Overnight – Stocks drift lower as investors await this weeks Fed meeting

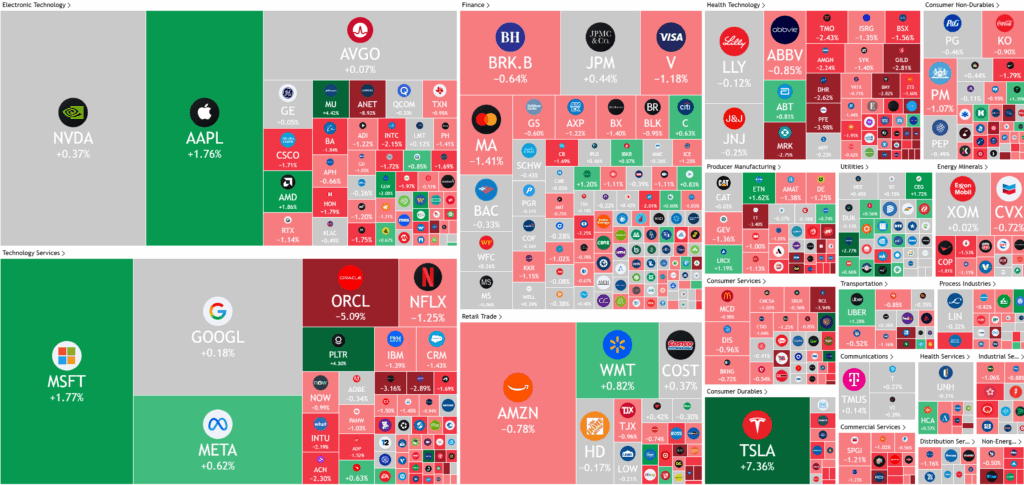

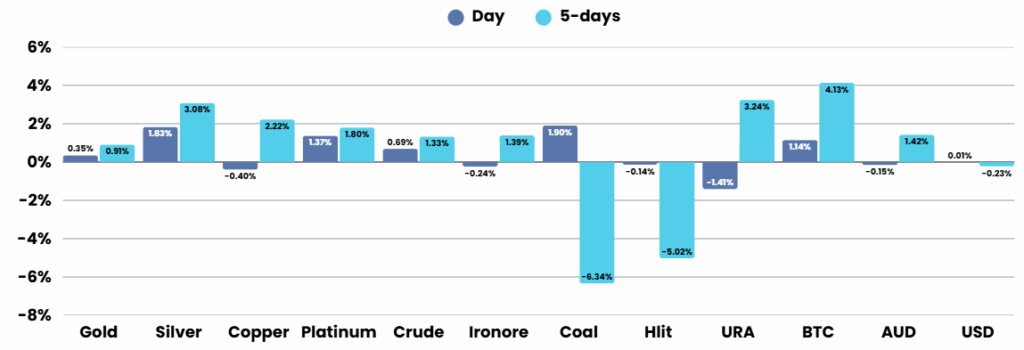

Stocks slipped Friday, weighed down by rising Treasury yields and fresh data showing consumers continue to worry about the economy.

