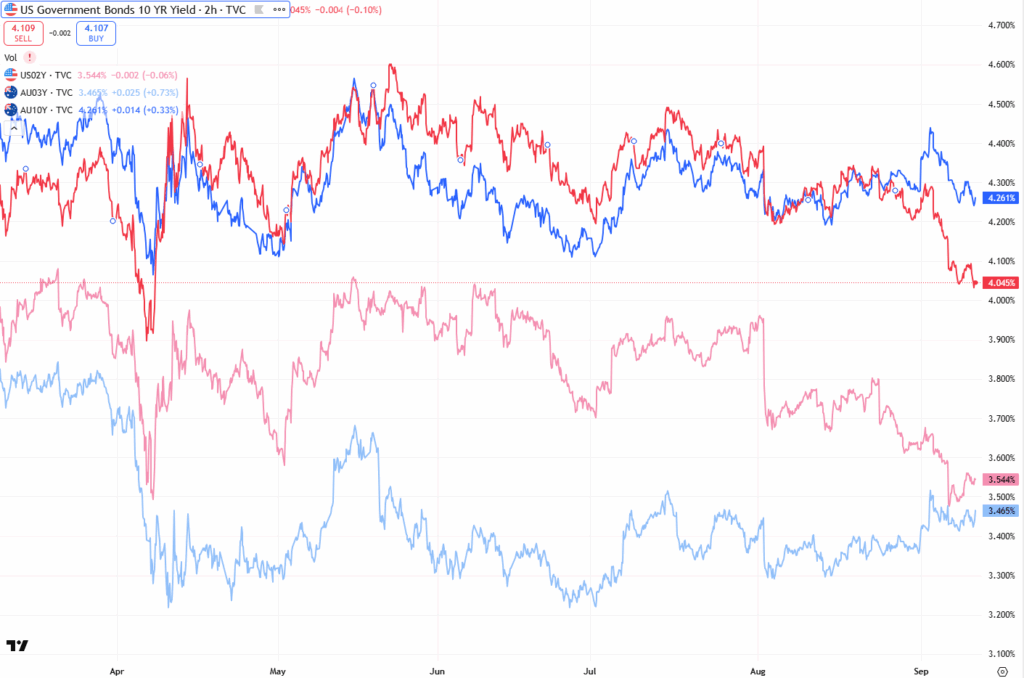

On the economic front, U.S. producer price index (PPI) data showed an unexpected decline of 0.1% in August, defying expectations for an increase. The drop in services costs was the largest since April and eased inflationary concerns, reinforcing the case for a Fed rate cut next week. With consumer price index (CPI) data due soon, traders are nearly unanimous in pricing in at least a 25-basis-point reduction, while odds for a deeper 50-basis-point cut have also gained traction as policy easing bets strengthen.

A sharp downward revision to U.S. employment figures for the 12 months through March suggested that the labor market may have begun cooling sooner than previously thought, even before new tariffs were introduced in April. Despite the weaker jobs data, Federal Reserve rate-cut expectations remained steady, with traders still anticipating at least a 25-basis-point reduction at the upcoming September meeting. U.S. Treasury yields moved higher following the revision, even as market focus shifted toward inflation and monetary policy.

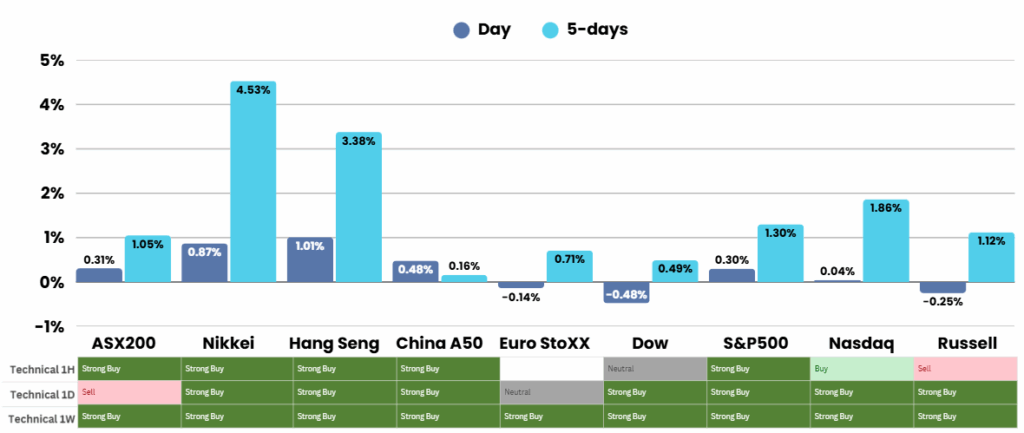

ASX Overnight: SPI 8811 (-0.19%)

The Day Ahead:

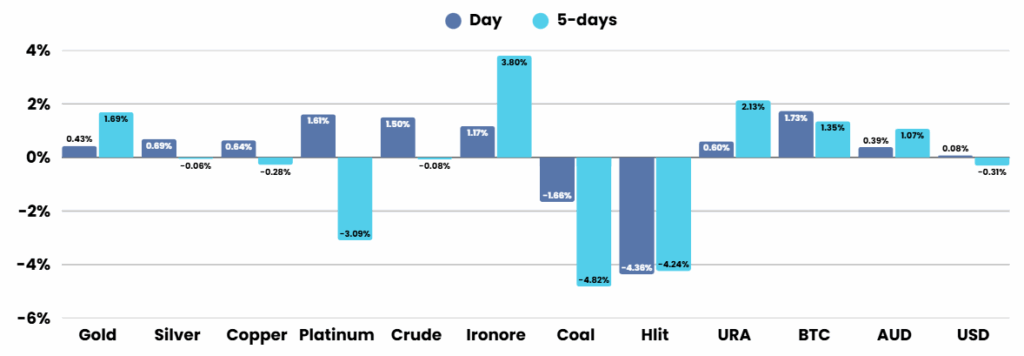

The focus will be on global events with the ECB meeting and CPI numbers in the USA tonight. Keep an eye on Iron ore stocks around 11am when China opens, as Iron ore prices knock on the 6 month high, a significant resistance level where it has failed 3 times in the last 6 months

Yesterdays Session:

The Australian sharemarket rose modestly on Wednesday, with the S&P/ASX 200 up 0.3 per cent to 8827.2 as strength in banks helped offset steep declines in miners. Lithium stocks slumped after news of CATL restarting operations in China, dragging Pilbara Minerals, Liontown, IGO, and Mineral Resources sharply lower, while BHP and Rio also fell despite firm iron ore prices. Gold miners retreated even as bullion hit record highs, and Iluka tumbled on plans to stop WA output. In contrast, bank stocks lifted sentiment, with major lenders advancing and Judo Bank jumping on a Citi “buy” upgrade.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.