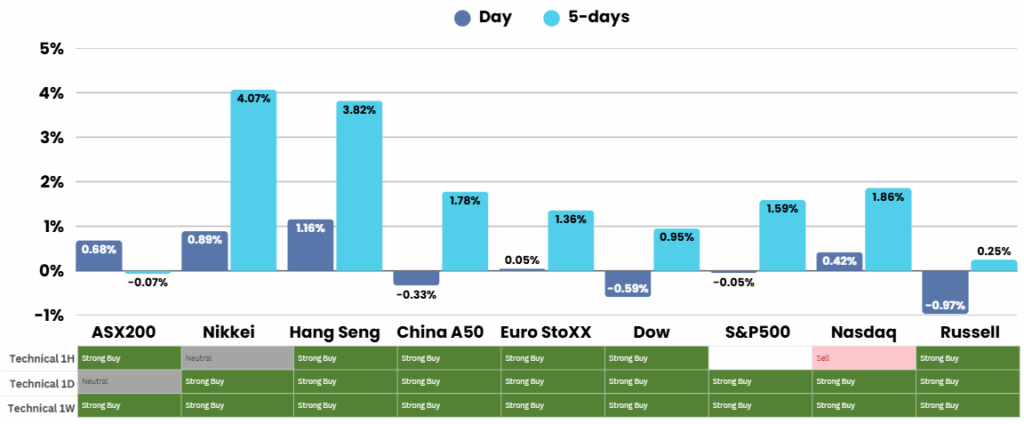

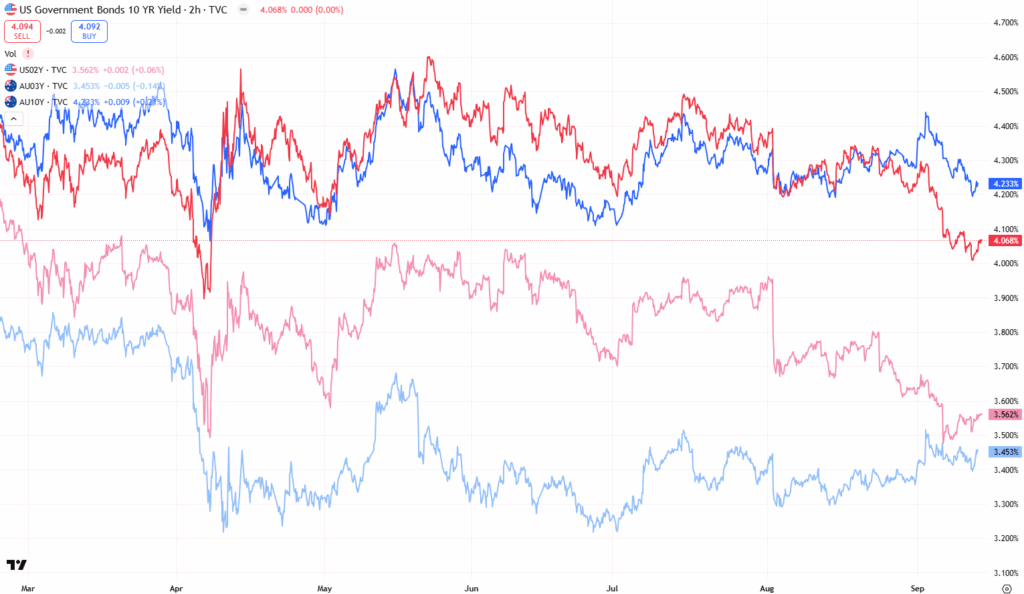

Consumer sentiment in the U.S. weakened in September as the University of Michigan Consumer Sentiment index dropped to 55.4 from 58.2, falling short of expectations. While one-year inflation expectations held steady at 4.8%, the five-year outlook rose to 3.9%, signaling persistent long-term inflation concerns. Meanwhile, Treasury yields moved higher, with the 10-Year climbing 6 basis points to 4.07%, despite markets largely anticipating a Federal Reserve interest rate cut next week.

Pressure continues to build around the Federal Reserve’s September 16–17 meeting, as recent economic data show a mixed picture: inflation came in hotter than expected, but weekly jobless claims climbed to their highest since 2021, reinforcing signs of a weakening labor market. Traders are overwhelmingly pricing in a 25 basis point rate cut, while a smaller chance of a 50 basis point reduction remains on the table. Analysts suggest that while inflation risks remain, the Fed’s focus is shifting toward supporting employment as layoffs and slower hiring begin to weigh on the economy.

On the investment side, global equity funds saw outflows of $3.06 billion in the week ending September 10, their first net withdrawal in over a month. Most of the outflow stemmed from U.S. equity funds, which lost $10.44 billion, while European and Asian funds posted inflows. In corporate news, Adobe raised annual forecasts, attributing the upgrade to strong demand for AI-driven creative tools. In contrast, furniture maker RH missed on revenue, while Super Micro Computer announced the launch of its Nvidia Blackwell Ultra-powered hardware. Additionally, Microsoft and OpenAI disclosed a preliminary agreement regarding OpenAI’s transition to a for-profit structure.

ASX Overnight: SPI 8804 (-0.66%)

The Day Ahead:

With the rate cut buzz now wearing off, we are likely to see a holding pattern into Thursday mornings Fed meeting.

Fridays Session:

The Australian sharemarket rose on Friday, with the S&P/ASX 200 up 0.7% to 8865.4, driven by strong gains in financials and materials following Wall Street’s record run. Major banks all advanced over 1%, while gold miners surged on higher bullion prices, boosting stocks like Bellevue Gold and Regis Resources. BHP also added 1.3%, though energy lagged as Woodside and Karoon fell on weaker crude. Among standout movers, Bank South Pacific jumped 8.5% after reassurances from PNG’s prime minister, and Ventia Services climbed 4.7% on a major contract extension.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.